Bitcoin prices are again in the doldrums amid profit booking activities and event impact. The Bitcoin prices which reached the level of US$13,764 (Dayâs high on 26th June 2019) previously, fell to the recent bottom level of US$10,961.0 on 2nd July 2019.

Post a decline of over 25 per cent in just a few trading sessions; the Bitcoin market again jolted the market participants over the high volatility in the digital assets market. To prevent against such high volatility, many new cryptocurrencies are knocking the marketâs entrance. Cryptocurrencies such as Facebookâs Libra and Minasulâs coffecoin are all over the media.

However, currently, the digital market is witnessing ambivalent response from the private and government sector. While, few private houses such as Cboe Global Market, Chicago Mercantile Exchange, etc., are offering the services to promote the digital assets, the central banks and various global leaders are getting apprehensive over the development in the digital asset market.

The bitcoin market is not just witnessing a surge in the number of service providers; it is also noticing an increase in the acceptance as a mean of financial transaction among the private companies.

BrewDog and the Bitcoin:

BrewDog the United Kingdom-based multinational brewery recently decided to raise crowdfunding; however, this time the company decided to accept the Bitcoin. BrewDog launched its new beer- Cryponite: Intergalactic Liquid Currency.

In a Tweet, BrewDog mentioned that this would be alternative finance for alternative business.

Contrarian to the private sector acceptance, the United States Federal Reserve is concerned over the newly proposed cryptocurrency- Libra.

FED VS Facebook:

In a meeting at the House of Financial Services Committee in Washington, the FED chair Jerome Powell mentioned that proposed currency from Facebook could raise concerns related to privacy, money laundering, and financial stability.

On further taking down on the Bitcoin, the FED chair also mentioned that the Bitcoin is a speculative store of value and no one is using it for payments instead the market is using it more as an alternative to gold.

In his further statement to media, the FED chair mentioned that the committee is working on the Libra proposal.

Libra is gaining sharp criticism from the government, despite the fact that Libra is backed by Real Assets.

In a recent tweet, the United States president Donald Trump mentioned that he is not a big fan of the cryptocurrency, and there would be only one true currency in the United States, and that would be the United States Dollars.

The United States president further added to the criticism by mentioning that the cryptocurrencies value carries high volatility. The president also took a troll over Facebookâs Libra and said that Libra would have little standing and dependability.

Mr Trump tweeted further and said if the companies such as Facebook want to become a bank, they should follow the same banking regulations and must seek a new Banking Charter.

Recently, Bitcoin prices have taken a hit in the international market, and the prices of the digital asset recently reached a low of US$11,006.0 on Bitfinex (Dayâs low on 11th July 2019).

However, the dollar plunge is currently providing mild support to the prices, and in todayâs session, Bitcoin reached a high of US$11,510.0 (as on 12th July 2019 4:44 PM AEST).

Dollar Vs Bitcoin:

(Daily Chart BTC and DXY Source: Thomson Reuters)

On following the daily chart of Bitcoin and the Dollar Index, we can estimate that the Bitcoin prices take dollar movement into consideration, and both the assets establish a negative correlation. The upside in dollar prices exerts pressure on Bitcoin. The recent plunge in dollar supported the Bitcoin prices, and the prices reached a recent high of US$13,764.0. The low in the dollar is followed by a high in the Bitcoin prices.

Likewise, the current-dollar plunge is supporting the Bitcoin prices. The inverse correlation in the Bitcoin and the Dollar Index is marked by the pink circle (two small circles) in the chart shown above.

Whatâs Next for the Bitcoin?

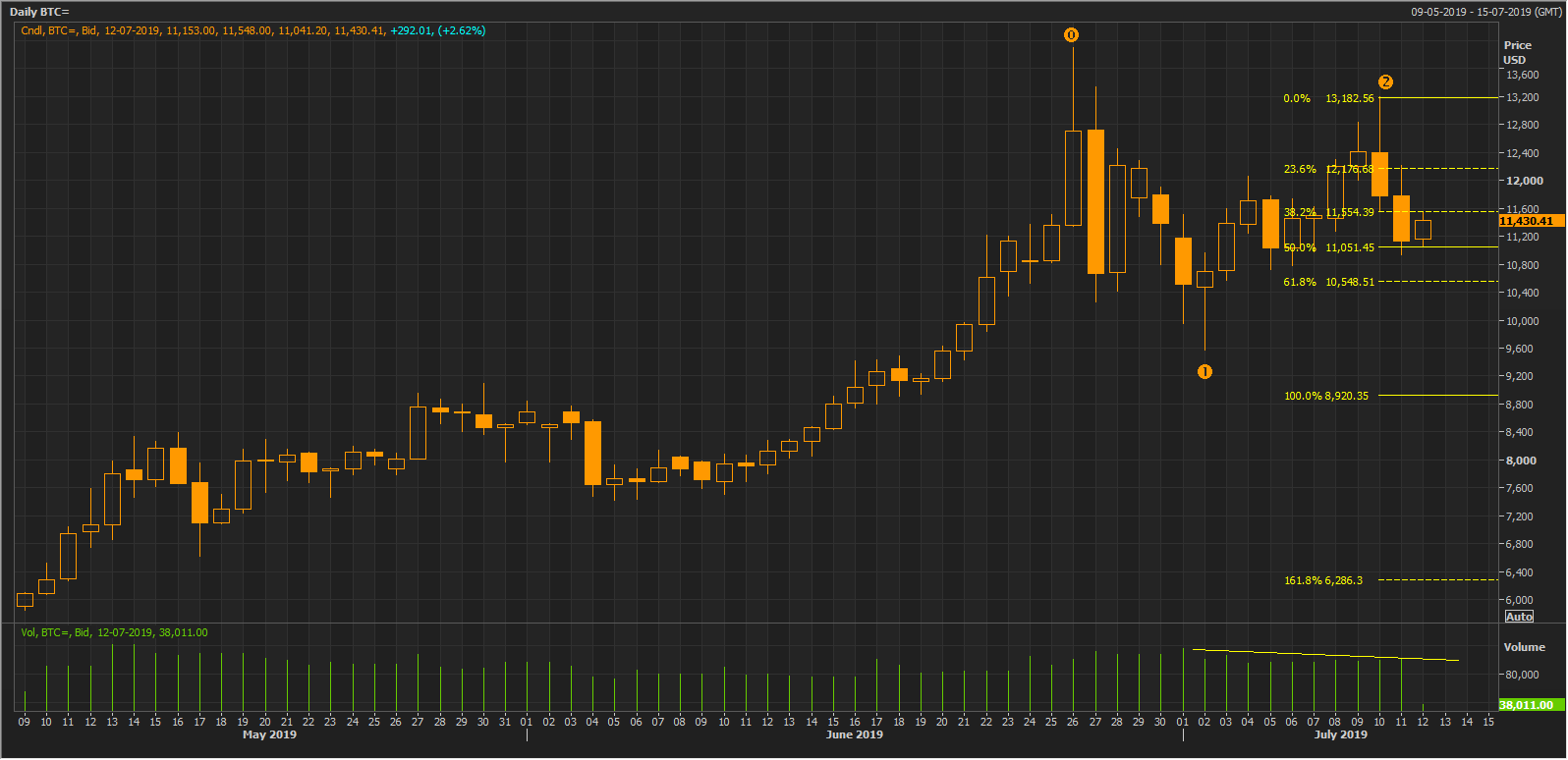

(Daily Chart BTC Source: Thomson Reuters)

On a daily chart, the Bitcoin prices rose to mark a high of US$13,764.0 with high volumes. Post witnessing the top, the Bitcoin fell to the level of US$9,745.1 on 2nd July 2019, and then the prices inched up again.

However, the second up-rally ended at US$13,173.0 (Dayâs high on 10th July), which was lower than the previous high level of US$13,764.0 (over 4 per cent lower), with lower volumes, which in turn, suggests that the bull strength is getting weak.

The price pattern could be forming a potential Double-Top (bearish pattern) on a daily chart. The neckline of this potential Double-Top is at the level of approx. US$9,546.17.

On following the simple moving averages (SMAs), we can notice that the prices are trading above the trio of 200,100, and 50-days SMAs. The 50-days SMA is at US$9708.36, which is near the neckline of the potential Double Top and could act as the support for the prices if the prices take a nose-dive further.

Investors should keep a close eye around the range of US$9730âUS$9790 as this could be the short-term support for the prices. A break below the provided range or failure to do so would decide further prices actions in it.

On the technical counter, the 14-days Relative Strength Index, which is a leading indicator, is showing a bearish signal. The RSI is reverting from the over-bought levels, which, in turn, suggests that the Bitcoin prices are capable of taking a short-term price correction.

The trend across the volume is declining, which further favours the RSI indication of short-term price correction.

(Daily Chart BTC Source: Thomson Reuters)

On further following the daily chart and connecting the Fibonacci projections from the points marked as 0,1,2 on the chart shown above. The prices are currently at the 50.0 per cent level of the projected series, which is at US$11,051.45, investors should keep a close eye around the level as a break below it could take the prices toward its short-term support range of US$9,730âUS$9,790.

The results of the series are as;

The 23.6 per cent of the projected level is at US$12,176.68, 38.2 per cent of the projected level is at US$11,554.39,50.0 per cent of the projected level is at US$11,051.45,61.8 per cent of the projected level is at US$10,548.51, and 100.0 per cent of the projected level is at US$8,920.35.

The plunge is Bitcoin prices and the sharp criticism the currency is pulling the ASX-listed blockchain software provider- DigitalX Limited down.

DigitalX Limited (ASX: DCC)

DCC is an Australian Securities Exchange listed software provider for Bitcoin trading and mining. The company engages with retail clients to provide Bitcoin mining and trading software. The operations of the company are divided into two segments of Software Development and Trading. The product portfolio of the company includes AirPocket- a short message service based international mobile bill payments platform, and the product portfolio of the company also cater the institutional investors through its DigitalX Direct- a business-to-business platform, which provides institutional investors liquidity.

Share Price Actions:

The share prices of the company are moving in a downtrend from the level of A$0.440 (Dayâs high on 10th January 2019) to the present level of A$0.042. The stock ended the dayâs session today on ASX at A$0.042, down by 2.326 per cent as compared to its previous close.

Return Profile:

The stock delivered a yearly return of -49.41 per cent, and the YTD returns of DCC stand at -17.31 per cent (as per the yesterdayâs closing).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_02_2025_00_23_12_199043.jpg)