Technology Metals Australia Limited (ASX: TMT), a metal miner and explorer, announced on 22nd May 2019, that the company has entered into a non-binding MoU (Memorandum of Understanding) with CNMC Ningxia Orient Group Company Ltd (CNMNC). The company had signed an MoU regarding a binding vanadium pentoxide off-take agreement over vanadium production from the Gabanintha Vanadium project.

The company and CNMNC mutually agreed to use their best endeavours respectively to negotiate a definitive and binding off-take agreement for supply and purchase of vanadium pentoxide product, that TMT plans to produce from the Gabanintha Vanadium Project.

The company previously decided to inch up the vanadium resource to meet the supply shortfall.

The Agreement:

Under the terms of MoU between Technology Metals and CNMNC, the initial quantity to be purchased by CNMNC annually is at 2,000Tpa on a take-or-pay basis, and CNMNC would buy during the ramp-up and commissioning phase of the Project from the company.

The procurement prices would be negotiated based on Metal Bulletinâs Vanadium Pentoxide Pricing Index, which would include a floor and ceiling price structure. The sales would be on a free-on-Board basis at Port of Fremantle, so the companyâs income sheet will recognise a sale once the product gets loaded on the ship.

The minimum purchase term is of three years with an option to extend the term by another three years, and the terms further include the consideration for CNMNC to refer the company to its parent entity to further discuss additional project support.

The progress of the agreement is now subjective on the due diligence considerations by both the parties in conjunction, with the progression of the Gabanintha Definitive Feasibility Study and further refinement and agreement of the key off-take terms.

The memorandum is valid till 1st October 2019 until and unless both the counterparties mutually agree to terminate or extend the term.

Gabanintha Vanadium Project:

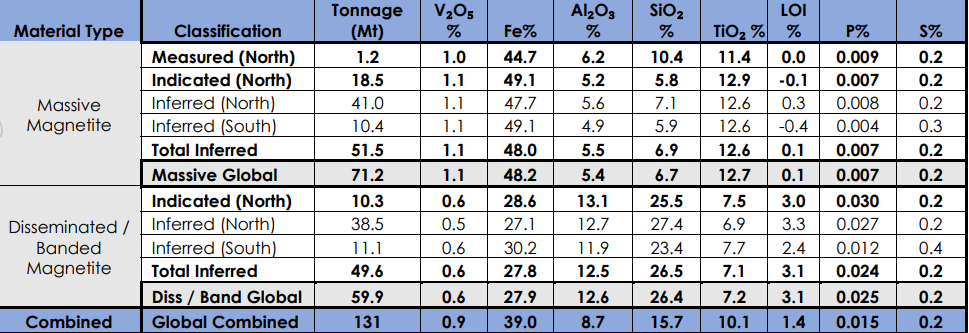

The project of the company hosts a combined global resource of 131 million tonnes, and the resource grades and category are as follows:

Source: Companyâs Report

Source: Companyâs Report

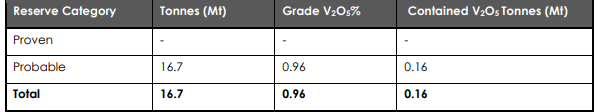

Also, the ore reserve estimate (as on 31 May 2018) is as follows:

Source: Companyâs Report

CNMNC:

CNMC (Ningxia) Orient Group Co., Ltd is among the top ten vanadium producer in China, and it produces vanadium-nitrogen & Ferrovanadium alloys for the consumption of the steel industry in China. The headquarters of the CNMNC is in Shizuishan, Ningxia provinces in China, and it is the largest producer of tantalum and niobium alloys in the domestic market.

CNMNC, established in 1965, hosts beyond 3,200 employees and it marked a restructuring in the year 2003 with a registered capital of RMB 2.3 billion. The ownership of CNMNC follows a hierarchy.

The management of the State-owned Assets Supervision and Administration Commission (SASAC) of the State Council manages a large-scale enterprise- China Nonferrous Metal Mining (Group) Co., Ltd (CNMC), which further controls the CNMNC in the Peoples Republic of China.

Development of nonferrous metal mineral resources and construction engineering are some of the business which covers a significant portion of the groupâs business portfolio.

The credit rating of the company provided by the China Chengxin International Credit Rating agency is AAA (as in November 2018).

The share prices of TMT were trading at A$0.210 (as on 22nd May 2019, AEST 02:24 PM), down by 10.638%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.