Companies in the payment services sector have been receiving strong investor traction, and the sell-side consensus appears to be highly optimistic for such business models; however, broader regulatory reforms are on the brink in a bid to mitigate potential risks.

RBA Embraces Regulatory Reforms in Payment Services Space

Payment industry has been on an optimistic trough, and the incumbent companies on ASX in the payments services space have been commanding expensive valuations even though most of these companies are yet to report profits.

Following the Wallis Inquiry in 1996-97, the RBA was given regulatory powers to control risk in the payment services sector as well as promote efficiency and competition in the sector.

In November 2019, the bank released its first issue paper as part of review of the payment industry, which was also influenced by inquiries undertaken by the Productivity Commission and the Black Economy Task Force.

Increasing penetration of innovation, development in technology and new entrants in the payment industry had forced the Payments System Board, which oversees payments at the bank, to conduct a holistic review of the payment services.

Due to second-order consequences of widespread smartphone uptake in Australia and globally, it appears that the central bank had embraced the requirement to review the ongoing shift of consumer spending from established channels to digital wallets, Beem It, buy now pay later (BNPL), etc.

RBA noted that 37 per cent of the transactions used cash as the payment medium, which was 70 per cent in 2007, according to 2016 Consumer Payments Survey. The number is likely to be lower than 37 per cent, given the rapid uptake in alternative payment services.

Moreover, the increasing application of new technologies is in part driven by secular trends like online shopping, thus resulting in changing habits of consumers when it comes to spending.

Presently, the payment services are operating under revised surcharging standards, which were directed to resolve issues related to excessive surcharging under the review of card payments in 2015-16.

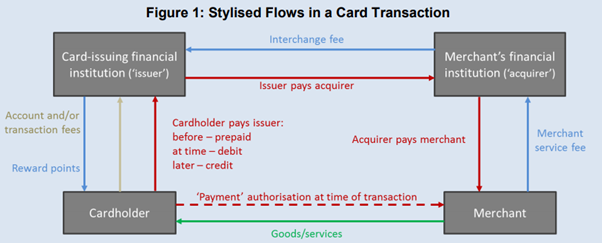

Source: RBA Issue Paper on Payment Industry, November 2019

Although the surcharging rights of merchants were preserved in the recommendations made by the review, the RBA made provisions to ensure that merchants are not charging above their cost of acceptance.

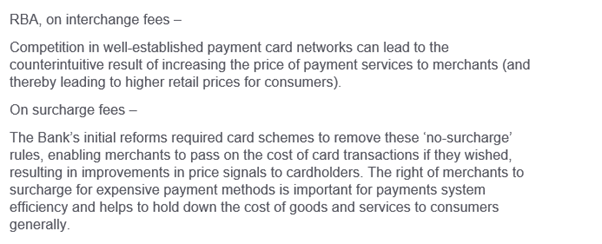

In its issue paper, the RBA had reviewed the stance of other jurisdictions in the retail payment space and reckoned that regulators had emphasised on interchange fees and surcharge fees.

Such as in Europe, the regulators had capped the interchange fees at 0.3 per cent for credit card transactions, and 0.2 per cent for debit cards in 2015, and the review of this reform is expected to complete in mid-2020.

It is clear that the RBA is undertaking a broader review of the industry, stressing on issues like:

- Future of cash, cheque payments.

- New technologies’ implications.

- Closed-loop and stored-value systems.

- Reliable electronic payment services.

- Importance of cross-border payments.

- Domestic schemes like AusPayNet, NPP, BPAY and eftpos.

- Potential issuance of e-banknotes.

The RBA has also noted that around 90 per cent of the debit cards issued in Australia are dual-network debit cards, which provides option to process payments through eftpos or other service providers like VISA and Mastercard.

A merchant could have a varying cost of acceptance across the networks that process the transaction, and the RBA reckoned that payments routed through eftpos could be significantly cheaper.

Therefore, the bank has raised a possibility of least-cost routing (LCR), which would allow merchants to route transactions from the network that has the most economical propositions, allowing merchants to reduce payments costs while increasing competition.

On tech-based payment solutions like digital wallets and payment applications, the bank noted that the emergence of digital wallets had gathered significant pace, which could be used to make contactless payments.

Between March 2017 and November 2019, the financial institutions offering the capability to pay via Apple Pay had jumped to 80 financial institutions as against a few at the beginning.

It was noted that the QR-code based payment services have not gathered a rapid uptake in Australia, which are very popular in China. However, NPP Australia had published QR codes on NPP, and AusPayNet is considering coming out with a QR-code functionality.

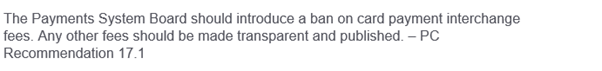

Amongst the Productivity Commission Recommendations, the one that is catching traction appears to be the ban on interchange fees. However, the recommendation requires the Australian Competition & Consumer Commission (ACCC) to conduct a separate enquiry to test the viability.

On surcharges, the bank said that it is aware of few merchants charging varying surcharges for cards within a system. And, it expressed the intension to hold talks with BNPL stakeholders that provide consumer spending financing at low or zero-interest rates.

Meanwhile, it was noted that some BNPL providers are offering financing at no cost if repayment is made timely while charging the merchants at a higher rate of fee for accepting the payments.

According to RBA, the selected BNPL payment providers processed around $6 billion worth of transactions in 2018-19. For merchants, BNPL providers deliver value as the payment is made up front, thus reducing the risk of default.

Small business operators have reckoned that the fees incurred in accepting payments from BNPL providers range in 3 per cent to 6 per cent, which is higher than the cost of accepting other payments.

RBA was cognizant of the fact that a few BNPL providers have been blocking merchants to impose surcharges in an effort to recover fees incurred by merchants when facilitating payments with BNPL services, and the bank would hold talks with such providers.

According to some media reports, the retailer associations of the country have been reuniting to consider the LCR capabilities that must be provided by the payment service providers in a bid to save costs.

It is likely to be favourable for retailers that accept payments through alternative channels like tap-and-go and mobile wallets. However, this also means that the revenues generated payment providers could be at risk.

BNPL is Less Technology & More Consumer Financing, Having Default Risks Yet No Risk-Absorbing Capital

In addition to the above-mentioned regulatory overhangs, the underlying fundamentals of the ‘buy now pay later service’ companies appear to be influenced largely by consumers rather technology.

BNPL is more of a consumer-focused industry with a large dependence on retail spending, wage growth, employment, disposable income, consumer confidence, credit profile, and uptake of new technologies.

In FY 2019, Afterpay Limited (ASX:APT) charged an impairment expense of $58.67 million on receivables to income statement.

In FY 2019, Zip Co Limited (ASX:Z1P) increased its provision for expected credit losses by $11.11 million to $25.6 million, owing to an increase of $15.35 million increase in the value of customer receivable subject to lifetime loss.

On 6 February 2020 (AEDT 01:47 PM), APT was trading at $ 38.930, while Z1P was trading at $4.205, both down from the previous close.