S&P 500 and Dow Jones extended their declines on Tuesday, August 23, while Nasdaq was flat, as investors struggled for direction ahead of Federal Reserve's annual meeting in Jackson Hole, Wyoming, later this week.

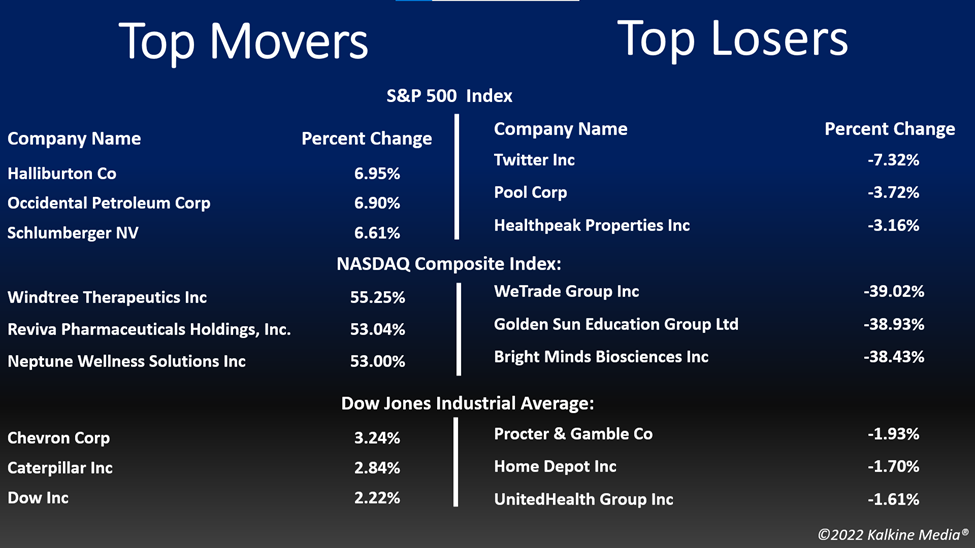

The S&P 500 fell 0.22 per cent to 4,128.73. The Dow Jones was down 0.47 per cent to 32,909.59. The NASDAQ Composite remained flat at 12,381.30, and the small-cap Russell 2000 rose 0.18 per cent to 1,919.14.

The indices have climbed from their June low in recent weeks, as investors assessed economic data that showed that the inflation had already peaked. The CPI rose 8.5 per cent annually in the prior month, following a surge of 9.1 per cent in June.

In addition to that, the positive corporate earnings have also helped gains in the market. However, the recent hawkish comments from the Fed officials have weighed on the traders' sentiment, raising concerns over aggressive rate hikes in the coming months.

Several investors bet a 50 basis point hike at their upcoming meeting, while some anticipate another 75 basis point hike in September.

The energy and materials sectors were the top gainers in the S&P 500 index on Tuesday. Seven of the 11 segments of the index stayed in the negative territory. The healthcare and information technology sectors were the bottom movers.

Shares of Macy's, Inc. (M) gained 3.20 per cent in intraday trading after the departmental store operator reported its second-quarter earnings results that may have topped the market expectations.

Palo Alto Networks (PANW) soared over 12 per cent in the intraday session after the cybersecurity firm posted strong quarter earnings results while providing upbeat guidance. In addition, Palo Alto said that its board of directors has approved a 3-for-1 stock split.

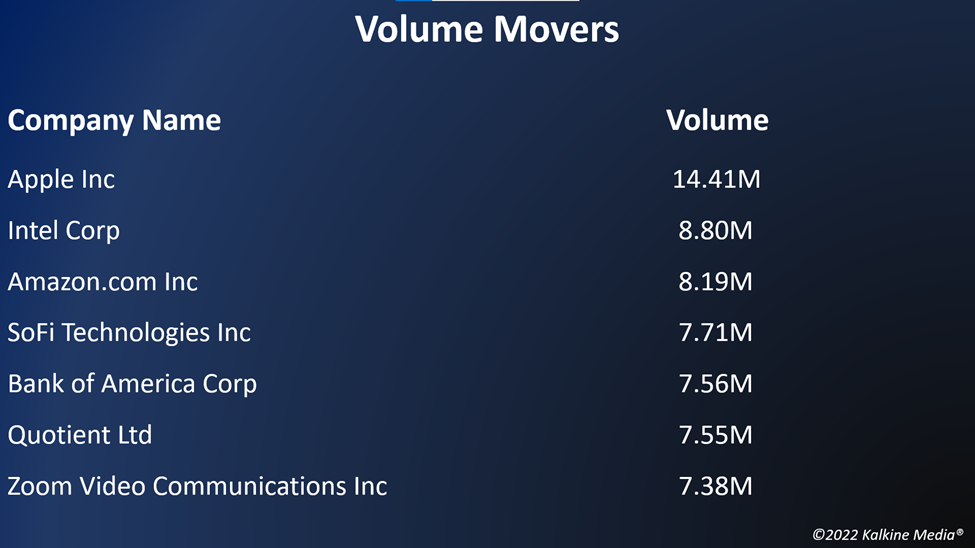

Zoom Video Communications, Inc. (ZM) fell over 15 per cent on Tuesday, a day after the communications technology firm trimmed its profit and revenue guidance for the current year.

In the energy sector, Exxon Mobil Corporation (XOM) increased by 4.24 per cent, Chevron Corporation (CVX) rose 3.24 per cent, and Shell plc (SHEL) added 4.16 per cent. TotalEnergies SE (TTE) and ConocoPhillips (COP) soared 3.24 per cent and 3.05 per cent, respectively.

In material stocks, BHP Group Limited (BHP) gained 2.58 per cent, Rio Tinto Group (RIO) surged 3.68 per cent, and Vale S.A. (VALE) jumped 7.75 per cent. Nutrien Ltd. and Freeport-McMoRan Inc. (FCX) advanced 5.20 per cent and 6.46 per cent, respectively.

In the healthcare sector, UnitedHealth Group Incorporated (UNH) decreased by 1.61 per cent, Eli Lilly and Company (LLY) fell 2.48 per cent, and Pfizer Inc. (PFE) tumbled by 1.82 per cent. Merck & Co., Inc. (MRK) and AstraZeneca PLC (AZN) ticked down 1.05 per cent and 1.20 per cent, respectively.

Futures & Commodities

Gold futures were up 0.71 per cent to US$1,760.75 per ounce. Silver increased by 0.60 per cent to US$18.992 per ounce, while copper ticked up 0.92 per cent to US$3.6852.

Brent oil futures increased by 3.91 per cent to US$100.25 per barrel and WTI crude was up 3.76 per cent to US$93.77.

Bond Market

The 30-year Treasury bond yields were up 0.85 per cent to 3.269, while the 10-year bond yields rose 0.92 per cent to 3.063.

US Dollar Futures Index decreased by 0.47 per cent to US$108.465.