Australia-based Middle Island Resources Limited (ASX:MDI) has marked a significant milestone after being allocated portions of all the four competing exploration licence applications within the newly identified Barkly IOCG (iron oxide copper-gold) super-project.

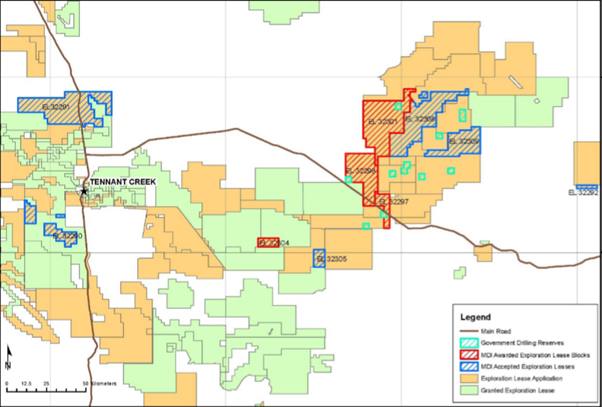

The Northern Territory (NT) government has successfully allocated between 19 per cent and 95 per cent of the four exploration licence applications (representing ~1,363 sq. km) in the now moratorium-free and recently announced East Tennant IOCG province beneath the Barkly Tableland, NT.

It is worth mentioning that the Company’s tenement applications partially or wholly coincided with competing applications by ASX-listed Rio Tinto Limited (in the Tennant Creek area) and Newcrest Mining Limited (in the Barkly moratorium area), providing a solid endorsement of the project’s technical strategy and merit.

The Company notified that the outcome of these four applications was adjudicated based on various application criteria.

ALSO READ: MDI Successfully Completes AC Drilling Program at Sandstone, To Initiate RC Program this Week

Strengthens Hold on Barkly IOCG Super-Project

The recently allocated license applications complement six Middle Island applications (covering a further ~1,890 sq. km) that have been already accepted, comprising 100 per cent of two uncontested applications inside the Barkly moratorium area.

The NT government has allocated 58 per cent of the four contested applications to the Company, which include:

- ELA32297 – 35 of 186 blocks allocated (19 per cent), representing 110.92km2.

- ELA32298 – 137 of 228 blocks allocated (60 per cent), representing 443.37km2.

- ELA32301 – 230 of 242 blocks allocated (95 per cent), representing 740.70km2.

- ELA32304 – 21 of 73 blocks allocated (29 per cent), representing 67.80km2.

Middle Island’s accepted and allocated tenement applications comprising the Barkly super-project, NT, Source: Company’s Report (18th February 2020)

The four competitive applications were lodged by the Company subsequent to lifting of a moratorium over the top priority Barkly area of the NT’s East Tennant province.

Middle Island notified that portions allocated by the government include corridors and priority targets identified by the Company from research data in some cases, while the allocated areas are peripheral to priority targets in other cases.

It is important to highlight that the allocated areas involve or immediately adjoin numerous individual blocks reserved for highly expected government basement stratigraphic drilling, scheduled to be conducted during 2020 as a component of the pre-competitive research program.

Awarded Project Blocks Now Comprise 10 Licence Applications

Subject to normal approval procedures, the Company’s awarded Barkly super-project blocks now include 10 exploration licence applications encompassing ~3,253 sq. km, extending semi-continuously for more than 350km along the axis of the East Tennant ridge from Tennant Creek east to the Queensland border.

Out of these applications, five (32297, 32298, 32301, 32308 and 32309) in the Barkly area adjoin or surround Newcrest Mining applications along the axis of the East Tennant Ridge.

The recent project release is comparable with other successful, collaborative pre-competitive research initiatives resulting in major Australian mineral discoveries under cover, including the Murray Basin of northern Victoria and the Paterson Province of WA.

What’s Ahead?

The Company will initially focus on:

- obtaining any remaining open file and pre-competitive data,

- modelling of exploration targets, and

- planning of high-resolution geophysical surveys to refine modelled targets preparatory to drill testing.

In a nutshell, the Barkly super-project represents a low initial exploration cost and low entry cost opportunity for Middle Island to discover high value, Tier 1 IOCG targets of interest to significant and mid-tier resources companies. The Company is well on track to commence exploration on the project in 2020 September quarter, following the receipt of all the regulatory approvals.

MDI closed the trading session at $0.005 on 18th February 2020.

DON’T MISS: Middle Island Delivers Solid Performance in December 2019 Quarter