Leading mid-tier Australian mining company, Sandfire Resources NL (ASX: SFR) is in the business of producing base and precious metals. The company is focussed on acquiring and exploring properties and projects in locations which are considered highly prospective for significant economic discoveries. Sandfire Resources is having a significant amount of interest (19.4%) in unlisted exploration company, Andes Resources Ltd.

Andes Resources Ltd and exploration and mining company, Metminco Limited have been discussion with regards to a proposed merger. Today, Sandfire has noted an announcement in which it has been advised that Metminco has signed a binding Bid Implementation Agreement with Andes Resources to create a leading Colombian gold explorer and developer, with a dominant position in the richly gold-copper endowed Mid-Cauca Gold Belt.

The merger is receiving strong support from Andesâ largest shareholders Sandfire Resources Limited and Bullet Holdings Corporation and Andes board of directors.

Sandfire has indicated an intent to commit ~$1.165 million in aggregate to the merged entity to potentially become a 15% shareholder in Metminco following the close of the transaction.

After obtaining a voting power of 15% or more in Metminco, Sandfire will have the right to nominate one board member. Further, Sandfire will have the right to subscribe for new equity to maintain their 15% interest in any future equity capital raising.

Currently, the merger is conditional on a number of conditions, in particular a minimum acceptance of 90% and the completion of a total $4 million capital raising including funds raised by both Metminco and Andes.

To support the proposed Merger, Metminco has completed a strongly supported placement of convertible notes to raise $918,000. Besides this, Andes is also in the process of completing its own working capital placement to raise up to $750,000 on analogous terms.

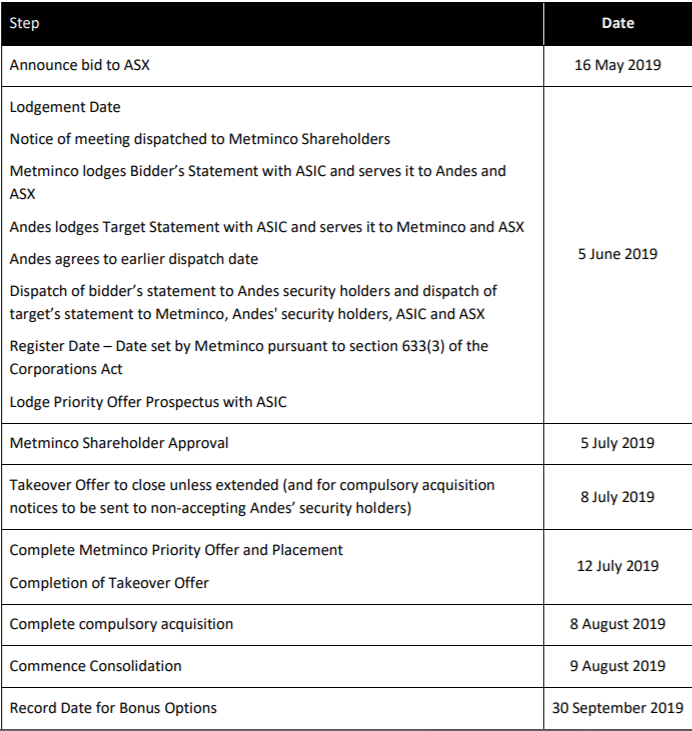

Proposed Timetable (Source: Company Reports)

Proposed Timetable (Source: Company Reports)

Metminco is planning to undertake a capital raising conducted at a price of $0.002 per share (for $2.33 million). Sandfire has confirmed to Andes and Metminco that it intends to subscribe for approximately $990,000 in new Metminco shares under the Capital Raising, which would result in Sandfire potentially being a 15% shareholder of Metminco upon close of the Merger and Capital Raising.

Post-merger two directors from Andes will be invited to join the Board of Metminco. Andesâ current Managing Director, Mr. Jason Stirbinskis will be offered the role of Managing Director of Metminco, and Mr. Ross Ashton will be invited to the Board as a Non-Executive Director.

In the last six months, the share price of Sandfire Resources decreased by 3.69% as on 16 May 2019.

At the time of writing, i.e., on 17 May 2019 AEST 12:32 PM, the stock of Sandfire Resources was trading at a price of A$6.790, up 0.147% during the dayâs trade with the market capitalisation of ~A$1.08 Bn. It is trading a PE Multiple of 9.520x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.