An Australian clean technology company, BluGlass Limited (ASX: BLG) was established in 2006 to commercialise deposition technology for compound semiconductor manufacturing. The company is now involved in developing a breakthrough technology, namely Remote Plasma Chemical Vapour Deposition (RPCVD), which is used in manufacturing Group III nitrides, essential components of millions of electronics devices.

The semiconductor technology developer has been granted 63 International Patents in key semiconductor markets, underpinning BluGlassâ future licensing, royalty, hardware supply and contract manufacturing business models.

BluGlassâ RPCVD technology is a revolutionary alternative for the manufacturing of semiconductor materials. Moreover, this technology has demonstrated performance advantages for applications in rapidly growing photonics markets, including the LED, microLED, laser diode and power electronics markets.

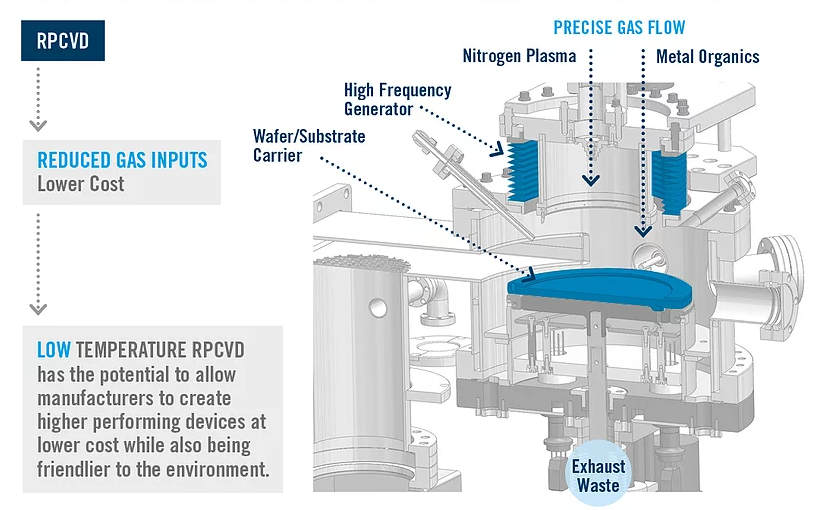

RPCVD Technology (Source: Company Reports)

RPCVD Technology (Source: Company Reports)

RPCVD technology offers many potential advantages over current technologies, which include:

- Low Temperature

- Increased Device Performance

- More Environmentally Sustainable & Sensitive compared to Current Technologies

- Cost Competitiveness

- Versatility

- Scalability

Advantages of RPCVD (Source: Company Reports)

Recently, on 9th May 2019, the company announced that along with its foundry customer, X-Celeprint, it has implemented a unique RPCVD p-GaN technology in high-performance microLED display prototypes.

Commenting on this, X-Celeprintâs Vice President of Displays, Mr Matt Meitl stated that BluGlassâ creativity in epi-wafer design, unique capabilities in epitaxial growth and dedication to continued product improvement make BluGlass a valuable development partner.

X-Celeprint 2000 cd/m2 microLED display, using RPCVD p-GaN (Source: Company Reports)

During the first quarter of 2019, BluGlass Limited was working on the facility upgrade and new laboratories at its Silverwater facility, which now houses two additional deposition systems, the BLG-300II and the commercial scale AIX 2800 G4.

It is expected that the commissioning of these new deposition systems will significantly increase BluGlassâ RPCVD development capacity and increase RPCVD customer foundry output; while demonstrating the scaling potential of this technology.

Additionally, the companyâs scaling project, in collaboration with AIXTRON SE, to implement RPCVD on a commercial scale platform, the AIX G4, is also making good progress and remains on schedule for its end of 2019 delivery.

During the 2019 March quarter, the companyâs operational and capital expenditures remained in line with the companyâs budgeted expectations. At the end of the 2019 March quarter, the company had cash and cash equivalents of A$8.71 million.

BLGâs Board consists of highly experienced directors, helping the company in achieving its strategic and financial objectives. The companyâs chairman, Mr William Johnson, is a seasoned player with extensive experience in the high-technology and semiconductor manufacturing sectors. In parallel, the companyâs Managing Director & CEO, Mr Giles Bourne has 20 years of experience in cleantech and manufacturing sectors. The company intends to invite shareholders to the official opening of the upgraded BluGlass Silverwater facility.

With multiple high growth markets, strong IP portfolio and several go-to-market options, BLG is rapidly progressing towards the commercialisation of its platform semiconductor technology.

At the time of writing, i.e., on 27 May 2019, the stock settled the dayâs trading at a price of A$0.150 with a market capitalisation of ~A$62.76 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.