Income generation is a very crucial part of returns for a lot of investors. Dividends are usually less volatile compared to share price movements; although a significant share price movement with many strings attached can impact dividends. The income returns from holding a security over a period can be referred to as yield. It is hence wise to invest in businesses that have a reliable dividend history and have every chance of growing at a good rate providing a great yield, and this is what an ideal investment scenario for a person looking for long term income stream would look like.

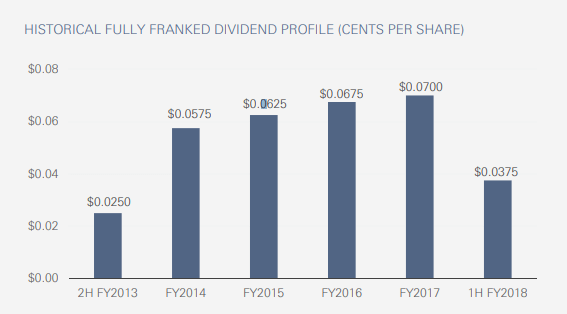

Naos Emerging Opportunities Company Limited (ASX:NCC) is known to provide exposure to listed entities outside the S&P/ASX 100 Accumulation Index. The stock traded at a market price of $1.230 with no price change since August 13, 2018. The stock has an annual dividend yield of 5.89% which is fully franked as at Aug 15, 2018, market open. The most recent dividend was 3.75c for which the dividend ex-date was March 12, 2018 and pay date was March 28, 2018. NCC mostly invests in micro-cap industrial companies with a market cap of less than $250 million, which brings portfolio performance since inception of 5 years and 5 months to +117.34% compared to the S&P/ASX Small Ordinaries Accumulation index which has returned +42.15%. The group has generally maintained a decent dividend stream over the last few years.

[optin-monster-shortcode id="wxhmli4jjedneglg1trq"]

Historical dividend for NCC, Source: Company Reports

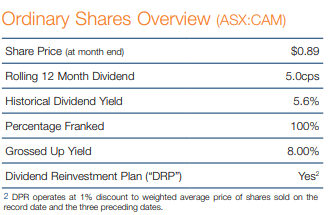

Clime Capital Limited (ASX:CAM) is a listed investment company which is investing pre-dominantly in ASX listed securities with good potential. The stock was trading at a market price of $0.900 which is close to its 52-week high and has seen a daily price change of $0.003 or a percentage change of 0.334% on August 14, 2018. The stock has an annual dividend yield of 5.56% which is fully franked. CAM usually pays the quarterly dividends in the month of January, April, July and October. To CAM Convertible Note Holders at a coupon rate of 6.25% per annum, CAM pays quarterly interest. On 12 September 2018 for the period 1 June 2018 to 31 August 2018, the next interest payment of 1.512 cents per note will be made.

Dividend Information, Source: Company Reports

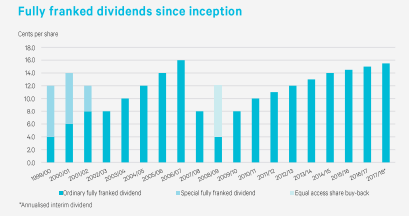

WAM Research Limited (ASX:WAX) is a financial sector company which invests in undervalued growth companies that are generally small to mid-cap. The stock was trading at a market price of $1.610 which is close to its 52-week high and has seen a daily price change of -$0.025 or a percentage change of -1.529% on August 15, 2018, market open. The stock has an annual dividend yield of 5.66% which is fully franked as at Aug 15, 2018. The most recent dividend was 4.75c for which the dividend ex-date was April 12, 2018 and pay date was April 27, 2018. In last three months, the stock has risen about 10% while the portfolio enhanced only by 0.7% in the month of July and has underperformed the S&P/ASX All Ordinaries Accumulation Index amid trade related tensions. However, the portfolio has outperformed the index by 8.5% since inception.

Historical Dividends for WAX, Source: Company Reports

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.