In the recent past, the financial service providers have reported stellar performances within Australia. The growth was majorly driven by an increased demand from the retail customers. Moreover, ‘Buy Now Pay Later’ segment has done immensely well driven by higher demand from certain strategies like ‘interest- free EMI’ offerings from the businesses.

The businesses also witnessed higher demand from financial products like, credit card services, retailers’ loans etc. Also, investors may choose to look at a few financial companies, where there is scope of growth and improved guidance from the management of these companies. These entities have been investing in technologies in order to cater to customer needs in an effective way. Moreover, within the fund advisory business-related companies witnessed decent growth in the recent past.

While, the global environment remained challenging in the last twelve to twenty-four months on account of Brexit and US-China trade war events, top funds houses across Australia have delivered positive fund flow during the period.

Let’s have a look at two entities along with their recent updates and guidance, which has delivered decent growth.

IOOF Holdings Limited (ASX: IFL)

IOOF Holdings Limited provides financial advices to its clients and several employers of Australia through its extensive network of financial advisors.

On 03 February, the company informed on the acquisition of OnePath Pensions & Investments (OnePath P&I) business from Australia And New Zealand Banking Group Limited (ASX: ANZ) effective 01 February 2020.

As per the recent announcement, IFL is expected to announce its first half FY20 results on 18 February 2020. As per the market update, the deal has been finalised for $850 million, which include funds of ~$25 million that ANZ had already received for the sale of its Aligned Dealer Groups in October 2018. As per ANZ, the above synergy is expected to improve its CET1 capital ratio by ~20 basis points.

Recently, the company reported that Sumitomo Mitsui Trust Holdings, Inc. and its Subsidiaries have decreased their voting power from 8.84% to 7.46% effective 29 January 2020.

Operating Highlights of OnePath Pensions & Investments: As per the end of CY19, the business reported funds under administration of $48.2 billion and funds under management of $26.8 billion. As reported, the company’s underlying net profit after tax came in at $42.3 million. The management expects that the above acquisition is likely to aid higher consequences for its members, clients and shareholders. Further, the management anticipates that the above collaboration is expected to deliver a profitability which is close to $63 million per annum. IFL estimates that the cost synergies are likely to come around $68 million pre-tax per year.

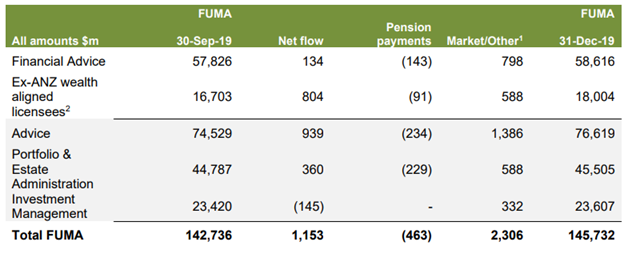

H1FY20 Highlights of IOOF Holdings: IOOF Holdings Limited reported its funds under management, advice and administration came in at $145.7 billion as on 31 December 2019, depicting a growth of 5.2% from 30 June 2019.

The business reported a net inflow of $939 million from its advice segment as compared to a net inflow of $295 million in prior comparative period which was aided by onboard of 11 new advice practices during the quarter. The advice segment delivered the growth, despite ongoing industry-wide reform, affecting advisers’ businesses including meeting FASEA standards, extra governance and compliance obligations and changes of the fee arrangements. Portfolio & Estate Administration segment has delivered a net inflow of $360 million, as compared to $403 million in pcp.

During the period, the business witnessed net inflows within the proprietary platforms, which posted improved functionality and scalability. The segment showed improved operational efficiency aided by higher client servicing. The company’s Investment Management segment delivered a net outflow of $145 million, as compared to $186 million in previous corresponding period.

The IOOF Multimix and Multiseries range of funds witnessed higher quarterly net inflows and strong investment performance, which was offset by outflows across the other financial products.

IFL Quarterly Fund Movement (Source: Company’s Report)

Outlook: The management expects that UNPAT for the first half of FY20 is expected within the range of $61 million to $63 million while on a continuing operations basis, the business expects UNPAT within the range of $56 million to $58 million.

Stock update: On 4 February 2020, the stock of IFL last traded at $7.49, reflecting a fall of 2.727 percent from tis last close, with a market capitalisation of $2.7 billion. The stock has delivered stellar returns of 3.49% and 42.97% in the last three months and six months, respectively. The stock is available at a price to earnings (P/E) multiple of 94.48x on its trailing twelve months basis. The stock has delivered an annualised dividend yield of 4.87%. The 52-weeks low and high of the stock stood at $4.556 and $8.450.

Flexigroup Limited (ASX: FXL)

Flexigroup Limited offers a wide range of financial products to the individual and business units such as ‘Buy now pay later’ services, credit card services and consumer lending etc.

On 03 February 2020, the company announced its strategic collaboration with Flight Centre Travel Group Limited (ASX:FLT) for being an exclusive provider of interest free finance to approved customers.

The above collaboration focusses on improving the consumer experience with long term interest free finance product. The above strategy is likely to drive the recurring business with added incentives available to the consumers. The above marketing strategy is likely to result in a double-digit to the revenue of the company in coming quarters.

FXL is likely to improve its profitability through rewards and benefits to consumers; however, the business will look upon the improvement on the credit risk and collections process. The group will be focusing on the strategy of comprehensive credit reporting, which includes added improvements of fraud controls, improved credit scorecards and enhanced collections capability.

The company informed that it would declare its results on 25 February 2020.

Key Trading Highlights for H1FY20:

During the period, the business witnessed a positive traction and delivered 12% customer growth during the period, followed by a 15% increase in vendor partnerships. The group reported transaction volume of $1.35 billion, depicting a growth of 3% on pcp. The volume of proforma transaction grew by 5% from H1FY19, which came in line with the management’s expectations. The company expects volume growth in H2FY20 on account of collaborations with new strategic collaborations.

As per the Management commentary in its FY19 results, the business will enhance its investment across brands, employees, high performance digital marketing and will focus on restructuring of functions taking place in FY20.

Outlook: As per the FY20 expectations, transaction volume is likely to grow within the range of 10% to 15%. The growth is driven by new product launches, addition of the new customers within the segment along with new partnerships. However, the management expects that the retail environment is likely to experience soft demand during FY20. Based on unaudited management accounts, the company expects Cash NPAT of $34.5 million in H1FY20.

Stock update: On 4 February 2020, the stock of FXL last traded at $1.890, indicating a rise of 1.07 percent compared to its previous close, with a market capitalisation of $737.51 million. The stock has delivered mixed returns of -5.79% and 5.65% in the last three months and six months, respectively. The stock is available at a price to earnings (P/E) multiple of 11.76x on its trailing twelve months basis. The stock has delivered an annualised dividend yield of 4.12%. The 52-weeks low and high of the stock stood at $0.975 and $2.710.