Incorporated in 2003, 3D Oil Limited (ASX:TDO) is an oil and gas explorer. Its strategy is to target the combination of favourable technical and commercial considerations, particularly in Eastern Australia for the motive of utilising niche positions. Presently, the company is focused on the offshore Gippsland and Otway Basins of South East Australia.

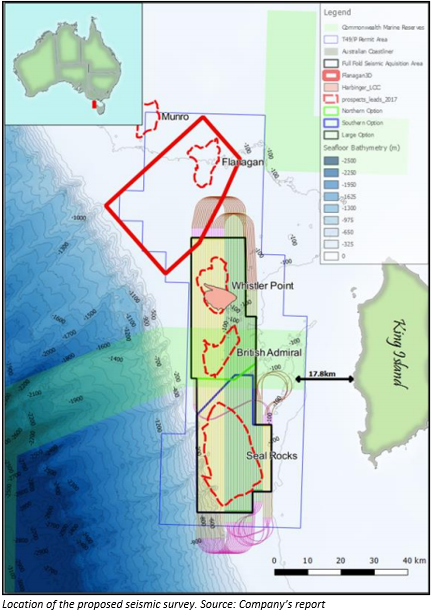

On 15th May 2019, the company announced that is had received the requisite approvals from the Commonwealth Statuary National Agency (NOPSEMA) and would now be able to acquire the Dorrigo 3D Marine Seismic Survey. This is situated within the 100% owned T/49-P of the Offshore Otway Basin. The Dorrigo survey covers quite a few key leads in 3D Oilâs 100% owned T/49-P project.

The survey is scheduled to take place in late 2019. It would cover leads which are remaining in the southern and central sections of TDOâs T/49-P acreage. The major target of the Dorrigo survey would be the Seal Rocks lead with the best estimate prospective resource of 4.64 TCF, which is in the south of the T/49-P acreage.

In April, the company published its Quarterly Activities Report for the quarter ending March 2019. The highlights of the report were 3 of the companyâs projects:

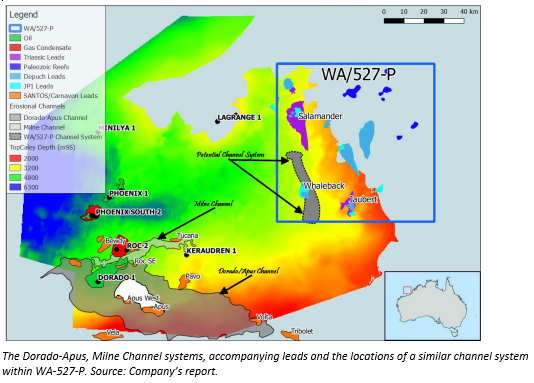

- WA-527-P (Bedout Sub-basin)- In this 100% owned basin, the Farm-in process had advanced via technical dilligence. As part of the same, the reprocessing of seven open-file 2D seismic lines was completed. There was identification of a potential erosional channel system along with channel features, like Dorado. Sauropod 3D MSS seismic survey would occur in late 2019 or early 2020, planning and stakeholder engagement for which, has already begun.

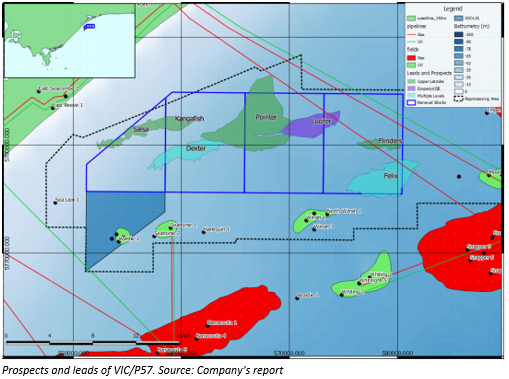

- VIC/P57 (Gippsland Basin)- On this 24.9% owned basin, Technical work has been completed for defining of Trapping mechanism of the Pointer Prospect.

- T/49P (Otway Basin): For this 100% owned basin, as of then, the submissions had been made to NOPSEMA (which were approved, as announced on 15th May 2019).

As per the companyâs cash flow statement, Net cash used in operating activities and investing activities was noted as A$298k and A$14k respectively. TDO held cash and cash equivalents worth A$1,068,000 with a further A$1,500,000 on deposit with a maturity greater than 3 months. The estimated cash outflows for the next quarter is A$438k with A$190k to be spent on exploration and evaluation.

Earlier in April, the company had presented on the Taylor Collison 2019 East Coast Gas Day. It stated that TDOâs top shareholders were Noel Newell (Executive Chairman) with 16.6% and Oceania Hibiscus (a joint venture partner) with 11.7%. The top 20 shareholders hold approximately 56% of the companyâs shares.

The company also shared its share price performance over 12 months:

Share Price Information: The stock is currently trading at A$0.110 as of 16th April 2019. It has a market cap of A$29.17m. In the last six months, the stock has delivered a return of 17.02% while YTD return stands at 25%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.