In the financial market, investors deploy their hard-earned money in the stocks, with an objective of building a good portfolio. However, the risks cannot be ignored relative to the specific stock, sector and the entire market. These risks can be managed and minimised. One of the best ways to minimise the portfolio risk is to diversify the portfolio of stocks.

A portfolio can be diversified in many ways including market capitalisation, sectorial diversification etc. Diversification via sector selection is the preferred approach towards achieving the objective of risk mitigation by seasoned investors. Fundamentally strong companies with inherent macro risk profile are selected to construct the portfolio.

The risk is minimised since the macro news do not move the fundamentals of all the sectors equally, for example high iron ore prices will be beneficial for the iron ore sector but negatively impact the automobile sector, construction sectors and would have no impact on a pharma sector, or a FMCG sector.

It must be noted by the investors that the sector diversification works well during a normal market scenario with its ups and downs, however it would not be protecting the portfolio returns during a deep recessionary condition. Albeit, the diversified portfolio would still perform relatively better than a concentrated portfolio.

Therefore, sectorial diversification is an important method to construct a stable portfolio.

As a thumb rule, lower the risk, lower the reward and vice versa. An investor needs to understand that while creating a diversified portfolio he/she is also foregoing some additional return which a concentrated portfolio might provide. However, on the risk side, a diversified portfolio triumph ahead.

Letâs look at some of the strongest companies across various sectors.

- Mayne Pharma Group Limited (ASX: MYX) is from health care sector, which is aiming at implementing its skills in drug delivery to generic pharmaceuticals. The company has more than 100 clients globally, and it also provides the facility of manufacturing services and contract development to them. The company has two project developments and manufacturing facilities based in Australia and the USA.

Recently, the company announced a substantial shareholderâs change of interests, stating that Investors Mutual Limited had increased its shareholding from 112.05 million to 134.1 million. The acquisition took place in several transactions which started on 18th March 2019. Now, the updated voting power with the substantial shareholder is 8.47%, (increased from 7.08%) effective 17 May 2019.

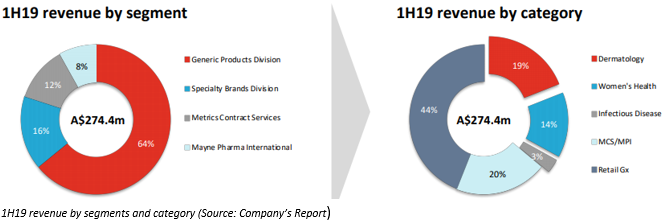

In the investor presentation for the Goldman Sachs Emerging Companies conference in April 2019, the company announced A$530 million of revenue in FY18 and 1H19 revenue of A$274.4 million, generics products division generating the highest revenue of 64%. The company focused on pipeline development on expanding portfolio within the therapeutic platforms. It also acquired and carried out activities related to licence concentrating on the platforms for products like LEXETTE⢠foam and generic EFUDEX® cream.

The company has a market capitalisation of A$799.38 million, and the stock had touched a 52-week high and low of A$1.425 and A$0.51 respectively. The stock was up by 3.96% and closed at A$0.525 after making an intraday high of A$0.530 (as on 7th June 2019). The last one-year return of the stock is negative 38.41%, and the YTD return stands at 32.21%. The volume of shares traded were 5,549,442.

On 14th May 2019, the company released market update for the 10 months ended 30th April 2019 in which 15% revenue fall was noted due to high competition in the market.

- Link Administration Holdings Limited (ASX: LNK) is an ASX listed information technology company, based in Australia. The company provides administration solutions with a workforce of more than 7,000 employees. The company is versatile in its offerings, which enables it to meet the requirements of even the largest firm or fund. Also, the company is the largest provider of services in Australia's superannuation fund administration industry.

Recently, the company provided trading and earnings update in which, it expected Operating EBITDA to be approximately between $350 â 360 million for the full year ending 30th June 2019.

The company also announced Challenger Limited and its entities as its initial substantial shareholder, effective 31 May 2019, with a total stake of 27,322,441 with 5.12% of voting rights.

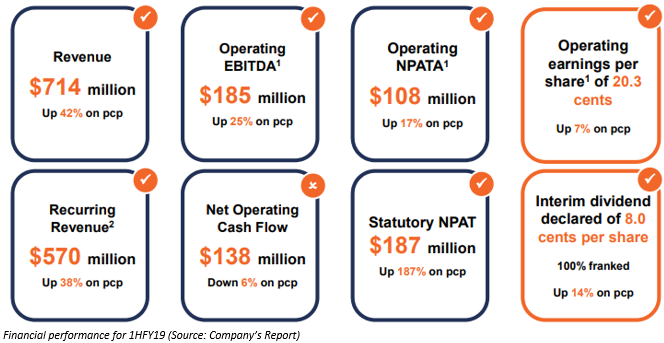

In the FY19 half-yearly results, the company stated its equity interest in PEXA had increased to 44.2% in January 2019, providing a new growth avenue. The revenue stood at $714 million up 42% on pcp, and recurring revenue was noted at $570 million, up 38% on pcp. The transfer transaction volumes have been continuously improving, as the industry embraces PEXAâs effective service and technology offering.

The company has a market capitalisation of A$2.94 billion, and the stock had touched a 52-week high and low of A$8.33 and A$5.490 respectively. The stock was up by 1.273% from its previous close and closed at A$5.57 after making an intraday high of A$5.620 (as on 7th June 2019). The last one-year return of the stock is negative 21.09%, and the YTD return stands at 17.91%. The volume of shares traded was 5,013,101.

Bapcor Limited

Bapcor Limited (ASX: BAP) is a company that belongs to the Consumer Discretionary sector and provides automotive aftermarket parts, accessories, automotive equipment as well as services in Australasia. The core business of the company includes the automotive aftermarket. The business of the company spans the end-to-end aftermarket supply chain which comprises of Trade, Specialist Wholesale and Retail.

The company (previously known as Burson Group Limited) was founded by Garry Johnson and Ron Burgoine in the year 1971 in Victoria, Australia. In 2016, Burson Group Limited became Bapcor Limited. Also, in the year 2004, Burson opened its 50th store. In 2019, the company acquired Toperformance Products.

In the past five years, the shares of BAP have given an outstanding return of 214.68%. However, the YTD return of the stock was 0.51%.

Recently, the company had entered into a partnership with Greenfleet to plant local forests in Australia as well as capture more than 5.250k tonnes of greenhouse gas emissions.

With this new partnership, Greenfleet is aiming towards reducing the greenhouse gas emissions that are related to Bapcorâs company fleet, which shows the key focus of the company on corporate social responsibility as well as sustainability.

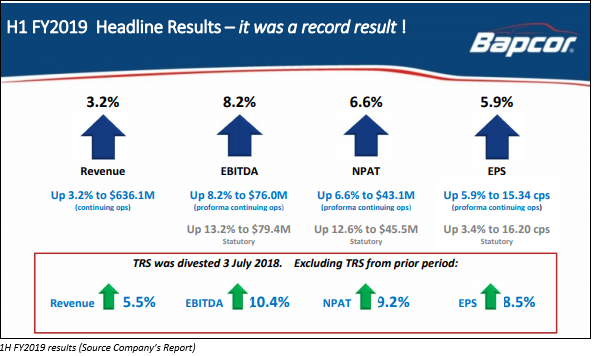

In the Macquarie Conference presentation released on 29 April 2019, the company highlighted its record 1H FY2019 results. The revenue of the company increased by 3.2% to $636.1 million. There was an increase in the EBITDA by 8.2% to $76 million, NPAT by 6.6% to $43.1 million and EPS by 5.9% t0 15.34 cps.

The company has a market capitalisation of A$1.67 billion, and the stock had touched a 52-week high and low of A$7.850 and A$5.320 respectively. The stock was up by 0.51% and closed at A$5.85 after making an intraday high of A$5.93 (as on 7th June 2019). The last one-year return of the stock is negative 12.63%, and the YTD return stands at 0.51%.

Qantas Airways Limited

Qantas Airways Limited (ASX: QAN) is a company from the industrial sector and it provides international and domestic air transportation services. It is also engaged in the sale of worldwide and domestic holiday tours as well as associated support activities such as catering, information technology, ground handling and engineering as well as maintenance.

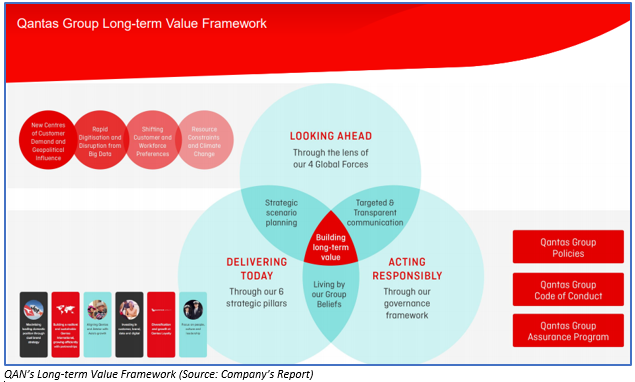

The company is serving the communities for nearly 100 years. It is constantly changing in order to make sure that it is well positioned for the future in order to create value for their shareholders, opportunities for its people and outstanding experiences for their clients.

In February 2019, the company announced the shares having a total consideration of up to $305 million. On 5 June 2019, the company released a daily buyback(on-market) notice where it had bought back 635,558 shares at $3,423,941.61 on 4 June 2019. Also, till 3 June 2019, the company had bought back 50,468,968 shares at $279,104,614.43.

In the Q3 FY2019, the company reported an increase in the revenue by 2.3% to $4.4 billion as compared to the previous corresponding period. Also, during the period, the company had reached the agreement for the sale of Melbourne Domestic Terminal. The company was able to settle the sale of the terminal as well as secure Terminal 1 access in future for $355 million. Around $276 million would be received in the form of cash in FY2019 period and the remaining amount would be accrued in future periods.

On 28 March 2019, the company paid a fully franked dividend of 12 cps.

Some key development across the Group since 1 January 2019 include as follows:

- Announcement of Sydney-San Francisco as the next Qantas Dreamliner route expected from December 2019, which will replace the less fuel efficient 747 currently used.

- The inking of 3 years wet-lease with Atlas Air for upgrading the 2 current 747-400 freighters that operates for Qantas Freight.

- Changes to the Group Management Committee, which comprises CFO as well as Qantas International CEO roles.

The company has a market capitalisation of A$8.69 billion, and the stock had touched a 52-week high and low of A$6.920 and A$5.180 respectively. The stock was up by 0.545% and closed at A$5.530 after making an intraday low of A$5.390 (as on 7th June 2019). The last one-year return of the stock is negative 14.06%, and the YTD return stands at -4.51%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_02_2025_00_23_12_199043.jpg)