Investors can earn income from stock investments via two sources- an increase in the market price of the stock or capital gains and dividend payouts. Capital gains arising from stock cannot turn into income unless they are sold and can vanish with a drop in the stock price. Dividends can provide you with a stable and consistent realised income stream in your future years. Dividends are shares of a Company’s profits that is made to the stakeholders. Also, stocks, bonds and mutual funds offer dividends to investors.

However, you must look for certain signs before investing in dividend stocks to make sure you are investing in the right stock. If you are interested in making money, looking at the dividend payout ratio and dividend yield can be important factors for you.

The dividend/distribution payout ratio is the percentage of net income paid in the form of a dividend to the stakeholders. It shows if the earnings of a Company can support the present dividend payment amount. Relatively older companies have higher dividend payouts since they have the financial stability to compensate well to the shareholders.

ALSO READ: Pockets Of Opportunities By Dividend Friendly Industries Amid COVID-19 Fear

The dividend yield is an indicator of the value of a Company and how well it is performing. It shows an investor about his earnings on the stock from the dividend alone based on the current market price. The yield measures investment productivity.

Dividend stocks are an attractive source of income for investors who are already retired or are near retirement. Many dividend stocks can withstand economic slumps with diminished volatility and can provide a consistent source of income.

Here is a look at a few dividend stocks, you as an investor can keep an eye on-

AGL Energy Limited (ASX: AGL)

Operational since more than 180 years, AGL is involved in Australia’s energy business and contains a significant portfolio of wholesale energy agreements and assets.

AGL was trading at $17.67 on 7 April (1:34 PM AEST), slipping by 0.057%. The annual dividend yield of the stock is at 6.28% with the market cap of $11.17 billion. the total shares outstanding of AGL stands at 632.06 million.

Highlights of 1HFY20 for the period ending 31 December 2019

AGL released is 6-month results in mid-February, the highlights from the same are mentioned below:

Underlying profit after tax (PAT) went down by 20% to $432 million for 1HFY20 compared to the previous corresponding period.

Earnings per share dropped by 19% to 66.4 cents compared to the previous period.

An 80% franked interim dividend of 47 cents per share was declared.

Cash generated from operating activities was $1,135 million, up 67% compared to previous period while ROE was 11.2%, a decline of 1.9 percentage point.

FY2020 Guidance:

The Company expects its underlying PAT for FY2020 to be in the upper half of the guidance range of $780 million-$860 million in spite of elevated depreciation costs, Loy Yang outage and market headwinds.

AGL provided a trading update related to DRP price on 16 March, which stands at $18.22.

Coca-Cola Amatil Limited (ASX: CCL)

The Company is known as one amid the biggest distributors of ready to drink (beverages) within the APAC region and operates in six countries across the globe.

The stock was trading at $9.49 on 7 April (1:45 PM AEST) with a market cap of $6.91 billion. The annual dividend yield of the stock is at 4.92% while the total shares outstanding of CCL stands at 724 million.

COVID-19 update

As per a trading update on 17 March, CCL withdrew its earnings guidance due to uncertainty in relation to duration and impact of COVID-19 and also due to subsequent effects of the bushfires in the Australian region.

Highlights of FY2019 results for the period ended 31 December 2019

CCL released the full year results for the financial year 2019, outlining the following pointers:

CCL reported a rise of 6.7% in its group trading revenue for the year ended 31 December 2019.

The ongoing earnings before interest and tax rose by 0.8% to $639.3 million while ongoing net profit after tax increased by 1.4% to $393.9 million.

The ongoing earnings per share rose by 1.5% to 54.4 cents

An unfranked final dividend of 26 cents per share with a full year payout ratio of 86.4% was declared.

Outlook

CCL had mentioned that it was expecting higher earnings growth during the second half of 2020 compared to the first half period. The mid-single-digit EPS growth over the medium term and in 2020 was also projected.

Dividend payout ratio of over 80% was said to be likely over the medium term. Dividends were being anticipated to being franked at above 50% in 2021 period.

Wesfarmers Limited (ASX: WES)

The Australian entity, Wesfarmers deals in ANZ or Australian and New Zealand retail, fertilisers, chemicals and many more.

The stock was trading at $35.29 (1:55 PM AEST) on 7 April, declining by 3.816%, with a market cap of $41.6 billion. The annual dividend yield of the stock is at 4.17% while the total shares outstanding of CCL stands at 1.13 billion.

On 31 March 2020, Wesfarmers (WES) sold 5.2% of the Coles Group Limited (ASX: COL) with pre-tax proceeds from the sale amounting to $1.06 billion. WES also announced to retain its 4.9% interest in Coles for a period of 60 days from sale, subject to customary expectations.

On 2 April 2020, WES ceased to be a substantial holder for the Coles Group. The firm has engaged Goldman Sachs and UBS to procure purchasers for its existing 69,364,342 fully paid ordinary shares in the Coles Group failing which the shares will be divided between underwriters in 50% proportion.

On 1 April 2020, WES declared that one of its directors Simon William English had secured 22 fully paid ordinary shares in Wesfarmers at a value of $37.8725. The shares held by the director post the change stands at 1,126.

COVID-19 update

The Group is continuing with its operations and ensures constant availability of products and services in a way that reduces the risk for the staff and customers, including Group’s online channels. It persists in supporting government efforts and is focussed towards protecting the health of its team and customers to fight the impact of coronavirus.

1HFY20 Highlights for the period ended 31 December 2019

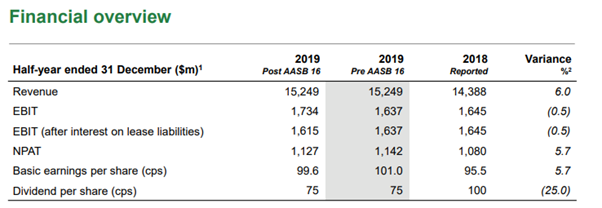

Source: Company’s Report

A few pointers from the 6-month results are mentioned below:

- WES mentioned NPAT standing at $1,210 million.

- The revenue was noted at $15,249 million, demonstrating a solid sales rise from different segments.

- The results were underpinned by solid increase in online sales noted at 35% for the period.

The Board of Directors announced an ordinary fully franked interim dividend of $0.75 per share for H1FY20 on 31 March 2020 that was paid on the same date as well.

The Directors of the Company declared a fully franked final dividend of 75 cents per share for the year 2019, bringing full-year ordinary dividend of $1.78 per share. WES also paid a special dividend of $1 per share in April 2019 for total fully franked dividends for the year of $2.78 per share.

After looking at the 3 stocks under discussion, it can be concluded that investors whose major source of income comes from investments and who likes to look at higher dividend income must be vigilant and must study a Company’s dividend payment history over the years. Moreover, the necessary research and analysis is important for making an investment decision.