The Citadel Group Limited (ASX: CGL) is a top technology & software organisation that specialises in enterprise information management in complex and secured settings. The company offers secure information to assist real-time judgments throughout the Health, Defence, National Security & Other Enterprises.

The company was formed in 2007 and has more than 200 employees throughout the country and has the potential to access more than 1300 subject matter experts via partnership.

Citadel's Industry Example:

From the health care segment, Citadel is the owner as well as the operator of the largest laboratory information system in Australia that supports more than 60 labs and 70,000 staff on a 24/7/365 basis. More than 50,000 transactions take place on a daily basis and it has more than 28 years of patient history.

For its respected National security customers, the company has created a range of big data management systems which include a national counter-terrorism fusion platform along with citizen-centric security & incident management digital platform for keeping the individuals secure.

For the Defense sector, the company has developed and is managing the largest enterprise content management solution in Australia which holds more than 500 million secure objects such as personnel records, corporate files, reports as well as data related to operations.

Other enterprises like education providers, government agencies as well as financial services firms use Citadel's digital solutions to improve teamwork & enable their processes via automated incorporation with other ERP systems.

Since the past two years, Citadel had focused on growing its business in the healthcare software sector in the UK, and it has worked on that front. Finally, the day arrived when it signed a binding agreement to acquire Wellbeing Software Group Limited (Wellbeing) for an enterprise value of £103 million.

Let's know about its recent Acquisition:

On 18 February 2020, The Citadel Group Limited (ASX:CGL) announced that it had signed a binding deal to acquire Wellbeing Software Group Limited for an enterprise value of £103 million.

Wellbeing is one of the leading healthcare software companies in the UK. It has been more than 25 years that Wellbeing has developed via a combination of organic development as well as acquisitions into the UK's top provider of radiology & maternity healthcare software that takes care of patient workflow along with data.

For 12 months ended 31 December 2019, Wellbeing generated revenue of £16.6 million, and it expects to generate £18.7 million revenue in CY2020. Gross profit during this period was £10.1 million, and EBITDA was £6.5 million at a 39% margin.

As highlighted above, Wellbeing is the market-leading provider of radiology and maternity software workflow solutions. Other than this, it captures market share of 59% & 23% of the respective NHS acute trusts in England.

Let's check out the drivers behind this acquisition.

- Wellbeing has superior, recurring revenues with solid margins

- Wellbeing has a robust sales pipeline with more than 80% surety on CY2020 revenues

- The acquisition would provide Citadel with an instant market share in the UK by means of a strong, established business.

- Extends the product suite of Citadel in Health with the addition of Radiology as well as Maternity Software to CGL's existing Pathology & Oncology Software. Thus, it would be able to provide a complete suite solution to healthcare providers.

- CGL would be able to offer a reliable platform to introduce the pathology & oncology solutions into the UK

- Improves and expands the customer base of CGL.

- Adds a powerful & aligned management team on the ground in the United Kingdom to continue driving growth in the active Wellbeing product suite along with the cross-selling of CGL's products

- The acquisition would support in improving the group EBITDA along with the Gross Profit margins.

Acquisition Funding; Key terms and Conditions:

As highlighted above, the enterprise value to acquire Wellbeing is £103 million which comprise of £4.8 million (equivalent to $9 million) in Citadel shares to the vendors & management. Each share is issued at $4.65 per share along with £98 million ($189 million) cash.

The cash portion which is $189 million would be funded via an underwritten placement and conditional placement to new and existing institutional investors. Subscription of new CGL shares to Wellbeing's management along with Underwritten Senior Secured term loan of $90 million and undrawn revolving working capital facility of $10 million depending on pro forma net leverage at closing of 2.1x EBITDA.

Through placement, the company has plans to raise ~ $127 million. The placement would happen in 2 tranches.

Tranche 1: It would be an unconditional placement of ~ 7.4 million shares through which the company plans to raise $34 million under CGL's present 15% placement capacity.

Tranche 2: It would comprise of conditional placement of ~ 20 million shares to raise ~ $93 million, depending on the shareholders' approval at an EGM that is likely to happen on 30 March 2020.

CGL’s 1H FY2020 Highlights:

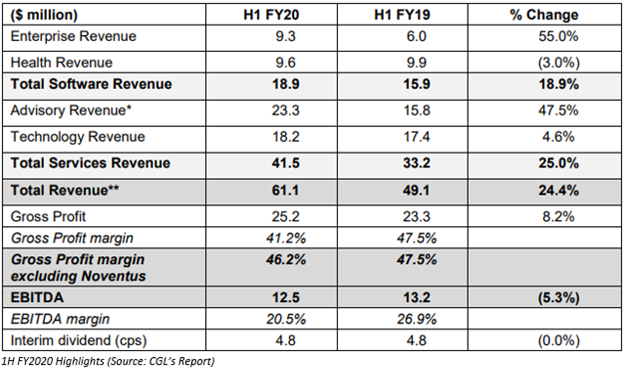

For 1H FY2020 ended 31 December 2019, CGL reported a 24.3% growth in its revenue to $61.1 million as compared to the previous corresponding period.

- EBITDA dropped by 5.3% to $12.5 million.

- Profit before tax declined by 25.5% to $6.6 million

- NPAT declined by 30.6% to $4.7 million.

- EPS declined by 32.7% to 7 cents per share.

- An interim dividend of 4.8 cents per was declared.

- By the end 1H FY2020, CGL cash and cash equivalent as on 31 December 2019 was $12.32 million. The company reported a reduction in Trade & Other Payables of $3.1 million compared to that as on 30 June 2019, which reduced the operating cash flow.

- Debt went up by $12.6 million to $19.6 million as on 31st December 2019, to fund the acquisition of Noventus plus managing the working capital needs.

Citadel expects its FY2020 revenue to be in line with its previous outlook. CGL's existing business is anticipated to deliver revenue in the range of $128 million to $132 million and EBITDA in between $28 million to $30 million.

Post the acquisition of Wellbeing, the company expects that its recurring revenue would increase from 41% to 48% of FY2020 pro forma normalised estimations. The FY2020 gross profit contribution of software is projected to rise from 47% to 63%. Dividend in FY2020 would be in line with that in FY2019.

_07_02_2025_00_23_12_199043.jpg)