The below-mentioned IT stocks have provided significant returns in the recent past. Letâs take a closer look at these stocks.

Integrated Research Limited (ASX:IRI)

Integrated Research Limited (ASX: IRI) designs and develops systems and applications management computer software. The company recently announced the appointment of highly experienced, Mr John Ruthven as Chief Executive Officer. In his 20 years of experience, Mr Ruthven held various senior executive positions in big companies like TechnologyOne, ANZ, CA Technologies and Computer Associates Inc. On the back of his leadership credentials and international software industry experience, Mr Ruthven is a significant addition to the companyâs management.

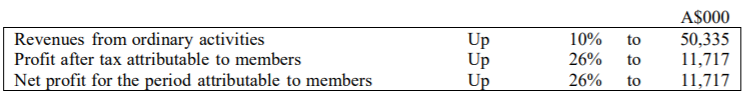

For the six months ended 31st December 2018, the company recorded a profit after tax of $11.7 million, up 26% on the previous corresponding period (pcp).

Half Year results for the Period ended 31 December 2018 (Source: Company Reports)

Half Year results for the Period ended 31 December 2018 (Source: Company Reports)

In the last six months, IRIâs stock provided a return of 61.15% as on 29th May 2019. The stock of IRI last traded at $3.000, with a market capitalisation of circa $527.61 million.

ELMO Software Limited (ASX:ELO)

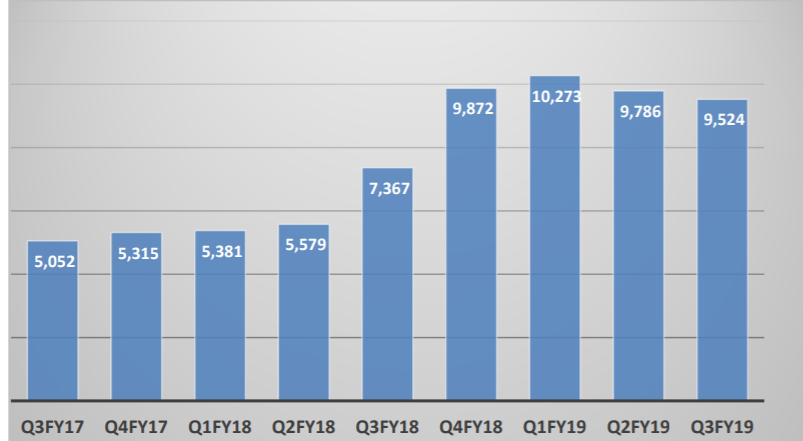

The HR tech company, ELMO Software Limited (ASX: ELO) has reported strong growth in its cash receipts during the third quarter of 2019. The company reported cash receipts of $9.5 million in Q3 FY19, up 29% on the prior corresponding period (pcp).

Customer receipts by Quarter (Source: Company Reports)

Customer receipts by Quarter (Source: Company Reports)

With the cash balance of $26.5 million as on 31st March 2019, the company is well-capitalised to fund its long term, multi-pillar growth strategy. During the third quarter, the company initiated ELMOâs partner program to further increase sales reach and grow its market share.

In the last six months, ELOâs stock generated a return of 30.19% as on 29th May 2019. The stock last traded at $6.950, down 0.43% during the dayâs trade with a market capitalisation of circa $441.36 million as on 31st May 2019.

Audinate Group Limited (ASX:AD8)

A leading provider of professional digital audio networking technologies, Audinate Group Limited (ASX: AD8) recently announced the appointment of Aidan Williams as AD8âs CEO. Mr Williams is currently working as a CTO and Co-Founder of Audinate Group Limited.

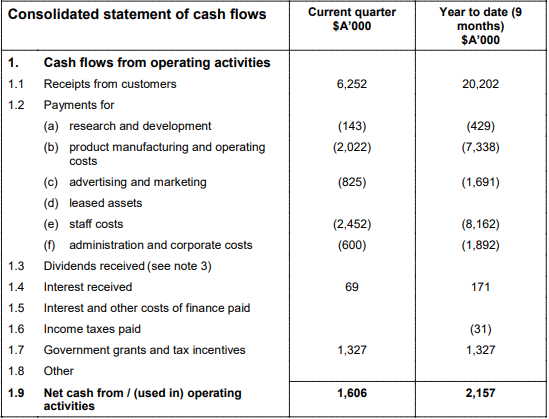

Aidan Williams will succeed Lee Ellison, who has expressed his intention of retiring from his role as CEO on 13th September 2019. Separately, in 3Q FY19, the company reported cash collections of $6.3 million, up 40% on pcp. For nine months ended 31st March 2019, the company reported operating cash flow of $2.2 million, up 42% on pcp.

Operating Cashflow for Marchâ19 Quarter (Source: Company Reports)

Historically, the company has generated annual revenue growth of between 26% and 31% in US dollar terms. For FY19, the company expects to generate similar top line growth.

AD8 was listed on ASX in 2017 and since then, has provided a return of 401.96% as on 29th May 2019. In the last six months, AD8âs shares have yielded a return of 125.88%. The stock of the company last traded at $8.000, with a market capitalisation of circa $472.73 million as on 31st May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.