Antipa Minerals Ltd (ASX:AZY) is a mineral exploration company focussed on the Paterson province in north-western Australia. The company first entered the province in 2011. It used its early entry to the advantage of building a tenement holding of approximately 5,000km square. The company has also established a mineral resource on its 100%? owned tenements (North Telfer and Paterson project). This is with the Minyari? WACA, Chicken Ranch area and Timâs Dome deposits which comprise of 827,000 ounces of gold and 26,000 tonnes of copper.

The company also owns 1,330km square of the Citadel Project that is subject to a Farm in and JV with Rio Tinto (ASX:RIO), as per which Rio Tinto can fund up to $60 million of exploration expenditure to earn up to a 75% interest in the Citadel Project.

Expenditure required to be incurred by RI0 under Farm-in Terms to earn up to a 75% JV interest include:

- $3 million exploration expenditure to be paid within 18 months of the agreement, which has been done now.

- $8 million exploration expenditure within a further 3-year period (beginning April 2017), to earn 51% JV interest; RIO is in the final year.

- Post this, $14 million exploration spend for next 3 years to earn a 65% interest, followed by $35 million within a further 3 years for 75% interest.

However, Rio Tinto exercises the right to withdraw from the project at the completion of each annual exploration programme.

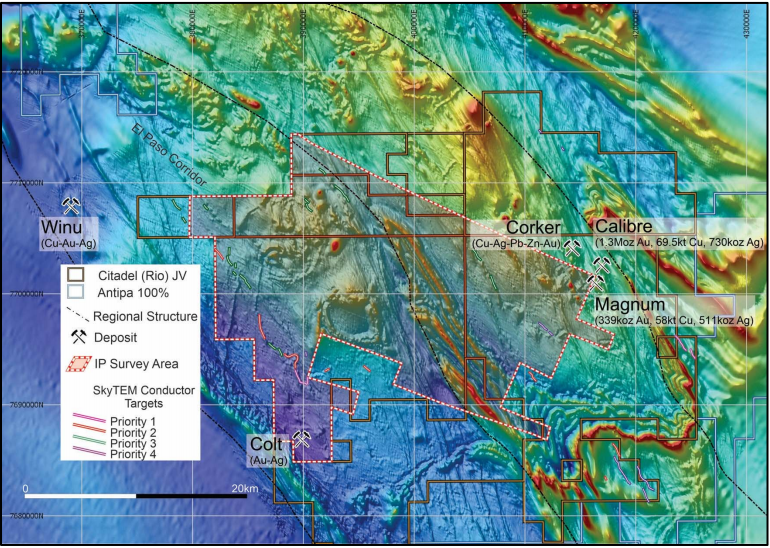

On 16th May 2019, the company announced that Rio Tinto had confirmed the commitment towards the Citadel Project Farm?in and Joint Venture, in the Patersonâs province. The company had resumed operatorship and the execution of the Citadel Exploration Programme in late March 2019. The budget allocated towards the exploration programme for the calendar year 2019 was $3.4million. It would be completely funded by Rio Tinto; prone to changes in case of results, field conditions and ongoing review. The activity would include drilling of existing targets and further target generation work.

The programme is inclusive of drill testing (upto 10,300 m of Air Core, RC, DD) both brownfield and greenfield targets, along with Calibre resource extension targets, aerial-electromagnetic conductivity anomalies and GAIP chargeability anomalies.

The programme consists of a ground based electrical geophysical survey (GAIP), of almost ~620 km square. The 4000 m air core drill programme would test eight existing copper?gold targets. The 2300 m reverse circulation and diamond-core drill programme would test targets at the Calibre gold?copper?silver deposit. A 4000 m reverse circulation drill programme would test two existing copper-gold targets and other targets laid down from the survey.

On the completion of this programme, Rio Tinto would earn an initial 51% JV interest in the Citadel project. In 2019, AZY aims to deliver the greenfield discoveries and increase the brownfield gold and/or copper resource. The exploration at Citadel would leverage this aim.

A Gradient Array Induced Polarisation survey, across almost 620km square within the Citadel Project plans to identify disseminated sulphides linked with Telfer, Winu and Calibre style copper?gold?silver mineral systems. It would begin in June and take two months. New greenfield targets are set to be drill tested during the second half of the 2019 calendar year.

Plan showing Antipa?Rio Tinto Citadel Project Joint Venture region (Source: Companyâs report)

Plan showing Antipa?Rio Tinto Citadel Project Joint Venture region (Source: Companyâs report)

Other exploration targets related to the Citadel project for 2019 include preparation of geophysical and heritage surveys and drilling programmes, on-going target generation from data and possible Calibre deposit Mineral Resource update following drilling.

Antipa Projects (Source: Companyâs report)

Share Price Information: AZY is trading flat at A$0.020 while RIO is trading 1.92% up at A$101.190 (As at 1:05 PM AEST, 17 May 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.