Australian technology sector since 18 February 2020 started its downward trend, which lasted until 23 March 2020. However, from 24 March 2020, the sector bounced back. During the period, the market players were looking at those stocks whose businesses have a positive outlook.

In the present scenario, the tech sector has become quite attractive amongst the market players because technology has become a part of every individual’s life.

However, in the past couple of days, the Australian technology sector started taking a U-turn beginning from 13 May 2020. On 15 May 2020, by the end of the day’s trade, the sector dropped by 1.02% from the previous close and settled at 1,352.3.

In this article, we would look at some of the tech players and see how they are placed in the present scenario.

Xero Limited

Xero Limited (ASX:XRO), the provider of an easy-to-use cloud-based business platform for small businesses and their advisors released its full-year results for the year ended 31 March 2020 on 14 May 2020. The company delivered top-line growth with positive free cash flow and net profit outcome. Let us take a look at FY2020 performance:

- Operating revenue grew by 30% to NZ$718.2 million.

- During the period, annualised monthly recurring revenue of the Company increased by 29% to stand at NZ$820.6 million.

- The number of subscribers rose 26% to 2.285 million.

- EBITDA improved by 88% to NZ$137.7 million

- The Company’s net profit during the period was $3.336 million. This reflects an enhancement of ~ NZ$30.5 million over a net loss of NZ$27.143 million.

Xero during COVID-19:

Xero is aware of the uncertainty due to COVID-19; however, its long-term strategic ambition remains unchanged and is committed to its three strategic priorities. These include:

- To drive cloud accounting across the globe.

- Raise the small business platform.

- Continue to shape for global scale & innovation.

The Company highlighted that in the present scenario, even the small businesses are able to acknowledge the advantage of using the cloud to run their business.

Stock Information:

By the market closure on 15 May 2020, XRO shares closed at A$75.32, down 5.579% from the previous close.

Afterpay Limited

Appointment of the Company Secretary:

BNPL player, Afterpay Limited (ASX:APT) announced the appointment of Natalie McKaig as the Company Secretary of Afterpay, effective 15 May 2020. She would be the person responsible for communications with ASX under Listing Rule 12.6.

Tencent became a substantial holder:

On 1 May 2020, the Company announced that Tencent Holdings Limited had become the substantial holder of Afterpay. A HKEX (Hong Kong Stock Exchange) listed entity, Tencent offers internet value-added (services), with digital entertainment, online advertising, etc to the consumers.

Stock Information:

APT shares started showing improvement in its performance from 24 March 2020 and reached near its 52 weeks high price. By the market closure on 15 May 2020, the shares dropped 1.08% and settled at A$41.20.

Kyckr Limited

RegTech company, Kyckr Limited (ASX:KYK) on 15 May 2020 announced that it entered into a new annual contract with Commerzbank AG, with ~ minimum value of A$100,000 for the Kyckr for Business portal in the UK.

Commerzbank AG is the second largest bank in Germany with 49,000 employees that operates in approximately 50 nations.

Earlier, Commerzbank used Kyckr’s customer verification platform on a pay-as-you-go basis. With this new contract, the relationship between the Company and Commerzbank extended to an annual contractual commitment for the Kyckr for Business Portal.

Other than this, the Company during April 2020, achieved its highest monthly revenue of A$260,000, up 39% on the previous year.

Stock Information:

By the end of the day’s trade on 15 May 2020, KYK shares closed at A$0.092, surging up 33.333% from the previous close.

Pushpay Holdings Limited

Pushpay Holdings Limited (ASX:PPH), the provider of donor management system on 6 May 2020, released its FY2020 results for the full year ended 31 March 2020.

- Revenue from continuing operations increased by 32% to US$129.797 million on pcp.

- Net profit declined by 15% to US$16.001 million.

- Gross Profit Margin increased from 60% to 65%.

- Operating cash flow improved by 953% to US$2.8 million.

- Cash and cash equivalent by the year ended 31 March 2020 decreased by 48% to US$7.2 million.

- Total customers rose 42% to 10,896.

- During the year, the Company processed 25.9 million transactions with an average transaction value of US$195 over the year.

Stock Information:

PPH shares have delivered a good YTD return of 69.59%. The shares showed improvement from 4 May 2020 and suddenly zoomed up on 6 May 2020. During the last 30 days period, the stock has given a return of 66.16%. On 15 May 2020, PPH ended the day’s session at A$6.58, up ~ 1.86% from the previous close.

Dicker Data Limited

Dicker Data Limited (ASX:DDR) is Australia’s foremost locally owned, as well as an functioned distributor of ICT hardware, software, cloud & IoT (internet of things) solutions for reseller partners.

Completion of the A$50 million Placement:

Dicker Data Limited, recently on 8 May 2020, announced the successful completion of A$50 million a fully underwritten institutional placement by issuing 7.5 million new shares. Each share was issued at A$6.70.

In the announcement, the Company mentioned that the Share Purchase Plan would be offered to the qualified Australian & New Zealand shareholders. These shareholders would have an opportunity to acquire up to A$30,000 in new shares via the share purchase plan.

The Company intends to raise around A$5 million through the Share Purchase Plan. Under the SPP, the shares would be issued at 2% discount to the 5-day VWAP of DDR shares up to, and comprising the closing date of the SPP, and the Placement price. Further, there would be no brokerage or transaction cost.

Issue of the SPP offer Booklet:

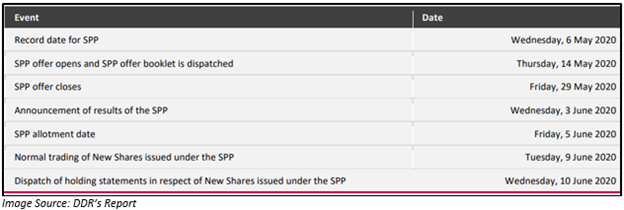

On 14 May 2020, the Company announced that it had dispatched the offer booklet related to the Share Purchase Plan to the qualified shareholders. Further, the Company confirmed that the SPP is open from 14 May 2020. Below are the key dates of SPP.

Stock Information:

DDR shares have delivered a YTD return of 3.25%. In the past one month, the shares have given a return of 5.76%. By the market closure on 15 May 2020, DDR increased by 0.287% and settled at A$6.980.