An independent oil and gas explorer aiming at high impact energy resources in the sub-Saharan Africa, Invictus Energy Limited (ASX: IVZ) has an impressive asset portfolio which consists of a highly prospective portion (250,000 acres) of the Cabora Bassa Basin in Zimbabwe, an under-explored and one of the largest interior rift basins in Africa.

Invictus is 80% owner and operator of SG 4571, that was granted in August 2017 for an initial 3-year period (renewable) in Cabora Bassa.

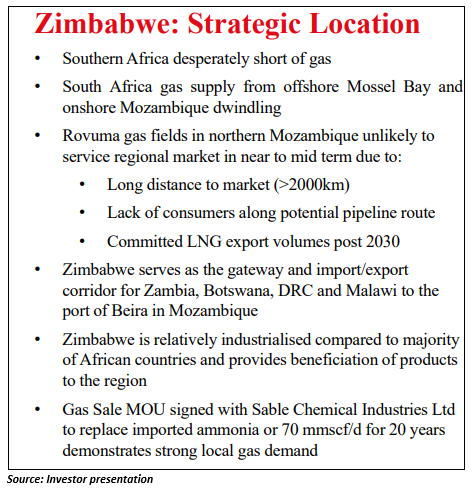

Interestingly, the new Zimbabwe government is pro-business, promoting foreign investment and has implemented investor-friendly reforms, including amendment of Indigenization and Empowerment Act and enactment of Special Economic Zones legislation.

Key Project Developments Through FY19

The Cabora Bassa Project comprises of the Mzarabani Prospect, a multi-TCF conventional gas-condensate prospect, believed to be potentially the largest undrilled seismically defined structure onshore Africa. The prospect is defined by a robust dataset acquired by Mobil in the early 1990s that includes gravity, aeromagnetic, seismic, and geochemical data

In FY19, IVZ focussed on the technical work program that was designed to mature the Companyâs understanding of the Cabora Bassa Basin petroleum system and de-risk the project (exploration and appraisal of the Project).

This work program has resulted in the identification of the largest undrilled prospect onshore Africa and independently assessed as one of the largest conventional exploration targets globally.

The Project was acquired in June 2018, and since then, several technical, commercial and strategic objectives have been achieved, including:

- In FY19, IVZ reprocessed the entire gravity and magnetic dataset covering the whole of Zimbabwe, confirming the Cabora Bassa basin extent and intra basin structural highs. This data was sent to the Geological Survey of Zimbabwe to be shared with the wider community and public as a whole, as new mineral deposits have been identified from it that will serve a purpose to encouraging other investors into Zimbabwe.

- The Company reprocessed 650 line kilometers of seismic originally acquired in the early 1990âs. The result depicted a considerable uplift and improved imaging and has enhanced the Companyâs understanding of the prospectivity. Interestingly, there were stacked basin margin noticed, which could be potentially more oil-rich over the more likely gas dominated basin centre mapped opportunities including and around the Mzarabani Prospect.

- New maps were compiled from the reprocessed seismic and resulted in a significant independent upgrade in the volume assessment with the latest concluding a Total Prospective Resource of 9.25 Tcf and 294 Million barrels of condensate.

- The Company initiated an Environmental Impact Assessment (EIA), bringing in key stakeholders to understand the issues on the ground and carry out a baseline survey ahead of ground operations.

- On the technical end, reprocessing of magnetic, gravity and seismic datasets resulted in a significant improvement in IVZâs ability to image the subsurface.

- The interpretation of the seismic data identified several other prospective horizons in the Mzarabani Prospect and the identification of a second structural prospect, Msasa.

- The stacked objectives in the prospects enable multiple horizons to be targeted by a single well and enable multiple opportunities to realise the exploration success.

- The Company was successful in advancing numerous options for monetising any oil or gas discovery made in the Cabora Bassa Project. Sable Chemical Industries Ltd, IVZâs industry partner and the sole manufacturer of agriculture grade ammonium nitrate fertiliser in Zimbabwe came on board, as the two entities signed a gas sale MoU to provide Sable with up to 70 million cubic feet per day of gas for 20 years (510 Bcf gross).

Invictus Inches One Step Ahead During September Quarter

During the September quarter, the Company made significant progress in the Cabora Bassa Project, including:

- It reported a Total Prospective Resource of 9.25 Tcf + 294 million barrels of conventional gas- condensate (gross mean unrisked) across SG 4571 in Mzarabani and the newly identified Msasa prospect (a new substantial structural prospect within SG 4571).

- The Msasa Prospect, a stacked anticline characteristic, has ~44 Mn barrels worth conventional gas-condensate along with 1.05 Tcf (gross mean unrisked).

- The Mzarabani Prospect grew substantially in its scale and is amongst the largest conventional exploration targets worldwide, estimated to include 8.2 Tcf + 250 Mn barrels of condensate (gross mean unrisked).

- Besides this, the farm out process commenced as planned, while the Company opened the physical data room in London. The process has garnered interest from E&P as well as Private Equity companies focused on upstream investments, to partner with IVZâs forward work program.

- During the quarter, the Company received approval for its EIA and commenced the EIA survey in the project area. The completion and approval of the EIA study will complete the necessary environmental approvals for exploration drilling and development of any resources by the regulator EMA in the future.

- IVZ has successfully matured the acreage and prospectivity in ~12 months since acquiring the project and completed the work program obligations well before time. The next phase of the exploration program will involve the drilling of a high impact basin opening well in the Basin.

New Geochemical Analysis Results

In November 2019, IVZ received the geochemical analysis results (conducted by GeoMark Research in the USA) from the recent outcrop source rock field sampling program in the Basin (to the west of SG 4571 permit), that was carried out in July 2019.

The analysis confirms that-

- A minimum of two source rock facies exist in the Basin in the Angwa Alternations Member (Triassic age) consisting of good quality gas and liquid (condensate and potentially light oil) prone source rock, and in the Mkanga Formation (Permian age) that comprise of a high-quality oil prone lacustrine source rock interbedded with good quality liquids and gas source rocks;

- The results indicate solid correlation to two oil seep samples on trend in neighbouring Mid Zambezi sub basin in Zimbabwe. Analysis of the Triassic aged Alternations Member (Upper Angwa) validates good source potential for gas and liquids generation.

With the cash reserves of $1.45 million (as on 30 Sept 2019) and recently secured placement of $1.5 million, Invictus is seeking a farmout partner ahead of planned high impact basin opening exploration well. FY20 will be incredibly important for Invictus and its shareholders as the Company progresses the Cabora Bassa Project. The potential of its acreage is truly staggering for a company this size as it thrives to grow exponentially.

IVZ traded at $0.026 as on 3 December 2019 (2:34 pm AEST)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.