Gold as a safe haven asset has been the parameter to gauge the global uncertainty.

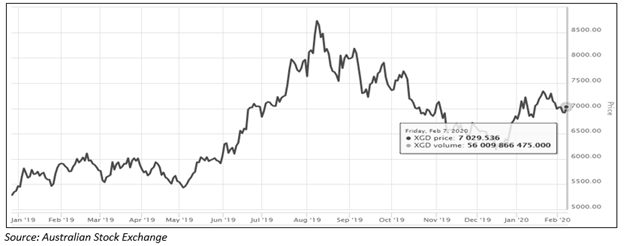

S&P/ASX All Ordinaries Gold (XGD), prices increased by 60% last year from A$5447.993 on 2 Jan 2019 to a maximum of A$8730.165 on 8 August 2019, perhaps attributable to the global uncertainty such as US-China trade tension and the dwindling interest rate to mention few.

Subsequently, the index price started to fall and reached A$6185.674 on 13 December 2019, perhaps driven by intermittent optimism towards trade deal post-Chinese efforts for policing intellectual property (IP) theft with stricter penalties and investment.

Come 2020, the price rose again amidst uncertain outcome of recently signed Phase 1 US-China deal, global concern of Coronavirus epidemic, while the nation grapples with bushfire and drought impact. The XGD price on 7 February 2020 was A$7029.536.

S&P/ASX All Ordinaries Gold Price Movement: -

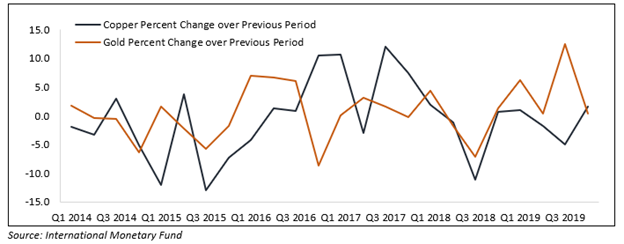

The gold price variation with global uncertainty is easily witnessed by comparing with a copper-the universal economic indicator which depicted relation inversely, as shown below.

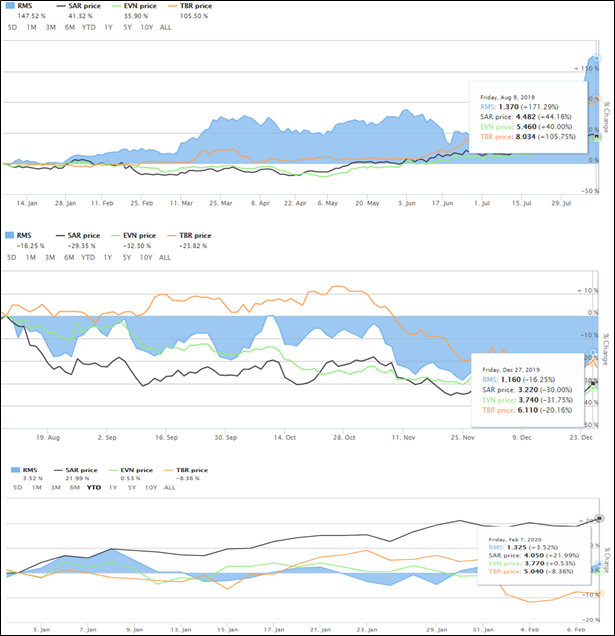

With the gold reaching new highs in 2020, it is quintessential to analyse the performance of the gold stocks on ASX. For the same, stocks with a market cap of above A$200 million to A$10 billion are chosen : RMS, SAR, EVN and TBR.

Interesting Read: Gold Takes A Breather; Global Economy Bolsters And AUD Appreciates

The companies mentioned above, the return of share price followed the same trend as gold price, as shown below.

Source: Australian Stock Exchange

During the period from 14 January to 9 August 2019, the soaring gold price has depicted tremendous return in share price, i.e. RMS (+147.52%), SAR (+41.32%), EVN (+35.90%) and TBR (+105.5%).

Similarly, in line with falling gold prices during August to December 2019, we can observe negative return for stocks between 8 August to 27 December 2019: RMS (-16.25%), SAR (-29.35%), EVN (-32.30%) and TBR (-23.82%).

However, the 2020 YTD return stands positive for RMS (+3.52%), SAR (+21.99%), EVN (+0.53%), and though negative but slightly improved for TBR (-8.36%) as of 7 February 2020.

Evolution Mining Limited (ASX: EVN) is an ASX listed gold producing company with assets presence across Queensland followed by New South Wales and Western Australia.

The gold production of 170.890 koz at AISC A$1,069/oz is achieved during December 2019 quarter. And it is essential to mention that the Company has reached its 50% guidance and expected to attain the remaining gold production easily in the next half of the year. The guidance for FY20 remains unchanged with ~725koz at AISC of ~A$920-990/oz.

Must Read: Evolution Mining Limited to Acquire 100% Of Red Lake Gold Project

EVN is presently traded at A$3.945 on 11 February 2020 (AEDT: 1:58 PM) with a P/E ratio of 31.570 and EPS of A$0.129 at annual dividend yield of 2.34 %. Its 52 weeks high and 52 weeks low stand at A$5.585 and A$3.04, respectively, and has a market cap of A$6.92 billion.

Saracen Mineral Holdings Limited (ASX: SAR) is an Australian listed gold company. The Company owns 100% of Thunderbox and Carosue operations. Also, it recently acquired 50% interest in KCGM, i.e. Super Pit gold mine.

December 2019 quarter has witnessed record gold production of 120,127oz at AISC of A$1,098/oz. Out of which Thunderbox produced 46,594oz, Carosue Dam produced 52,899oz and KCGM produced 20,634oz. Cash cost excluding royalty for Thunderbox is A$750/oz, Carosue Dam is A$1000/oz, and KCGM is A$1265/oz with overall as A$951/oz. The production guidance for FY20 is <500koz and FY21 as <600koz.

The stock of SAR increased by 14% from A$3.55 on 14 January to A$4.13 on 10 February 2020 post the announcement of quarterly update and RED sale announcement.

The stock traded at A$4.155 on 11 February 2020 (AEDT: 2:00 PM) with a P/E ratio of 36.55 and EPS of A$ 0.113. Its 52 weeks high and 52 weeks low stand at A$4.659 and A$2.423, respectively, and has a market cap of A$4.55 billion.

Ramelius Resources Limited (ASX: RMS) is a gold producer company based out in Western Australia. The company presently operates Vivien, Mt Magnet and Edna May gold mines. Further, last year RMS acquired Marda and Tampia Hill gold projects to increase the total gold production of the company.

The total production of the company during the December quarter was 47,902 ounces at an AISC of A$1,245/oz, out of which Mt Magnet (incl. Vivien) contributed ~37,956 ounces at an AISC of A$1,182/oz and remaining 9,946 ounces by Edna May at an AISC of A$1,512/oz.

The cash and gold equivalent at the end of the quarter was A$87.7 million after payment of dividend A$6.6 million and capital, development and exploration expenditure of A$29.5 million.

The 1H20 production was reported as 92,084oz at an AISC of A$1,240/oz whereas, FY20 guidance is 205,000 - 225,000 ounces at an AISC of A$1,225 - 1,325/oz.

The surge in FY20 guidance of more than 100% is expected to be coming from Marda mine and ramp-up of production (coming from Eridanus, Vegas, Stellar, Brown Hill, Hill 60 UG, Shannon UG).

Good Read: Ramelius Resources proposed a higher bid to acquire Explaurum

The share price witnessed increment by 5% from A$1.29 on 30 January to A$1.355 on 4 February 2020 post the announcement of the quarterly update.

The stock traded at A$1.285 on 11 February 2020 (AEDT: 2:01 PM) with a P/E ratio of 33.82 and EPS of A$0.037. Its 52 weeks high and 52 weeks low stand at A$1.44 and A$0.56, respectively, and has a market cap of A$832.97 million.

Tribune Resources Limited (ASX: TBR) is an ASX listed gold producer with principal activities involving exploration, development and production around East Kundana Joint Venture tenements (EKJV). Also, it owns 100% of the issued capital of Singapore based Prometheus Developments Pte Ltd and leases grant for the Japa Project in Ghana.

In the EKJV agreement, the Company holds a 36.75% interest while remaining is owned by Rand Mining Ltd (ASX: RND) and Northern Star Resources Ltd (ASX: NST) with an ownership interest of 12.25% and 51%, respectively.

During the December quarter, EKJV processed 223,191 tonnes of ores at Kanowna Plant and 58,250 tonnes at the Greenfields Mill while 30,267 tonnes of ores from Rand and Tribune (R&T) treated at the Lakewood Mill.

The production credited to R&T Bullion Accounts is 23,494 oz of gold and 4,050 oz of silver of which tribune share is 75%.

Also, recently the Company announced EKJV exploration report in which only one diamond hole out of seven targeting Falcon returned significant gold mineralisation. Therefore, the Company revised the mining plan and put Raleigh UG mine on care and maintenance in April 2020 to conduct a detailed assessment of the potential, review the seismic events to recommence mining.

Interesting Read: Northern Star’s Offers Got Rejected by Tribune And Rand

The share price witnessed a tremendous fall by 16% from A$5.8 on 31 January to A$4.85 on 4 February 2020 in the period of quarterly, EKJV exploration and production announcements.

The stock seems to be correcting, presently trading at A$4.830 on 11 February 2020 (AEDT: 2:02 PM) with a P/E ratio of 7.79 and EPS of A$0.652. Its 52 weeks high and 52 weeks low stand at A$8.8 and A$3.787, respectively, and has a market cap of A$55.5 million.