Copper prices are moving flat, with COMEX Copper Future trading in a range, from $2.951 (which marked the closing on 22nd February 2019) to $2.933 (which marked the closing on 1st March 2019); currently, the COMEX copper is hovering around the level of $2.906.

Copper prices are sluggish over the ambiguous data in the market.

The China Manufacturing PMI marked a level of 49.2 for the month of February, below the mean value of 50, which indicated towards a slight slowdown in the China manufacturing sector, as the figure declined from the previous month level of 49.5, which in turn created a negative sentiment in the market.

Source: Thomson Reuters: China Manufacturing PMI

Source: Thomson Reuters: China Manufacturing PMI

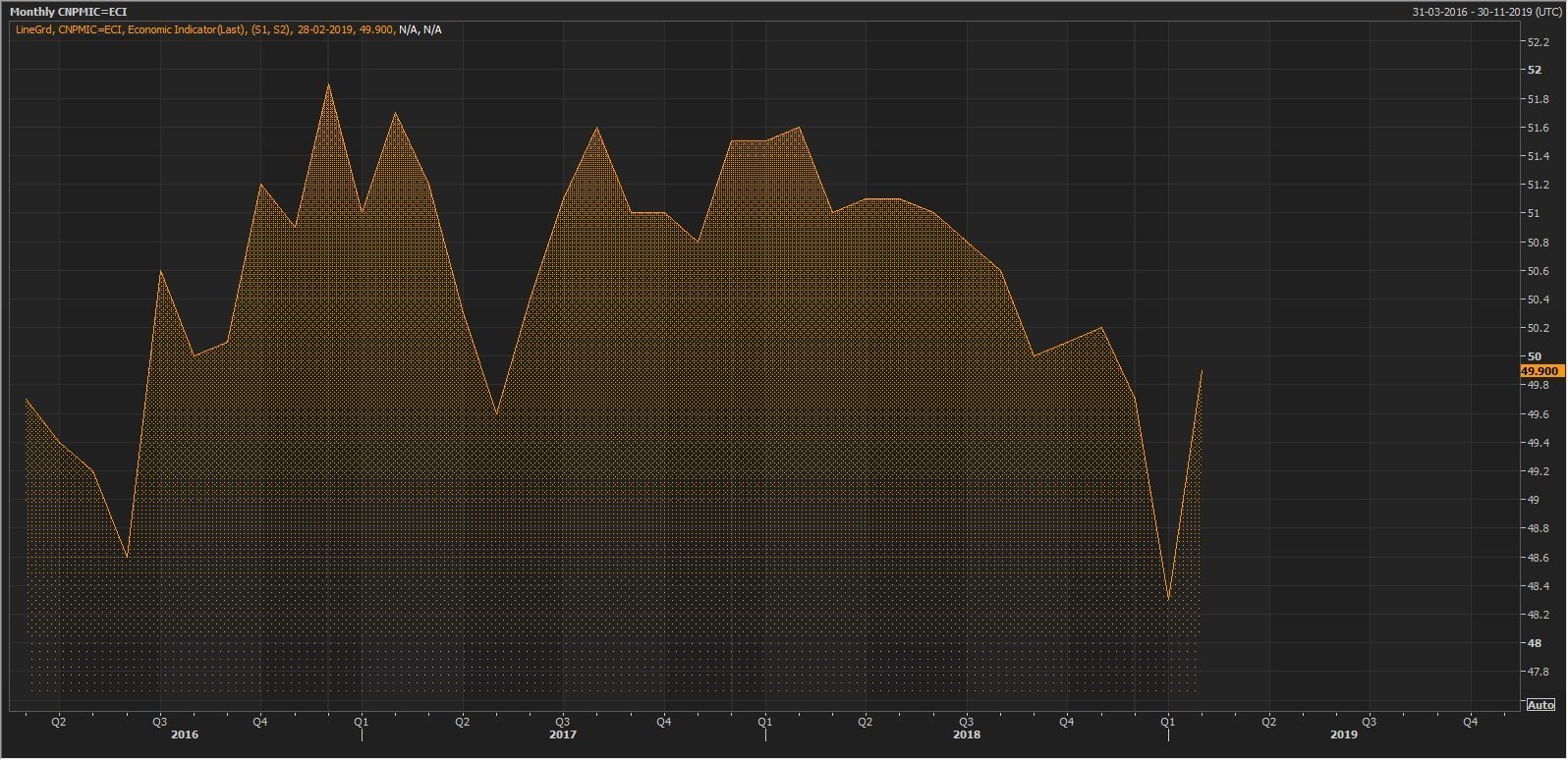

However, the Caixin Manufacturing Index marked a value of 49.9 for the month of February 2019 and moved upward, towards the mean value of 50, as compared to the 48.3 reported in January 2019, indicating towards the possible expansion in the index.

However, the combination of both the index performances pulled the value closer to the mean value of 50 and somewhat supported the copper prices.

Source: Thomson Reuters: Caixin Manufacturing PMI

Source: Thomson Reuters: Caixin Manufacturing PMI

Apart from the supporting Manufacturing index, the U.S. economic indicators also marked a recovery, with the U.S. Q4 Advance GDP q/q surged from market expectation of 2.2% to 2.6% and thus, supported the copper prices. The Advanced GDP numbers provided an impetus to the investors and supported the market view on betterment in the U.S. economy and the global economy as well.

The ongoing trade resolution is also expected to support the copper prices in the near future as a better economy needs more copper for the expansion activities.

On the supply side, we have marked a decline in Copper inventories over the shortage in production from major copper producing countries.

The falling inventory in the LME registered warehouses and increasing demand for copper, due to the rapid electrification process in the transportation industry is supporting the copper prices. The declining inventory in the LME registered warehouses is mainly due to the tighter regulation adopted by the London Metal Exchange (LME) on the souring for the metal. The LME is keeping a strict eye on the producers, who are sourcing their metal from the Democratic Republic of Congo (DRC) because of political and ethical issues associated with the country.

The political instability in the DRC is another reason, which is creating a decline in the supply chain as the government is making it difficult for the metal producers to operate in the region. The inclusion of more and more metals under the âStrategic Metalâ tag is allowing the DRC to raise the royalty in the base metals, and thus, in turn exerting pressure on the metal producers and creating a shortage in the supply chain.

Technical Outlook:

Source: Thomson Reuters: COMEX Copper Futures Daily Chart

Source: Thomson Reuters: COMEX Copper Futures Daily Chart

The 7 days moving average is well placed at $2.9258, covering more than the half body of the candle. The prices are moving in an uptrend, with a correction seen on the chart, which will be a perfect opportunity to initiate a buy in the commodity. The Relative Strength Index (14) is well placed at the level of approx. 60 and is above the mean 50. The MACD (12,24,9) is showing a golden crossover with signal line (Blue) crossing the average line (yellow) from below, indicating a chance of reversal.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.