The Education and Training market

This is the division that delivers education services via pre-schools, primary and secondary schools, technical institutes, other universities and training centres.

The Education Market in Australia

Laying our focus on the Aussie land, which, according to market experts and researchers, is counted amongst the countries with the highest literacy rates of almost 95%. The Australian education sector is deemed to be a significant resource to the Australian society. As per a recent market analysis, the country has a $20 billion worth export industry which interests international students from across the globe. This makes education the 3rd largest export sector in Australia and the top export sector in the services division.

As per market experts, the sector is most likely to grow at a CAGR of 2.02% till 2019.

A Look at 3 Education Stocks Listed on ASX- NVT, 3PL and AKG

With the context of the significance of the education and training market as a consumer service industry in Australia, let us now dig into 3 stocks of this genre, listed on ASX:

Navitas Limited (ASX: NVT)

Company profile:

A global education provider with a wide range of educational services, the company offers university programs, professional education, creative media education, settlement services and English language training.

Few of NVTâs partnerships in Australasia (Source: Company website)

Recent Updates:

On 14th June 2019, S&P Dow Jones Indices announced that, according to S&P Dow Jones Indicesâ June rebalancing, Navitas Limited will be removed, subject to approval from shareholders and the Supreme Court of Western Australia of the scheme of arrangement whereby an investment consortium will acquire NVT. Austal Limited will replace Navitas Limited. The changes will come into effect on 24th June 2019.

The company announced the registration of the scheme booklet related to the acquisition with the Australian Securities and Investments Commission on 13th May 2019. NVT had notified on 10th May 2019 regarding the proposed acquisition plan by BGH BidCo A Pty Ltd, which is an entity that would be owned by a consortium which BGH Capital leads. The companyâs general scheme meeting is due to be held on 19th June 2019.

On 30th May 2019 in an announcement with ASX, the company unveiled a one-year extension to its contract with La Trobe University for La Trobe College Australia. The extension would aid both entities in further negotiating a long-term agreement and considering potential opportunities.

Share Price Information:

On 14th June 2019, the stock settled the dayâs trade at A$5.790, down by 0.34% on ASX. The company has a market cap of A$2.08 billion and over 358 million outstanding shares. It has generated a YTD return of 17.37% to its investors.

3P Learning Limited (ASX:3PL)

Company profile:

3P Learning Limited is a provider of learning resources on the online platform. The company serves students, as well as families, with operations spread across Asia-Pacific, Europe, Middle East & Africa and Americas. Educators and educational technologists design the companyâs e-learning programs. The companyâs flagship mathematics resource, Mathletics was nominated for 2 BETT Awards 2019.

Recent Updates:

On 1st May 2019, 3PL presented at the 2019 Macquarie Australia Conference in Sydney. The company notified that it is in line with the execution of its three-year (2020-2022) strategic plan, for which H2-FY19 marks the final stages. The company mentioned that the goals have been achieved to:

- Reset the operating model

- Reinvest to boost 3PLâs product portfolio

- Develop an accessible digitised sales and marketing model

The company would present a detailed version of the plan and its details in its full year result.

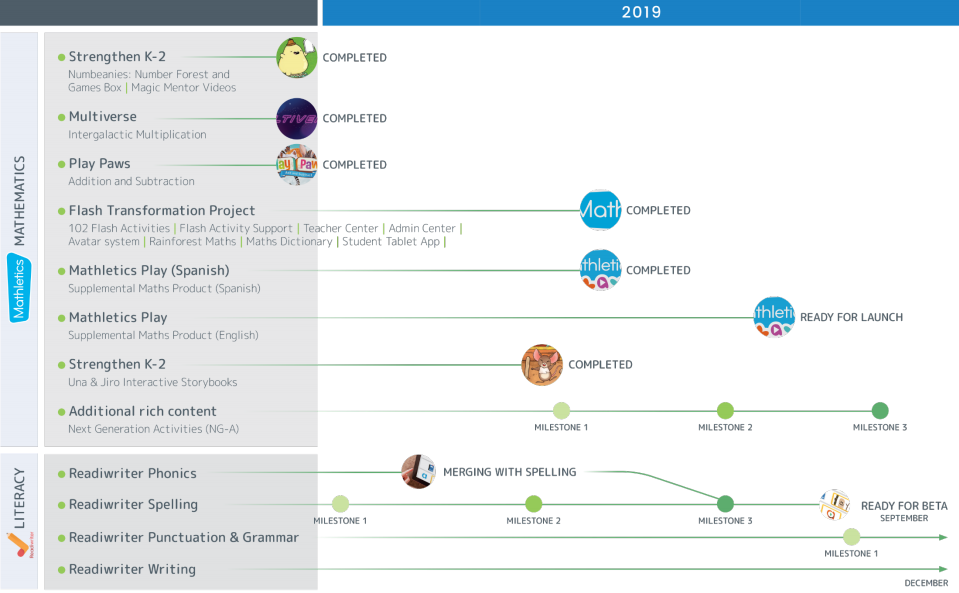

Besides this, the company depicted its product roadmap, which can be understood from the image below:

Product roadmap (Source: Companyâs report)

3PL is expecting a stronger balance sheet for FY19 with cash ranging between $25 million and $28 million by the end of the year.

Share Price Information:

On 14th June 2019, the stock settled the dayâs trade at A$1.030. It has offered a negative YTD return of 13.81% till date.

Academies Australasia Group Limited (ASX:AKG)

Company Profile:

As an education provider, Academies Australasia Group Limited (ASX:AKG) offers courses covering Bachelor and masterâs degree programs, senior high school, diplomas and advanced diplomas. AKG has campuses in Sydney, Melbourne, Brisbane, Adelaide, Perth, Gold Coast and Dubbo in Australia, with a student count of almost 10,000 across its campuses. It offers 150 plus qualifications and has a college in Singapore. The company has been operational for more than 110 years and has been listed on ASX for 40 years.

Recent Updates:

Earlier this year on 13th February 2019, the company announced its financial report for the half year ended December 2018.

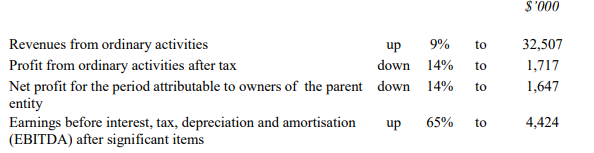

As per the report, the companyâs revenue from ordinary activities increased by $2,768,000 (it was $29,739,000 in the prior comparable period) and amounted to $32,507,000. The EBITDA was recorded at $2,930,000 in the first half of FY19, compared with $3,374,000 in the year-ago period.

Financial Summary (Source: Companyâs report)

Operating cash flow was reported at $2,732,000 and this was four times the amount of the previous period where it was $678,000. Besides this, AKG continued to reduce its bank borrowings and at the end of period under discussion, these amounted to $623,000, depicting a 65% reduction (the amount owed in the prior comparable period was $1,789,000).

The companyâs revenue from global operations witnessed an increment of 15% and stood at $26,006,000, while the domestic operations registered a decline of 8% and stood at $6,501,000. During this period, the company had no dividend reinvestment plans in operation and no conduit foreign income as well.

In the first month of this year, the company announced a new appointment to its board. It appointed Gabriela Rodriguez as the Chief Operating Officer and Group Managing Director. She is associated with the company since April 2001 and has headed each department with the exception of finance in her term.

Share Price Information:

On 14th June 2019, the stock settled the dayâs trade at A$0.445, up by 2.29% on ASX. It has generated a negative YTD return of 5.43% to its investors.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.