With factories and businesses shut, travel bans, schools closed, and increasing restrictions on people movement, coronavirus pandemic has rendered several workers unemployed.

Australia's unemployment rate has remained on a higher side as compared to several other countries, including the US. Australia's last recession was in 1990-91 when the unemployment rate went from 6% to a peak of 11.2% in late 1992. The rate had lingered at 10% till April 1994, and it took about 10 years for the unemployment rate to return back to its level.

As per the National Treasury, the jobless rate in Australia is set to double this quarter from 5.1% in February soaring to ~10% in June as the service industry faces the worst shutdowns.

As countries around the world, including Australia, are exercising social distancing and isolation amid coronavirus, businesses have witnessed a substantial fall in economic activity with some facing total closure.

ALSO READ: IMF Warns Coronavirus to Trigger' Worst' Economic Fallout Since 1930's Great Depression

The Australian government has taken AUD 320 billion worth of stimulus packages to fight coronavirus pandemic so far that included giving help to 6 million workers under its JobKeeper Payment Program, supporting households and premature releases of superannuation temporarily.

The government has given AUD1500 fortnightly for its JobKeeper Payment program to sail through the economic fallout of coronavirus is expected to support millions of Australian jobs.

About 80,000 businesses have already registered under the program that is expected to help the economy recover quickly.

The Treasury estimates that unemployment figure would have reached 15% in June in the absence of the government's AUD130 billion JobKeeper Payment.

Rating agencies cut outlook but expects improvement

The global credit rating agency S&P had downgraded Australia's" AAA" credit rating outlook from stable to negative due to projected weakening of government's debt position as it rolls out large fiscal packages to lift the economy suffering from fallouts of coronavirus.

However, the agency noted that the country's public debt is still in a good position. S&P stated that the fiscal stimulus measures taken up by the government are expected to moderate the setback of COVID-19 to the economy. Though the actions will severely affect the public funds in the near future, they will not structurally undermine the fiscal situation of Australia.

Recently, Fitch Ratings downgraded the Issuer Default Ratings (IDRs) for Australia's four largest banks from AA- to A+ due to anticipated economic shock in 1H20 due to actions taken to health the spread of coronavirus.

However, the rating agency believes that the buffers for capitalisation of banks will be affected by poorer asset quality, but buffers must be sufficient. Hence, banks retain a stable outlook for this factor. The funding and liquidity are supported by firm liquidity management, and the Australian central bank provides significant support.

Bill Evans, Chief Economist of Westpac, reduced the peak unemployment rate prediction from 17% for the June quarter to 9%, subsequently falling to 7% by end December after the government introduced the JobKeepers Payment (JKP) package and further tightening of social distancing measures.

This would mean a job loss of 500,000 up to June quarter followed by a recovery of 350,000. He stated that the JKP program would lower the peak in the unemployment rate and also reduce the cyclical deficit by 4% of GDP from an earlier estimation of 5%.

ABS Survey Results

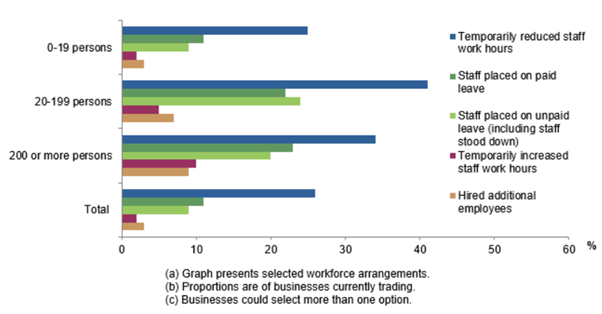

As per ABS survey results on the COVID-19 impact on businesses released on 7 April, about 47% of the businesses have made changes in their workforce arrangements. About 2 in 5 (41%) of trading businesses with 20-199 people reported a temporary reduction in staff working hours. 34%of large businesses with 200 or more people and 25% of businesses with 0-19 people also momentarily decreased working hours for the staff.

Source: ABS

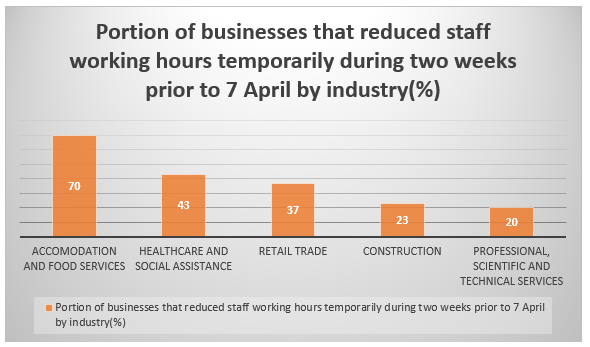

Now, let's have a look at the proportion of businesses engaged in selected industries that have made changes in their workforce two weeks prior to 7 April. About 70% of the business in "Accommodation and food services" have lowered work hours temporarily in the past two weeks. Also, 44% of the businesses in healthcare and 37% in retail trade have decreased their staff working hours temporarily.

Reduced working hours is one of the first steps businesses resort to when they are faced with such a crisis situation like the present time.

Grim outlook ahead

Market experts have both praised and criticised the measures taken by the domestic economy so far to lift up the economy in its bid to fight the coronavirus pandemic. The impact on the economy will become difficult to reduce if unemployment rises. Previous recessions with high unemployment have told us that it's not easy to bring back jobs in the economy.

ALSO READ: Where is the economy heading to- RBA's Eye

Nonetheless, by keeping employees well connected with businesses, businesses can accommodate the lift in demand which will come once restrictions subside.

One thing that is certain is that once the economy revives, there will a considerable amount of corporate restructuring with businesses trying to boost their balance sheets by reducing the workforce, which can further weigh on the growth. While a large number of measures are being taken that are expected to support recovery, continuous weak businesses and consumer confidence could see a slower recovery.