Afterpay and Southern Cross Media witnessed fluctuations in their stocks recently. Both of these companies are significant players in their respective sectors. As an informed investor, one must know the reason behind the fluctuations in their stock prices.

Afterpay Touch Group Limited (ASX: APT)

130% increase in APTâs active customers

Afterpay Touch Group Limited (ASX:APT) came into existence as a buy now pay later company by the coming together of Afterpay and Touchcorp in June 2017 as a retailing technology company. APT actively delivers in crucial areas of retail consumer brand and a blend of retail, mobility and health services.

The company operates globally and is a part of multiple industries. The coming together of Afterpay and Touchcorp has put forward huge opportunities for the future ahead.

As per the recent update from APT, on 25th September 2019 media reported the upgradation of APT from âneutralâ to âbuyâ with a share price target of $42.90 in the conviction list of Goldman Sachs. However, Afterpay remained unsure about the incidentâs influence on the recent trading in APTâs stocks. Also, Afterpay could not approve of the statement that the change in the price of the stocks was specifically related to this factor.

APT further mentions that it was also reported in media that Thorney Technologies had put out an update containing an "upbeat" view of APT on 25th September 2019.

As per more recent media reports, a leading investment bank has predicted that Afterpayâs share price might slip down within a yearâs time. The same has blamed persisting regulatory risks for the prediction made.

According to the ASIC or Australian Securities and Investments Commission that acts as the nation's corporate regulator, the spending habits of consumers (especially younger consumers) are being highly impacted by provisions of buy now pay later companies.

ASIC reports an increase in the number of users for buy now pay later to 2 million from 400,000 over the years 2015-16 to 2017-18. Moreover, the growth in the number of transactions is 1.9 million in June 2018 from approximately 50,000 in April 2016.

It is worth noting that the companyâs sales increased by 140% to an amount of $5.2 billion during the FY19. Other highlights of APTâs performance during FY19 are:

- Active customers of 4.6 million at the end of FY19, up 130%, and in excess of 5.2 million currently;

- Active merchants of 32,300 at the end of FY19, up 101%, and 35,300 currently;

- US underlying sales of nearly $1 billion in FY19. The run rate in excess of $1.7 billion;

- $33.3 million of underlying free cash flow representing a high return on capital employed (ROCE);

- More than $230 million of cash on hand and fully undrawn receivables finance facilities of $947 million.

- Gross losses reduced to 1.1% in FY19 from 1.5% in FY18.

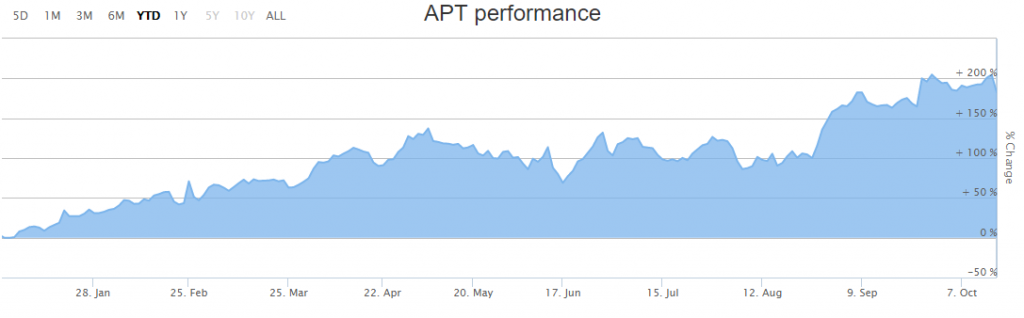

182.67% return on APTâs Stock (YTD basis)

Figure 1 APT's Stock Performance (Source: ASX)

Figure 1 APT's Stock Performance (Source: ASX)

At the time of writing on 18th October 2019 (AEST 1:30 PM), the company's stock was trading at a price of $29.76, down by 6.942 percent, with a daily volume of ~3,407,576 and a market capitalisation of approximately $8.08 billion. The stock has a 52 weeks high price of $37.410 and a 52 weeks low price of $10.360 with an average volume (year)of ~ 2,439,092. On a year to date basis, the companyâs stock has provided 166.50% return.

Southern Cross Media Group Limited (ASX: SXL)

As one of Australiaâs leading media companies, Southern Cross Media Group Limited or Southern Cross Austereo (SCA) (ASX: SXL) penetrates into more than 95% of the Australian population through its assets including radio, television and digital assets. PodcastOne Australia, Australiaâs leading premium podcasting network, is operated by SCA. SCA further offers Australian sales representation for international open audio platform SoundCloud.

SXL to Acquire Redwave Media

SXL notified the market on 18 October 2019, that it is all set to acquire Redwave Media of Seven West Media Group Limited (ASX: SWM). However, the sale is dependent on regulatory nods from the authorities with regards to the proposed acquisition of the spirit 61 licence in Southwest/Bunbury, where SXL manages Hit and Triple M radio licenses. The purchase price amounting to $28 million could be paid in cash on conclusion.

SXLâs outlook

SCA recently gave a trading update and earnings guidance for the period of 6 months closing 31st December this year. Because of the weak media markets during the first quarter, SCAâs revenues decreased to 8.5% lesser than the prior year in the quarter ended 30th September 2019.

Additionally, SCA reported an operating cost to be $1 million less than the prior comparable period for the first quarter, including one-off restructuring costs of $1.5 million.

SCA further expects the depreciation to be about $4 million lesser than the prior comparable period for the first half, plus, full-year capex of $5 million to $7 million lower than in FY19 is expected.

The company expects EBITDA of $60 million to $68 million for the first half before adjustments for AASB16 (Leases). According to the company reports, the projected decreases in the companyâs financials are the outcome of the decisions to outsource transmission and television playout services.

SXLâs underlying NPAT up by 3.1%

What drives attention towards SXLâs performance is the increase of 3.1% in the underlying NPAT to $76.2 million and an increase of 0.9% in underlying EBITDA to $159.9 million during FY19. Few other highlights of the companyâs performance during FY19 are:

- Group revenue was up by 0.5% to $661.0 million, while underlying expenses were flat at $501 million;

- Revenue in the Audio segment (comprising metropolitan and regional radio and podcasting) was 2.4% higher at $453.4 million driven by 9.2% growth in national revenue.

- Underlying EBITDA in the Television segment improved by 1.2% to $33.7 million supported by strong cost discipline with underlying expenses down by 4.0%;

- Strong cash conversion of 91% supporting a further reduction of $11.3 million or 3.7% in net debt;

- Shareholder returns were maintained with fully franked dividends of 7.75 cents per share, including the final dividend of 4.00 cents per share;

At the time of writing on 18th October 2019 (AEST 1:29 PM), SXL's stock was trading at a price of $0.895, up by 3.468 percent, with a daily volume of ~3,480,605 and a market capitalisation of approximately $665.02 million. The stock has a 52 weeks high price of $1.430 and a 52 weeks low price of $0.845 with an average volume of ~ 1,896,696.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.