Benchmark US stock indices closed the week flat on Friday, October 8, after weak employment data and inflation concerns lowered investors’ confidence.

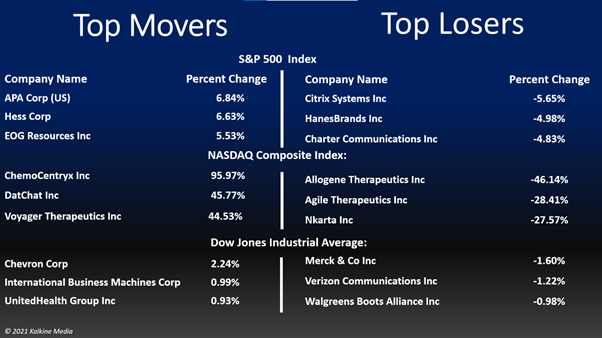

The S&P 500 was down 0.19% to 4,391.34. The Dow Jones fell 0.03% to 34,746.25. The NASDAQ Composite fell 0.51% to 14,579.54, and the small-cap Russell 2000 was down 0.76% to 2,233.09.

On Friday, the Labour Department said that the US economy added 194,000 jobs in September, lower than the economists’ forecast of 250,000 to 500,000 jobs.

The department also has revised its August figures to 366,000. In addition, the data showed the unemployment rate declined to 4.8%, the lowest in the last 18 months.

This week, oil prices had reached multi-year highs, forcing the government to consider releasing crude from its strategic reserves as they heightened inflation pressures.

Can Global Market rebound on Monday?

Energy and financial stocks led gains on the S&P 500 index on Friday. Seven of the 11 stock segments stayed in the red. Real estate and basic material stocks were the bottom movers.

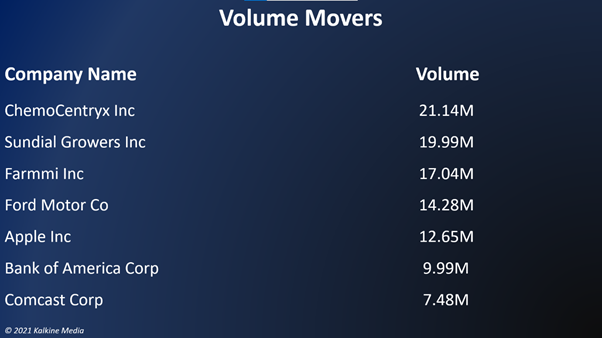

ChemoCentryx, Inc. (CCXI) stock rose 97.81% after receiving FDA approval for its oral drug Avacopan to treat a rare autoimmune disease. It will market the medicine under the brand name Tavneos.

Stocks of cannabis company Sundial Growers (SNDL) surged 4.20% a day after it announced to purchase Canadian liquor company Alcanna Inc. (TSX:CLIQ) for US$346 million in an all-stock transaction. The acquisition is expected to boost Sundial’s cash flow profile.

Allogene Therapeutics, Inc. (ALLO) stock declined 45.65% after the US Food and Drug Administration (FDA) put a hold on its AlloCAR T clinical trials. Vaxart, Inc. (VXRT) stock declined 0.28% despite positive results from its covid drug study.

In the energy sector, Exxon Mobil Corp (XOM) rose 2.49%, Chevron Corp (CVX) rose 2.30%, and ConocoPhillips (COP) gained 4.17%. EOG Resources, Inc. (EOG) and Pioneer Natural Resources Company (PXD) advanced 4.58% and 3.72%, respectively.

In financial stocks, Morgan Stanley (MS) gained 1.12%, The Charles Schwab Corporation (SCHW) rose 1.21%, and American Express Company (AXP) rose 1.04%. Chubb Limited (CB) and Ameriprise Financial, Inc. gained 2.33% and 1.26%, respectively.

In the real estate sector, American Tower Corp (AMT) declined 1.03%, Crown Castle International Corp. (CCI) fell 1.00%, and Equinix, Inc. (EQIX) sank 1.43%. Simon Property Group, Inc. (SPG) and Digital Realty Trust, Inc. (DLR) plunged 1.03% and 1.45%, respectively.

Also read: General Motors (GM), Avis Budget (CAR) stocks rise on upbeat business outlook

Also read: Five oil and gas stocks under US$35 with over 370% YTD return

Also read: Why are Ford (F), Plug Power (PLUG) stocks gaining traction today?

Futures & Commodities

Gold futures were down 0.14% to US$1,755.70 per ounce. Silver decreased by 0.07% to US$22.642 per ounce, while copper rose 0.77% to US$4.2760.

Brent oil futures increased by 0.67% to US$82.50 per barrel and WTI crude was up 1.56% to US$79.52.

Bond Market

The 30-year Treasury bond yields was up 1.35% to 2.162, while the 10-year bond yields rose 2.37% to 1.608.

US Dollar Futures Index decreased by 0.11% to US$94.118.