When an investor thinks of investing in a particular stock, then he considers earnings of the company as one important criterion. Earnings are representation of net income after taxes. It is considered as an important figure while analysing the company. The earnings of any company are used to derive various financial ratios. This enable investors to check on the financial health of the company.

Earnings refer to the profit made by the company during a particular time frame. Earnings also have a direct impact on share prices. In most of the cases of any increase, the earnings would have a positive impact on the share price. However, the share price might get influenced by other macro level factors as well. The company which surpasses its earnings estimates is considered to be an outperforming one.

In this article, we would look at four companies which have released their half yearly results. So, let’s look at their performance during the period.

Nick Scali Limited (ASX: NCK)

On 6 February 2020, Furniture retailer Nick Scali Limited (ASX: NCK) has released its 1H FY2020 results for the period ended 31 December 2019.

The company reported a net profit after tax of $21.4 million, which comprise of $1.3m post-tax gain on the sale. After adjusting for the property gain, the underlying profit was $20.1 million.

- During 1H FY2020, sales revenue declined by 2.5% to $137.5 million as compared to 1H FY2019.

- Gross margin declined from 62.8% in 1H FY2019 to 62.2% in 1H FY2020.

- Expenditure which includes depreciation and finance costs increased by 4.1 percentage points to 40.2% as compared to the previous corresponding period (pcp).

- EBITDA declined by 18.8% to $31 million and EBIT by 19.6% to $28.8 million.

- A fall was also seen in the basic earnings per share by 15.7% to 26.4 cents.

- Operating cash flow before interest and tax tumbled by 22.6% to $25.7 million.

- During the period three new stores were opened.

- NCK’s directors declared an interim dividend of 25 cents per share (fully franked).

The company during the Q1 FY2020 experienced a substantial fall in the store traffic plus negative comparable store sales growth of 8.3%. However, during Q2 FY2020 trading conditions improved with written orders up 3.5% on a similar store basis.

Outlook:

The company, at this stage is not in a position to provide guidance for FY 2020. Even though there was significant progress in the sales & store traffic; still, there is uncertainty around the present level of customer psyche because of the coronavirus outbreak as well as other factors.

Coles Group Limited (ASX: COL)

On 6 February 2020, Coles Group Limited (ASX: COL) provided its trading update ahead of its 1H FY2020 results. This trading update provided by the company is a provisional result, and the final results depend on management accounting and finalisation and auditors’ review thereof.

In Q1 FY2020, the company reported that Supermarkets comparable sales growth had moved towards the level reached in the Q4 FY2019. However, because of the success of the Christmas campaign, the expectation got surpassed with Supermarkets providing comparable sales growth of 3.6% in Q2 FY2020 and 2% in 1H FY2020.

The comparable sales growth of Liquor during Q2 FY2020 was 2.1% while Express (c-store) was 5.1%. For 1H FY2020, the comparable sales growth in Liquor and Express (c-store) was 1.5% and 2.9% respectively.

The company’s provisional 1H FY2020 Group Earnings Before Interest and Taxes is anticipated to range in between $710 million & $730 million.

According to Coles, the provisional first half FY20 Group EBIT before the application of AASB16 on a retail calendar basis is anticipated to lie in between $710 million and $730 million. The provisional EBIT during the period was affected by favourable timing as well as non-operating elements.

Supermarkets EBIT growth during the period was augmented from incremental expenditure in 1H FY2019 pertaining to the elimination of plastic bags & enhanced flybuys advertisements which was not there in 1H FY2020.

Even though the results of the company were quite satisfactory, still Liquor EBIT declined as compared to the previous corresponding period due to margin pressure and clearance as well as promotional activities undertaken.

Dexus (ASX: DXS)

On 6 February 2020, Dexus (ASX: DXS) announced its 1H FY2020 results and has upgraded its guidance of distribution per security growth from ~ 5% to ~ 5.5% for FY2020.

1HFY2020 Financial Highlights.

- Net profit after tax increased by 36.9% to $994.2 million on pcp.

- Underlying Funds from Operations per security went up by 1.9% to 31.9 cents.

- Distribution per security was 27 cents. It remained consistent with the prior corresponding period.

- Net tangible asset within six months went up by 5.9% to $11.10 per security.

Operational Highlights:

- Retained high occupancy of 97.4% for Dexus office as well as 96% for its industrial portfolios.

- Completed the development of 240 St Georges Terrace in Perth & advanced the $11.2 billion development pipeline of the Group.

- Dexus Wholesale Property Fund raised approximately $180 million of new equity.

- Realised $27.8 million of trading profit post the sale of the 1st tranche of 201 Elizabeth Street in Sydney.

Mirvac Group (ASX: MGR)

On 6 February 2020, Mirvac Group (ASX: MGR) released a consolidated summary of its operational and financial performance for the half-year ended 31 December 2019.

Key Financial Highlights:

- Operating profit after tax increased by 21% to $352 million, driven by a strong 1H Residential settlement profile.

- Profit attributable to stapled security holders for the period is $613 million, a fall of 5% due a fall in net valuation gains on investment properties.

- Operating cash inflow increased from $167 million in 1HFY19 to $354 million in 1HFY20

- Net tangible assets (NTA) per stapled security went up by 3% to $2.58.

- 1H FY2020 distributions of $240 million which represent 6.1 cents per stapled security.

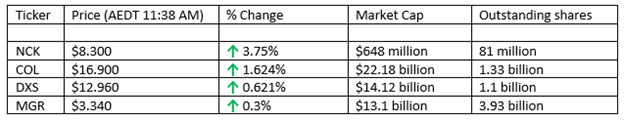

Stock Information