Infratil Limited (ASX:IFT) is a company from the Utilities sector, and it is the owner of the energy, transport, data as well as social infrastructure businesses in growth sectors.

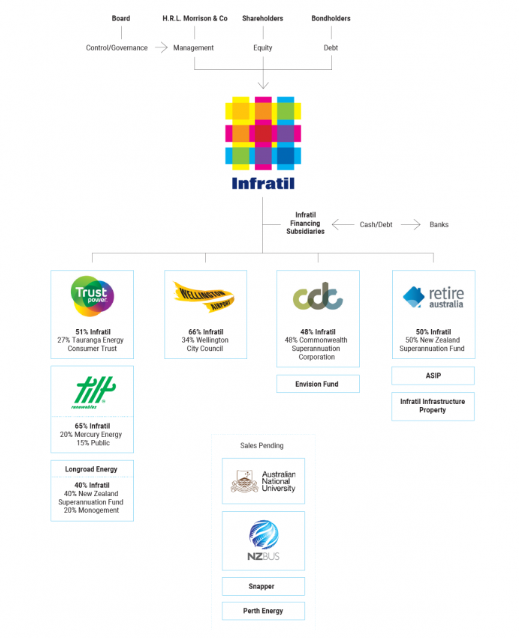

Companyâs Corporate Structure (Source: Companyâs Website)

On 31 May 2019, Infratil announced that Longroad Energy had closed the financing of its 379 MWdc Prospero Solar project in Andrews County, Texas, U.S.A.

Longroad Energy is a US-based renewable energy developer, owner as well as operator. Longroad Energy is owned 40% by the company and 40% by the New Zealand Superannuation Fund, 20% in partnership with management. Longroad Energy focuses on wind and solar energy development, ownership, along with services in the United States. It is considered as one of the worldâs largest and fastest growing renewable energy markets.

As per the companyâs update on Longroad, dated 31 May 2019, the construction of project named Prospero Solar in Andrews County, in Texas region has begun. The complete package of financing for the project stands at ~ USD416 million.

Once this project completes in 2020, Prospero will become one of the largest solar farms with the nameplate capacity of 379 MWdc in the U.S.

In this project, Facebook will be the only tax equity investor, and it will be its first direct investment into the renewable energy project.

Paul Gaynor, the CEO of Longroad, stated that for the conclusion of the Prospero Solar project of such magnitude, a lot of effort, as well as cooperation from its suppliers to investors, was contributed.

Shell Energy North America has signed a 12-year Power Purchase Agreement with Longroad Energy for the power off-take of the project, which is considered as one of the first off-take agreements of this type in the solar industry.

The Prospero solar farm will spread across 4,600 acres of land in Andrews County, Texas. This project will be delivering above $21mn in the form of property taxes, which includes beyond $12mn to the Andrews ISD.

Through this project, hundreds of jobs related to construction, along with jobs for the operating facility, will be created.

The project will install the initial Solar panels, TMEIC inverters, as well as NEXTracker tracking systems. The EPC contractor for the project is Swinerton Renewable Energy, and the linking will be through Sharyland Utilities.

Facebook, along with Shell, will be sharing the renewable energy attributes produced through the project.

Further, on 31 May 2019, the company announced the completion of the sale of Snapper Services Limited, the public transport ticketing subsidiary company of IFT to Allectus Capital Limited for a nominal amount. Snapper is a technologically cutting-edge, low-cost ticket service provider. It was established in the year 2008. In December 2017, IFT started the strategic assessment of its investment made in Snapper. In January 2019, Allectus Capital was granted exclusivity by the company.

In February 2019, the company finalized the conditional sale agreement, and the sale depended on certain consents which have now been obtained.

On 31 May 2019, in another announcement released by the company, it mentioned that it had executed the conditional agreement to acquire 50% of Vodafone New Zealand from Vodafone Group Plc for an enterprise value of NZ$3.4 billion on 14 May 2019. The conclusion of the acquisition is conditional on approvals from the Overseas Investment Office and Commerce Commission clearance.

As per the company, the Commerce Commission had released its statement of Preliminary issues on IFTâs application for clearance procedure. The preliminary issues raised are in accordance with IFTâs anticipations and IFT continues to believe that there are very solid reasons for clearance to be granted to them.

The stock of the company was trading at A$4.040 (as on 3 June 2019, 3:09 PM AEST), up by 0.373%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.