Highlights:

- Honeywell International posted sales of US$ 8,951 million in Q3 2022.

- Caterpillar Inc. has a dividend yield of 1.929 per cent.

- Q3 2022 profit of Caterpillar Inc was US$ 131 million.

Industrial stocks form a crucial part of the equity market, and many investors consider them an integral part of the broader market. Industrial stocks are synonymous with the Dow Jones. However, market volatility in the past year has played the leveler and pinned almost every stock to the ground. The industrial stocks were no different.

Amid, we look at two US industrial stocks and their performances in the latest quarters:

Honeywell International Inc. (NASDAQ:HON)

Honeywell International is a US multinational conglomerate based in Charlotte, North Carolina. It does business in four segments -aerospace, performance materials and technologies, building technologies, and safety and productivity solution. With a dividend yield of 1.959 per cent Honeywell pays a quarterly dividend of US$ 1.03.

The company reported sales of US$ 8,951 million in the third quarter of fiscal 2022 compared to US$ 8,473 million in the same quarter in 2021.

Cash flow from operations of Honeywell in Q3 2022 was US$ 2,083 million versus US$ 1,119 million in the year-ago quarter.

The company's earnings per share in the reported quarter were US$ 2.28 against US$ 1.8 in the corresponding quarter in 2021.

The company said it deployed US$ 1.2 billion of Capital in the third quarter of 2022 to buy back shares and pay out dividends and capital expenditures.

Caterpillar Inc. (NYSE:CAT)

Caterpillar Inc. is part of the US Fortune 500 companies. The largest construction-equipment manufacturer in the world paid a quarterly dividend of US$ 1.2.

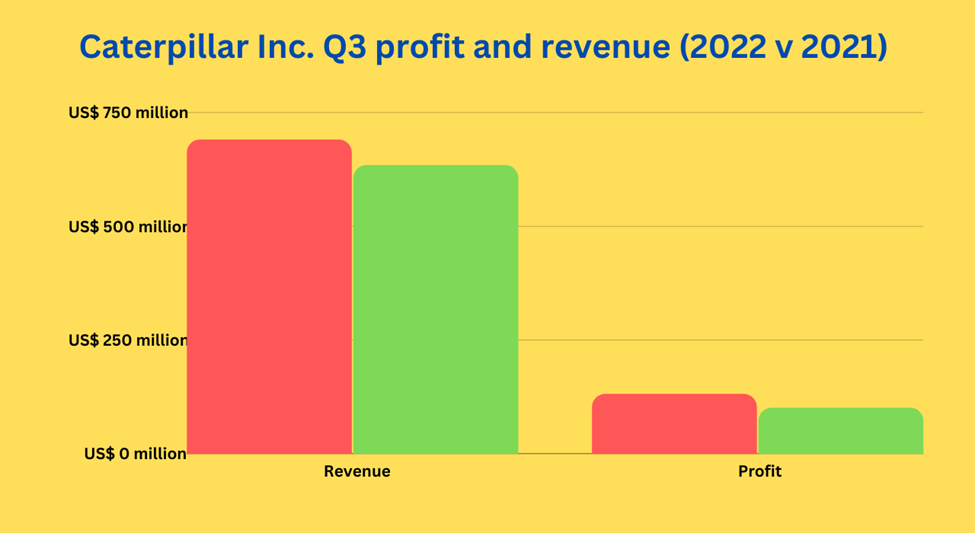

The company posted revenue of US$ 690 million in the third quarter of 2022 compared to US$ 634 million in the year-ago quarter. Caterpillar’s profit (pre-income tax) was US$ 188 million in Q3 2022, up 44 per cent year-over-year (YoY).

The Q3 2022 profit of the company was US$ 131 million compared to US$ 101 million in the same quarter in 2021. The company attributed this increase in revenue to a favorable US$ 63 million impact from elevated average financing rates.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line:

As investors, always do your analysis before making any decision. You can diversify your portfolio and adopt a long-term strategy to tide over the market volatility phase.