Safe-haven metals like gold and silver have started to witness increased attention from investors, following an exponential increase in the number of coronavirus cases outside of China. In light of this scenario, let’s take a look at a few ASX-listed gold players and how they have performed lately.

Resolute Mining Limited

Resolute Mining Limited (ASX: RSG) is mainly engaged in gold mining and development of the Syama Underground Mine. RSG’s stock is currently trading close to its 52 weeks low price of $0.915.

The company’s sales revenue for FY19 stood at $770 million which comprises of A$656 million revenue from continuing operations at Syama and Mako, and $114 million from Ravenswood. For Fy19, the company reported a net loss after tax for continuing operations of $59million corresponding with a loss per share of A$0.07. The financial performance of RSG has been impacted by the ramp-up of the Syama Underground Mine as well as the structural repairs required to the Syama roaster.

Going forward, the company is focused on generating positive free cashflow from operations at Syama and Mako. The company’s plan for 2020 also includes optimising the asset portfolio, strengthen its balance sheet, and deliver value for shareholders. For FY20, the company is expecting production of 500,000oz at an AISC of US$980/oz. RSG anticipates production of 260,000 ounces gold at Syama with an AISC of US$960/oz. The company’s exploration budget for FY20 has been set at US$15 million with main areas of focus being the identification of oxide resources at Syama, the expansion of the underground resources at Tabakoroni, and mine life extension opportunities at Mako.

The company recently took advantage of the strength in the gold price to extend its US dollar denominated gold hedge position, as it forward sold 30,000 ozs of gold at an average price of US$1,670 per ounce.

By AEDT 12:57 PM, RSG stock was trading at $0.942 with a market cap of around $988.39 million.

Westgold Resources Limited (ASX: WGX)

Like Resolute Mining, Westgold Resources Limited has also been benefited from the recent strength in the Australian gold price. The company has used the strength in the Australian gold price to extend and restructure its hedge book with its banking counterparty, Citibank, adding a further 60,000oz at spot prices above A$2350/oz.

Westgold’s recent half year results for the period ending 31 December 2019, demonstrates a considerable improvement in financial outcome compared to the previous half year results. Over the period, the company’s mining segments of Meekatharra Gold Operations (MGO) and Fortnum Gold Operations (FGO) were strongly profitable.

The company recently informed the market that the underground sub-level cave mining has recommenced at Big Bell, reflecting a major milestone for Westgold and a terrific achievement by its CGO team.

By AEDT 12:57 PM, WGX was trading at a price of $2.00 with a market cap of around $835.79 million.

St Barbara Limited (ASX: SBM)

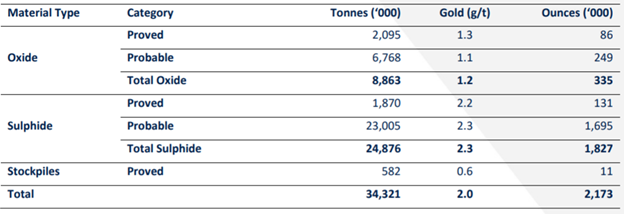

Gold producer and explorer, St Barbara Limited recently released an ore reserves and mineral resources statements for Simberi gold mine in which it reported ore Reserves of 33.7 Mt @ 2.0 g/t Au containing 2.2 Moz of gold, and mineral Resources of 93.5 Mt @ 1.4 g/t Au containing 4.4 Moz of gold.

Simberi Gold Mine Summary at 31 December 2019 (Source: Company’s Report)

The company had reported production of 182 k ounces of gold with AISC amounting to A$1,391/oz, for the six months ended 31st December 2019. Lower production at Gwalia and Simberi impacted the company’s financials, and as a result of which, statutory profit after tax and underlying profit after tax stood at $39 million and $35 million, respectively.

Further, the company declared fully franked interim dividend amounting to $0.04 for the period, which is to be paid on 25th March 2020. For 2020, the company is anticipating gold production to be in between 370?400 koz at an AISC (All in Sustained Cost). SBM stock is currently trading near to its 52 weeks low price.

Regis Resources Limited (ASX: RRL)

Gold and mineral explorer Regis Resources Limited recently released the presentation for BMO Investor Conference 2020. In the presentation the company reiterated its production Guidance of 340,000 - 370,000oz gold at A$1,125-$1,195/oz AISC 1 (US$787-837/oz) with growth capital of ~A$62m/US$43m for FY2020.

In the first half of FY20, the company had delivered record net profit after tax amounting to $93.4 million and net profit margin of 25%, demonstrating the continuing strong profitability of the Duketon operations. Revenue for the period stood at $371.4 million, with saleable gold of 182,807 ounces at an average price of $2,063 per ounce.

On the back of strong financial performance, the company declared fully franked interim dividend 8 cents per share, which is to be paid on 18th March 2020 with the record date of 3rd March 2020. The company finished the half-year with the cash and bullion of A$169 million with nil debt.

OceanaGold Corporation (ASX: OGC)

Multi-tier gold company, OceanaGold Corporation recently entered into a forward gold sale arrangement with the support of members of the current banking group of the company, as per which, OGC is expected to receive a pre-payment of $78.5 million on 28th February 2020, in exchange for delivering 48,000 ounces of gold between September 2020 and December 2020.

For the full year 2019, the company reported revenue amounting to USD 651.2 million. This includes Q4 2019 revenue of USD 152.1 million. Consolidated capital expenditure increased by 10% in 2019 stood at USD 240.7 million, mainly due to increased capitalised pre-strip at Haile and Macraes, and increased exploration and growth capital spend at Waihi with respect to the Martha Underground development.

For 2020, total capital investment is expected to be in the range of USD 220 million – USD 255 million. Cash costs are anticipated between USD 675/oz – USD 725/oz sold. The company’s focus for FY20 mainly revolves around Waihi district study and a restart of Didipio.

By AEDT 12:57 PM, OGC stock was trading at a price of $2.460, near to its 52 weeks low price.