NRW Holdings Limited (ASX: NWH) is a group of industry leading companies which provides diversified services to the mining, energy, civil infrastructure and urban development sectors.

The company is focused on pursuing new opportunities to further diversify its revenues. In accordance with this strategy, the company had acquired Golding in 2017 and more recently the company acquired RCR Mining Technology and Heat Treatment business units. With the acquisition of RCR Mining Technology, the company now has an opportunity to offer clients an integrated service offering that includes design, procurement and maintenance and besides that this adds scale and recurring income from maintenance activities.

Recently, some media sites speculated that the company is in talks with BGC Contracting for an acquisition. However, in an announcement made on 22 May 2019, the company has clarified that it is not pursuing any acquisitions related to BGC Contracting.

After acquiring Golding in 2017, the company structured its business reporting into three segments, - Civil, Mining and Drill & Blast.

The Civil business specialises in the delivery of private and public civil infrastructure projects, mine development, bulk earthworks and commercial and residential subdivisions and its projects include roads, bridges, tailings storage facilities, rail formation, ports, water infrastructure and concrete installations.

The Mining business specialises in mine management, contract mining, load and haul, dragline operations, coal handling prep plants and other similar activities. Action Drill & Blast (ADB) is a market leader in the provision of integrated, end to end production drill and blast services to the mining and civil construction sectors across Australia.

The company is progressing well with its recent acquisition of RCR Mining Technology. Recently, RCR Mining Technologies (RCRMT) was awarded a significant OEM equipment package for the Rio Tinto Iron Ore Koodaideri project to supply 3 large Apron Feeders, 11 Slide Gates and 2 Belt Feeders, to a combined value in excess of $18 Mn.

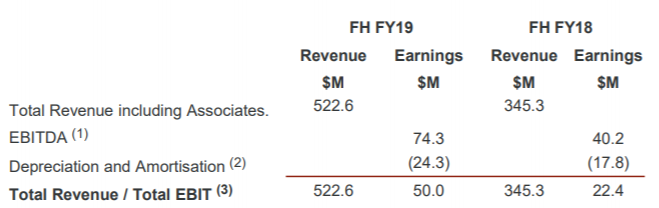

In the first half of FY19, the company recorded a revenue of $521.1 million, up by 50.9% as compared to the previous corresponding period (pcp). The companyâs EBITDA increased by $74.3 million compared to $40.3 million in the pcp.

Revenue and EBIT in H1FY19 (Source: Company reports)

Revenue and EBIT in H1FY19 (Source: Company reports)

Not only the company has delivered incremental earnings growth, but it has also maintained strong cash flows with a reduction in net debt to $12.8 million and gearing to 4.3% despite an increase in capex driven by the purchase of key mining assets.

In the past six months, the share price of the company increased substantially by 53.40% as on 21 May 2019. At the time of writing, i.e., on 22 May 2019 AEST 12:44 PM, the stock of the company was trading at a price of A$2.955, up 0.853% during the dayâs trade with the market capitalisation of ~A$1.1 Bn. The stock is having a dividing yield of 1.37% and its trading at a PE multiple of 19.660x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.