The consumer staples index on ASX - S&P/ASX 200 Consumer Staples (Sector) dipped 0.22% by the end of the day’s trade on 19 February 2020. However, the S&P/ASX 200 settled in green zone with an increase of 0.4% from its last close.

Lately, many companies have been declaring their financial results for the period ended 31 December 2019 and the influence can be seen on the stocks, where various sector index is experiencing the response of the investors accordingly.

Although, there was no consumer discretionary stock amongst the top 5 S&P/ASX200 declines for the day on 19 February 2020, yet the decline in the consumer staples stocks like - COL constituted the fall in the consumer staples.

Although the consumer staples settled in the red zone for the day, but there are stocks constituting the consumer staples sector that ended the day’s trade in the green zone.

Let us discuss the latest developments with some of the consumer staples stocks.

Coles Group Limited (ASX:COL)

On 18 February 2020, Wesfarmers Limited (ASX:WES) announced that it had entered into an underwriting agreement with two lead managers to sell 4.9 per cent of the issued capital of Coles Group Limited, for which trades have been executed for total pre-tax proceeds of $1,050 million and the settlement is expected on 21 February 2020.

Moreover, Wesfarmers looks forward to recognising a pre-tax profit on sale of approximately $160 million and later to the above-mentioned sale, Wesfarmers shall have a 10.1 per cent interest in Coles and retain its right to nominate a director to the Coles Board.

Coles was demerged from Wesfarmers in November 2018 and the retained shares shall help to contain the present relationship between the two companies. Moreover, the declared sale of the Coles shareholding is expected to generate a robust return for shareholders and simultaneously maintaining sustained strategic alliance and collaboration amongst Coles and Wesfarmers.

COL stock fell by 4.239% and settled at a price of $16.040, with a market capitalisation of $22.34 billion by the end of the day’s trade on 19 February 2020.

However, WES stock increased by 2.873% intraday, inching closer to its 52-weeks high price of $46.960, and settled at a price of $46.550 with a market capitalisation of $51.31 billion.

Asaleo Care Limited (ASX:AHY)

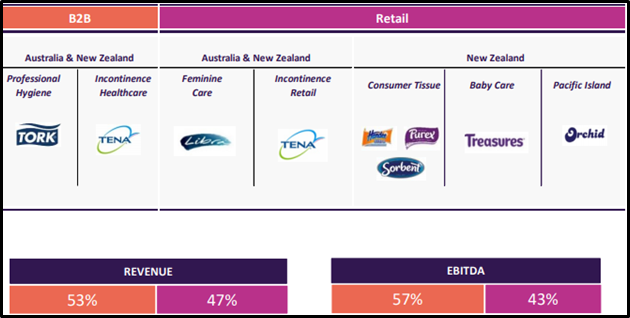

Being a leading personal care and hygiene company, Asaleo Care (ASX:AHY) engages in manufacturing, marketing, distribution and sales of personal care and hygiene products with a portfolio of market-leading brands that includes Libra, TENA, Tork, Treasures, Viti and Orchid.

The Company recently announced its full-year financial results for the period ending 31 December 2019 and reported an underlying EBITDA of $82.4 million and a Statutory Net Profit after Tax of $22.1 million.

According to the Company, the result is within the Underlying EBITDA guidance previously provided of between $80 million to $85 million and further declared a final FY19 unfranked dividend of 2 cents per share to be paid on 3 April 2020.

The highlights from the financial results are as follows:

- Revenue of $420.2 million was up 3.0% as compared to revenue of $407.8 million during FY18;

- Underlying EBITDA increased by 1.1% and stood at $82.4 million compared to $81.5 million in FY18;

- Underlying NPAT increased by 14.3% to $31.7 million from $37.0 million in FY18;

- Net Profit/(Loss) from Continuing Operations increased by 3,462.5% from $0.8 million in FY18 to $28.5 million in FY19.

The business has achieved revenue growth across both its business segments, Retail and B2B and the progress further empowers the Company to reinvest for future growth.

Segment wise Revenue Growth (Source: Company's Report)

The Company looks forward to bringing:

- Market world-leading innovation

- Research and technology

- Marketing materials

- Pipeline of new product development for its Tork, TENA and Libra brands

For the delivery of substantial operating efficiencies and additional products during the year 2020, the Company looks forward to the major capital investment that was made to upgrade the Kawerau, New Zealand manufacturing facility (successfully completed during 2019).

Moreover, the reduction in its debt through the sale of the Australian Consumer Tissue business during the year had further solidified the Company’s balance sheet for future growth.

Asaleo forecasts Underlying EBITDA to be in the range of $84 - $87 million for FY20 on the basis of continuing sales growth and the easing of pulp prices sheltering the growth in other cost.

The AHY stock witnessed an increase of 3.687% from its last closing price, inching closer to its 52-weeks high price of $1.165, at the end of the day’s trade and was at a price of $ 1.125 with a market capitalisation of $ 589.29 million on 19 February 2020.

Let us look at another stock in the consumer staples sector.

GrainCorp Limited (ASX:GNC) is a diversified food ingredients and agribusiness company listed on ASX in a crucial industry with grains and oilseeds operations in Australia as well as internationally providing a diverse range of products and services across the food and beverage supply chain.

In his Address during the Annual General Meeting, the GrainCorp Limited’s Chairman said that the past year was an extremely challenging one for GNC, since there were disappointing financial results for the Company, adversely driven by one of the worst droughts on record in significant parts of eastern Australia, compounded by significant disruptions in global grain markets.

On the contrary, GrainCrops’ Malt business remained relatively unchanged by these factors and showcased fair performance throughout with solid demand from the Company’s international customer base.

Moreover, the Company’s Crop Production Contract with White Rock Insurance (SAC) Ltd is expected to provide strength to the long-term sustainability of the Company while also facilitating smooth cash flow through the cycle. GrainCrop is expected to receive $57.9 million for the 2020 financial year under the agreement.

GNC undertook a portfolio review during the year with the following outcomes:

- Sold its Australian Bulk Liquid Terminals business to ANZ Terminals for $333 million;

- Combined its Grains and Oils businesses to create one integrated domestic and international grain handling, storage, trading and processing business;

- Announced the proposed Demerger of its international malting business- United Malt.

Also, the indicative proposal by Long Term Asset Partners Pty Limited (LTAP) to acquire 100 percent of the shares in GrainCorp was withdrawn since LTAP failed to come forward with a formal offer.

The Company confirmed that the completion of Grains and Oils integration and the demerger is well advanced.

The GNC stock dipped 1.061% intraday on 19 February 2020 and settled at a price of $8.390 with a market capitalisation of $1.94 billion.