Industrial sector includes those companies that are in the business of manufacturing and distribution of capital goods, such as construction, aerospace & defense, electrical equipment, and engineering & building products. On 10th March 2020 (AEDT 11:28 AM), the S&P/ASX 200 Industrials (Sector) was trading downward by 9.9 points or 0.17% to 5,857.7.

In the following article, we are discussing three ASX-listed industrial sector players, covering their latest updates and stock performance.

Boral Limited (ASX: BLD)

Boral Limited (ASX: BLD) is a materials sector player, which is engaged in the manufacturing and supply of building and construction materials.

First Half – In Line with Expectations for Boral Limited

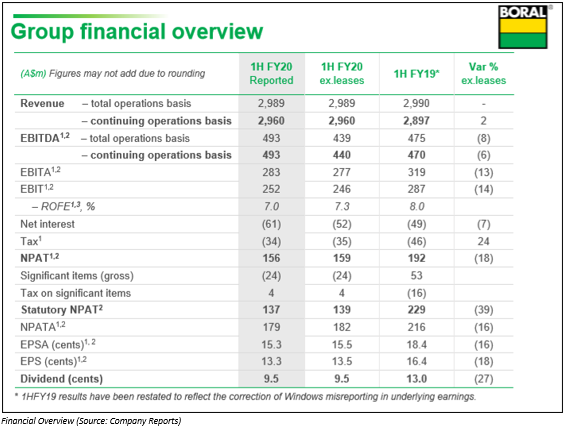

In February 2020, the Company notified the market with its operational and financial performance for 1H FY20 ended 31 December 2019. Its results during the period were broadly in line with guidance.

Result Highlights -

- Cyclical fall in housing markets in Australia as well as South Korea, which was partially offset by improvement initiatives, resulted into lower earnings for 1H from Boral Australia and USG Boral.

- Boral North America also reported lower earnings, which reflect volume pressures and higher costs.

- The Company reported net profit after tax before significant items amounting to $159 million, representing a decline of 18%.

- Reported sales revenue for the period stood at $2,989 million, which was steady as compared to 1H FY19 and sales revenue from continuing operations reached $2,960 million, reflecting a rise of 2%.

- For the same time period, the Company reported earnings before interest, tax, depreciation & amortisation of $439 million and EBITDA from continuing operations stood at $440 million, down 6%. This demonstrates softer EBITDA in all three divisions of BLD.

- The Board of BLD declared an interim dividend amounting to 9.5 cents per share, which is franked to 50%, indicating a payout ratio of 71%. The dividend is scheduled for payment on 15th April 2020.

FY2020 EBITDA to be Down Relative to FY2019

Considering the Company’s performance in the first half, a lower than previously anticipated earnings from the Windows business, major project scheduling delays in the second half and bushfire related impacts, the Company is expecting FY2020 EBITDA to be down relative to FY2019. Net profit after tax for FY20 is anticipated in the range of $320 to $340 million.

The Company remains focused on managing a prudent balance sheet, which will provide operational flexibility. It is also committed for retaining its BBB / Baa2 investment grade credit ratings.

The stock of BLD was trading at $3.745 per share on 10th March 2020 (AEDT 11:41 PM), indicating a fall of 2.727% against its previous closing price. The market capitalisation of the Company stood at $4.51 billion. At the same market price, the annual dividend yield of BLD was noted at 5.5%. The total outstanding shares of the Company stood at 1.17 billion. During the time period of three months and six months, the stock of BLD delivered returns of -15.75% and -13.29%, respectively.

Monadelphous Group Limited (ASX: MND)

Monadelphous Group Limited (ASX: MND) is involved in the provisioning of engineering services within Australia. MND was officially listed on the Australian Stock Exchange in 1991. The Company recently notified the market that a serious accident occurred at its workshop services facility in Kalgoorlie, resulting in the loss of one of its employees.

Strong Performance by Maintenance and Industrial Services Division

MND, during mid-February 2020, reported strong performance for the first half of financial year 2020 ended 31 December 2019.

- The strong performance in Maintenance and Industrial Services division of MND enabled the Company to report revenue amounting to $852 million for 1H FY20, with a rise of 2.6% as compared to pcp.

- Net profit after tax for the period stood at $28.5 million.

- A fully franked interim dividend of 22 cents per share was declared by the Company.

- During the period, MND secured new contracts and contract extensions worth $850 million. This would further cement the work pipeline.

- The Company secured major construction contracts at West Angelas Project of Rio Tinto and at Kemerton lithium hydroxide plant of Albemarle Lithium.

- MND managed to close the half-year with strong balance sheet comprising a cash balance of $163.3 million. It reported a cash flow from operations of $38.6 million with a cash flow conversion of 78%.

- Monadelphous wrapped up numerous strategic acquisition investments of $14.3 million, enabling the Company to expand the breadth of services provided to customers in the coal seam gas and rail sectors as well as facilitating the expansion of core services into South America.

On the outlook front, MND expects extent and duration of project and supply chain delays owing to coronavirus outbreak to influence the financial performance of the business for FY20.

The stock of MND was trading at $12.100 per share on 10th March 2020 (AEDT 12:13 PM), up 1.425% against its previous closing price. The market capitalisation of the Company stood at $1.13 billion. At the same market price, the annual dividend yield of MND was noted at 3.77%. The total outstanding shares of the Company stood at 94.39 million. During the time period of three months and six months, the stock of MND delivered returns of -26.54% and -25.81%, respectively.

Clean TeQ Holdings Limited (ASX: CLQ)

Clean TeQ Holdings Limited (ASX: CLQ) is an environmental and mining services company, which caters to several markets including air purification and resource recovery. The Company recently announced to have made good progress towards a proposal for an EPC contract for a large-scale water recycling plant. CLQ is working towards the proposal with the Townsville City Council, under which it plans to use its HiROx® process and BioLense encapsulated bacteria.

Decline in Water Projects’ Contract Income Impact First Half

For the half year ended 31st December 2019, the Company reported loss amounting to $10,280,000. It delivered revenue from continuing operations of $666,000 against $2,953,000 of 1H FY19. This fall was mainly due to decline in contract income from Water Projects in the half?year.

With respect to Metals Division, there was continued progress in the Clean TeQ Sunrise Ni?Cu?Sc (Nickel-Cobalt-Scandium) development project.

The Company plans to continue working towards securing commercial contracts while expecting substantial revenues from both the water and metals divisions in the future.

The stock of CLQ was trading at $0.175 per share on 10th March 2020 (AEDT 12:25 PM), up 2.941% against its previous closing price. The market capitalisation of the Company stood at $126.9 million and total outstanding shares were noted at 746.46 million. During the time period of three months and six months, the stock of CLQ delivered returns of -20.93% and -46.03%, respectively.