Industrial Sector or the secondary sector of the economy processes raw materials / inputs provided by other sectors into manufactured goods and finished products.

Some economists are of the view that manufacturing industry generates more wealth relative to the services sector; and countries that export manufactured goods are usually found to have higher marginal GDP growth. Thus, a well-functioning industrial sector promotes economic development, enabling a better quality of life for the citizens. A few well-known industrial sector divisions are Steel production, Automobile industry, Chemical industry, Consumer electronics, Industrial equipment, Aerospace manufacturing and others.

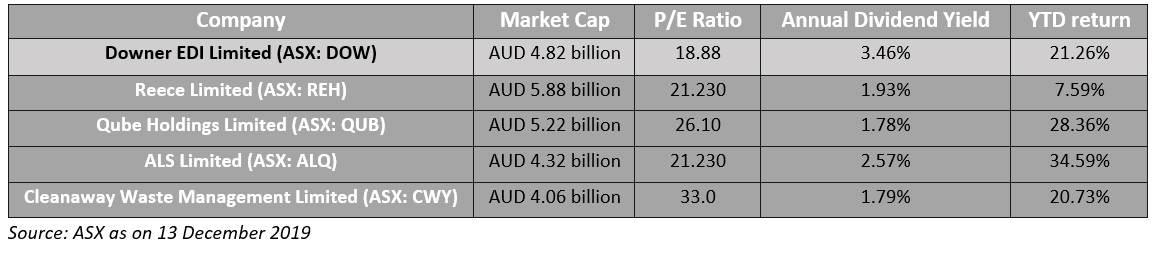

Letâs take a look at 5 prominent ASX-listed industrial sector stocks in Australia including Downer EDI Limited, Reece Limited, Qube Holdings Limited, ALS Limited and Cleanaway Waste Management Limited.

The recently released November 2019 business survey report by National Australian Bank (NAB), suggested that there has been a stabilisation in the construction and manufacturing sectors while business Confidence has also been improving.

Downer EDI Limited (ASX: DOW)

A leading provider of integrated services in Australia and New Zealand, Downer EDI is focussed on creating and sustaining the modern environment to help in its customers succeed in designing, building and sustaining assets, infrastructure and facilities.

It is a well-established company with a staff of over 53,000 employed across 300 locations, not just in Australia and New Zealand, but also in the South America, Asia-Pacific region as well as Southern Africa.

Consecutive contract wins: On 12 December 2019, Downer EDI reported to have secured a five-year contract, valued at approximately $ 520 million, to plan, design and deliver water and wastewater infrastructure for Logan City Council (LCC). The contracts commences in January 2020 with provisions for 2 years each. The nine-year term would be valued up to $ 1 billion in total.

Earlier in November 2019, Downer EDI, as a member of the NEWest Alliance, was selected as the preferred bidder for the delivery of the Thornlie â Cockburn Link and Yanchep Rail Extension, both being a part of the METRONET program in Perth. Downer EDI and CPB Contractors would be delivering the project in a joint venture (JV) alliance with expected completion by 2023. Moreover, funding for the project has to be provided by the Western Australian state and Australian federal governments.

Downer other project assignments include the delivery of the Parramatta Light Rail project Stage 1 in a 50:50 JV alliance with CPB Contractors for the New South Wales Government.

The company received another two-year $ 200-million contract back in October 2019 whereby it will provide mining and related services at the Goonyella Riverside coal mine.

With that, Downer EDI demonstrates its contract winning capabilities underpinned by the delivery of services. And, it appears that the customer proposition offered by Downer EDI is comparably higher than similar players. This possibly depicts the competitive advantage that Downer trailing against its peers.

Financials: Looking at the P/E ratios of the five stocks discussed in this article, Downer EDI is available at the cheapest valuations of all. The company also posted an impressive result for the financial year ended 30 June 2019 (FY19) with the following highlights:

- Total revenue including joint ventures another income increased by 6.6% to ~ $ 13. 45 billion from $ 12.62 billion.

- Improvement in earnings capability by 125.7% as the EBIT rose from $ 204.8 million to $ 462.2 million.

- Profit from ordinary activities after tax before amortisation of acquired intangible assets (NPATA) also increased by 176.2% to $ 325.6 million.

- There has been a stellar improvement in the basic earning per share of 300.9%, from 10.7 cents in FY18 to 42.9 cents in FY19. Despite that, the DOW stock is only priced at $ 8.250 and traded 1.852% higher on 13 December 2019.

With a low P/E ratio, the companyâs annual dividend yield is the highest than the other four stocks and DOW has also generated a good positive Year-to-date return of 21.26%.

Recce Pharmaceuticals Ltd (ASX: RCE)

Recce Pharmaceuticals Ltd is presently focussed on development and then subsequent commercialisation of a New Class of Synthetic Antibiotics with Broad Spectrum activity, recently reported positive data in a rat topical burns model from an assessment of its lead compound RECCE® 327 in addressing the unmet medical needs of burns treatment and associated difficulties in wound closure. The study was undertaken in co-operation with an established Australian teaching hospital, by an independent Contract Research Organisation (CRO) and the results indicated Wound contraction (healing) - greater than market drug.

For FY19, Recce Pharmaceuticals recorded sales revenue of ~ $ 5.46 billion and normalised EBITDA of $ 522 million with a Statutory NPAT of $ 202 million.

The RCE stock settled the dayâs trading on 13 December 2019 at $ 10.700, moving up 2.002% by $ 0.210.

Qube Holdings Limited (ASX: QUB)

Qube Holdings Ltd (ASX:QUB) is a logistics company operating in divisions including Automotive, Bulk and General Stevedoring, Landside Logistics and Strategic Development Assets.

At the backdrop of a slowing economy, Qube delivered earnings growth across all divisions in FY19. The companyâs broad diversification and strong market positions provided an insulation against the economic headwinds experienced in FY19. Highlights for FY19 include-

- An increase of more than 15% in underlying NPAT to more than $ 123 million after amortisation.

- Underlying revenue growth of 4.7% to $ 1.73 billion.

- statutory NPAT attributable to Qube of over $ 196 million.

Besides, the company Board worked on broader strategic issues throughout FY19 to position Qube for further growth in the long-term. At the same time, the company tested and supported managementâs initiatives to improve profitability and returns for shareholders.

On 13 December 2019, the QUB stock settled the dayâs trade at $ 3.230, settling 0.62% higher after having delivered a 6-month return of 9.93%.

ALS Limited (ASX: ALQ)

ALS is a global Testing, Inspection & Certification business with a strategy to broaden its exposure into new sectors and geographies where it can eventually establish a leadership position.

For the half year ended 30 September 2019 (H1 FY20), the company recorded an increase of 11.3% in the revenue from continuing operations to $ 919.1 million and an Underlying NPAT of $ 98.2 million, up 5.3% as it exceeded the prescribed guidance of $ 90 million to $ 95 million.

The H1 FY20 performance can be attributed to a strong organic growth witnessed across all regions in both Life Sciences (10.2%) and Industrial (20.3%) business divisions coupled with some acquisition growth, including an initial contribution from Mexico-based pharmaceutical laboratory ARJ, which was acquired in August 2019.

An interim dividend of 11.5 cps (partially franked to 30%), was paid out to the shareholders, depicting an increase of 4.5% over the prior year.

The ALQ stock settled the dayâs trade on 13 December 2019 at $ 9.140, moving up 2.123% having delivered a 6-month return of 30.28%.

Cleanaway Waste Management Limited (ASX: CWY)

Australia-based Cleanaway Waste Management is a pioneering total waste management, industrial and environmental services company employing a staff of over 6,000 supported by a fleet of ~4,900 specialist vehicles working from ~300 locations across the country. The company recently closed the acquisition of SKM Recycling Group and its assets.

For the financial year ended 30 June 2019 (FY19), Cleanaway Waste Management announced a 34.8% increase in the net revenue to $ 2,109.1 million and 34.2% improvement in the EBITDA to $ 433.7 million. All operating segments of the company recorded increased revenue and earnings.

A final dividend of 1.90 cents per share (pcp: 1.40 cents per share) was declared depicting an increase of 35.7% from the final dividend paid last year.

On 13 December 2019, the CWY stock settled the dayâs trade at $ 2.0, up 1.01% having delivered a one-month return of 5.88%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.