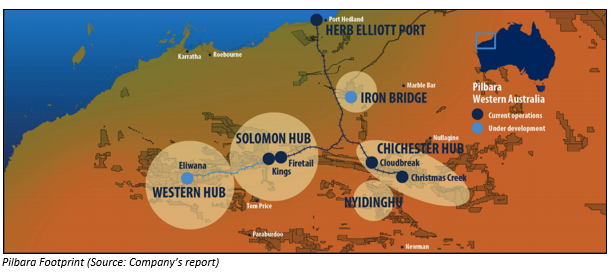

Fortescue Metals Group Limited (ASX: FMG) is the worldâs fourth-largest iron ore producer. The company was founded in 2003 and since then, it has been discovering and working towards developing quite a few iron ore deposits. FMG has even constructed some of the notable mines in the world. The companyâs iron ore production each year is 170 million tonnes. According to the Metalytics Resources Sector Economics analysis the company is deemed to be the least cost seaborne provider of iron ore into China. FMG is a major supplier of iron ore to China, Japan, South Korea and India. With headquarters in Perth, FMGâs vision is to be the lowest cost, safest and most profitable miner.

On 22nd May 2019, the company declared that it has approved the development of Queens Valley mining area. The development would maintain production of the low-alumina Kings Fines product. The production would be in sync with the companyâs strategy of optimising its margin via an enhanced product mix. All Environmental and heritage approvals are in place to begin the development of Queens. This announcement continues the companyâs commitment to maintaining long mine-life at low operating costs while adopting innovation in the operations.

Queens is at the Solomon Hub in the Pilbara region of Western Australia. It is approximately 15 km from the Kings ore processing facility. The Queens development has a life expectancy of 10- 15 years, having an initial strip ratio of 1.4, maintaining the companyâs low operating cost of production.

Fortescueâs Chief Executive Officer, Elizabeth Gaines stated that FMGâs integrated operations and marketing strategy describes a product portfolio aimed to maximise the value from the companyâs orebodies in the long run. This, in turn, confirms good returns to the companyâs shareholders. The Queens mining area, with its development, would maintain the highly valued Kings Fines low-alumina sinter fines product. This caters to important customers across China, Japan and Korea.

The total capital expenditure for the Queens development is forecasted at almost US$287 million and would be incurred in 4 parts: US$10 million in FY 19, US$151 million in FY 20, US$98 million in FY 21 and lastly US$28 million in FY 22. The development would be inclusive of the construction of an innovative hydraulic barrier wall, considering all environmental approvals. There would be a relocation of the Solomon mobile maintenance facilities, close to the operation base, to serve the purpose of reduced travel distance, low operating costs and provide Queens with access to additional tonnes surrounding the Kings OPF.

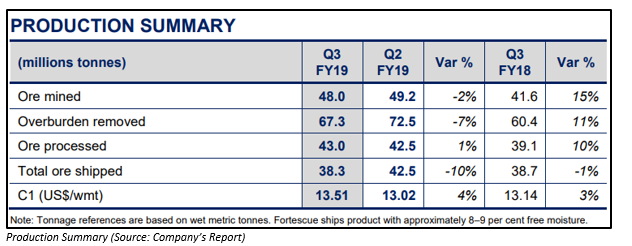

As per its Quarterly production report for the period ending 31st March 2019, the company had reported total shipments of 38.3 million tonnes.

The cash production costs amounted to US$13.51 per wet metric tonne. The companyâs cash on hand totalled US$1.1 billion. The gross debt was US$4.0 billion and net debt was US$2.9 billion. The total capital expenditure for this period was US$196 million.

The company also published its Reporting Calendar in the quarterly report.

Share Price Information:

On the technical front, the stock is trading down by 8.05% at A$8.275 on ASX, (as of 22nd May 2019 at 3:38 PM AEST). The YTD return is 120.67% and in the last six months, the stock has delivered a return of 131.25%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.