Investors in Australia have been closely monitoring the Coronavirus’ impact on ASX share market as well as different sectors. One sector that has been significantly impacted by the outbreak of the virus is ‘Travel Sector’. Coronavirus outbreak has massively hit the operations and functioning of various travel companies, as travel restriction has been put across the majority of the world.

In order to manage the financial impact caused by the outbreak of coronavirus, many travel-related companies are taking a range of measures. These includeclosing down of operations, cutting down expenses, reducing staff, giving ‘Leave Without Pay’ to their employees.

Let us take a quick look at three ASX-listed airline companies and learn how they are managing the impact of the virus outbreak.

Virgin Australia (ASX: VAH)

Australian airline, Virgin Australia recently confirmed that it is exploring a several options to manage through the COVID-19 crisis.In order to prepare for a prolonged crisis, the company has recently requested Australian Government for financial support.

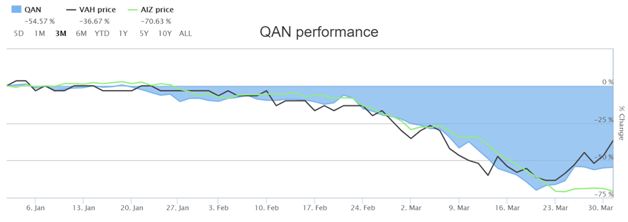

A leading credit rating company, Fitch Ratings recently downgraded the Long-Term Foreign-Currency Issuer Default Rating (IDR) of Virgin Australiato 'B-' from 'B+' and placed the rating on Rating Watch Negative (RWN), mainly due to a sharp drop in demand in the aviation market due to coronavirus as well as the removal of the one notch of shareholder support included in the rating. In the past three months, VAH stock has declined by 36.67% on ASX.

Air New Zealand (ASX: AIZ)

Air New Zealand (ASX:AIZ) recently announced that it will start reducing its workforce from this week due to the severe economic impact from COVID-19. The company has cut over 95% of its flights here in New Zealand and around the world and is collaborating with its Unions and its Air New Zealanders to explore how it can together reduce the costs of running its airline.

The airline is reducing costs by asking all its Air New Zealanders to take Leave Without Pay, forgo bonuses, reduce hours and consider voluntary exits and it has also made savings from voluntary pay cuts by the Board of Directors, myself as Chief Executive Officer and my Executive team, and cancelling all incentive payments for staff on Individual Employment Agreements.

Air New Zealand recently entered into a debt funding agreement with the New Zealand Government under which the Government will provide a standby loan facility of up to $900 million to support the airline as it manages the unprecedented impact of the Covid-19 outbreak on its business.

In the last one month, AIZ stock price has declined by 58.42%.

Qantas Airways Limited (ASX: QAN)

At a time where whole airline sector is under tremendous pressure due to Coronavirus Outbreak, Qantas Airways Limited, an Australian airline company has managed to secure a $1.05 billion in additional liquidity to strengthen its position. This fund will increase the company’s available cash balance to $2.95 billion with an additional $1 billion undrawn facility remaining available, thereby improving the liquidity position of the group.

Over the past few years, Qantas has significantly strengthened its balance sheet and it is now able to draw on that strength under the current challenging circumstances.

The company has also assured that it has taken various steps to significantly reduce activity levels and costs given the dramatic revenue impact of the Coronavirus pandemic. Few days back, Qantas and Jetstar had announced cuts to 90% of international flying and about 60 per cent of domestic flying and along with this, both the parties have also decided to suspend scheduled international flights from late March.

For International network, Qantas is making following changes

- All regularly scheduled Qantas and Jetstar international flights from Australia will be suspended from end March until at least end May 2020;

- Jetstar Japan has suspended international flights and cut domestic flying;

- Jetstar Asia (Singapore) will suspend all flights from 23 March to at least 15 April 2020

- Jetstar Pacific (Vietnam) has suspended international flights and will significantly cut domestic flying

In the first half of FY20, Qantas Group delivered strong results with Underlying Profit Before Tax (PBT) of $771 million, Statutory PBT of $648 million and Statutory EPS of 28.8 cps. The company’s Underlying Profit $4 million lower than last year, mainly due to $51 million in higher foreign exchange costs; a $68 million impact from unrest in Hong Kong and trade wars hitting international freight; and a $55 million increase in domestic airport overheads due to terminal sales. In the past three months Qantas stock has declined by 54.57%.

By looking closely at the price chart of the above- mentioned three airline stocks, it can be seen coronavirus has significantly impacted the share price of these stock in the past three months

Three months Price Chart (Source: ASX)