Summary

- AKM is well placed in terms of partners and investors- has financial backing from Mr Tserenpuntsag and development agreements with Chinese partners such as Sinosteel MECC.

- China Railway 20 Bureau Group Corporation and China Gezhouba International Engineering Co Ltd have been awarded Erdenet to Ovoot Railway provisional EPC Contract by Northern Railways.

Aspire Mining Limited (ASX: AKM) is engaged in the exploration and development of its flagship 100%-owned premium “fat” Ovoot Coking Coal Project, with 255Mt of total Reserves, located in the Orkhon-Selenge Coal Basin of Northern Mongolia, which has a rapidly developing coal mining industry.

Coking coal, also known as metallurgical coal, has unique caking ability which makes it useful to produce coke, one of the key constituents in steel production.

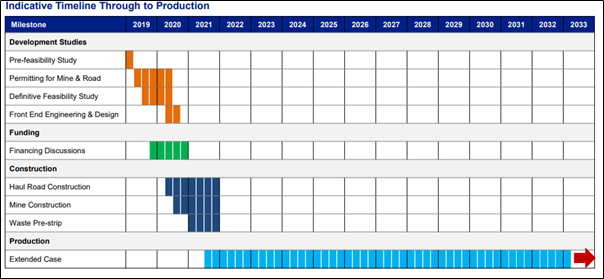

The company has crossed significant milestones to unlock production via the Ovoot Early Development Project (OEDP). The first stage of the project, as the updated PFS confirmed a pre-tax NPV10 of USD 878 million, pre-tax IRR of 49.9% based on an extended case of 12.5 years mine life and delivering up to 4Mtpa of washed, saleable fat coking coal via a rail and road mode to the neighbouring steel mill customers in Russia and China.

Northern Railways LLC (Aspire Mining’s subsidiary) is looking after the construction of the Erdenet-to-Ovoot Railway, which is expected to fuel operational expansion.

For a look into the project details, Read – Aspire Mining’s Northern Railways Secures Extension of Erdenet to Ovoot Rail Concession; Aspire Mining Achieves Progress On Special Purpose Road and DEIA For The Ovoot Project.

Funding Support from Mr Tserenpuntsag

Mr Tserenpuntsag Tserendamba, a well-renowned Mongolian businessman with an impressive track record of establishing large scale businesses in the country, owns the largest internet service in Mongolia, has the exclusive distributorship of Pepsi in the country as well as holds a major stake in Mongolia’s biggest satellite TV business. As a strategic partner in advancing the Ovoot Project, Mr Tserenpuntsag has committed supporting Aspire Mining strategically and financially for materially de-risk delivery of the OEDP.

In early December 2019, he provided A$ 33.5 million via increasing his stake in the Company from 27.5 per cent to 51 per cent. He further exercised his 53.3 million listed options at 1.8 cents each, raising an additional A$ 2.75 million for Aspire Mining and with his current equity interest reaching at 52.5%.

He envisages Ovoot being developed for the benefit of the Company shareholders as well as people of Mongolia.

Non-Binding Agreement with Sinosteel

Sinosteel Equipment & Engineering Co., Ltd., a key player in the Chinese steel industry, with Aspire Mining signed a Non-Binding MoU agreement, which is expected to open potential Engineering, Procurement and Construction (EPC) and trade-based funding opportunities for high-quality Ovoot coal product.

The two parties have been holding discussions concerning an EPC contract for construction of a 5Mtpa Coal Handling and Preparation Plant at the Ovoot Mine Site (estimated cost: USD 37 million); trade-based financings for future metallurgical coal sale prepayments; and a streaming funding facility.

The favourably low capital intensity and significant expansion potential, comparable to global metallurgical coal projects, would place Aspire Mining as a low-cost producer on the global CFR China seaborne coal cost curve, (as per Wood Mackenzie Feb 2019) with estimated Life of Mine C1 cash costs to Chinese border of USD76/t and total cash costs of USD 97/t.

The Company is currently completing the OEDP Definitive Feasibility Study (DFS) and associated road engineering study, before starting the infill drilling with production targeted for Q2 2021, subject to all necessary approvals).

Source: Investor Presentation

Stock Information: The AKM stock settled the day’s trade on 29 May 2020 at AU$ 0.079, climbing up 5.33% by AU$ 0.004.