Benchmark US indices closed higher on Thursday, March 24, boosted by gains in big technology stocks as crude oil prices dropped more, lifting investors’ sentiments on Wall Street.

The S&P 500 gained 1.43% to 4520.16. The Dow Jones rose 1.02% to 34707.94. The NASDAQ Composite rose 1.93% to 14191.84, and the small-cap Russell 2000 was up 1.00% to 2072.81.

Markets in recent sessions have recovered from their lows after the central bank moved to rein in the spiraling high inflation, and global oil prices continued to fall from their peak.

US benchmark WTI crude fell over 3% to US$111.34 a barrel. The energy sector has been one of the best performing segments so far this year. The energy stocks traded flat on Thursday.

The stock rally follows the Labor Department’s new economic data released earlier in the day.

First-time jobless benefits claims fell by 28,000 to 187,000 in the week ended March 19, down from 215,000 in the week before. It was the lowest level since September 1969, it said. Higher oil prices and supply chain issues remained a significant worry for the economy.

Technology and communication sectors led gains in the S&P 500 on Thursday. Ten out of the 11 sectors of the index stayed in the green, with the energy segment trading near the flatline.

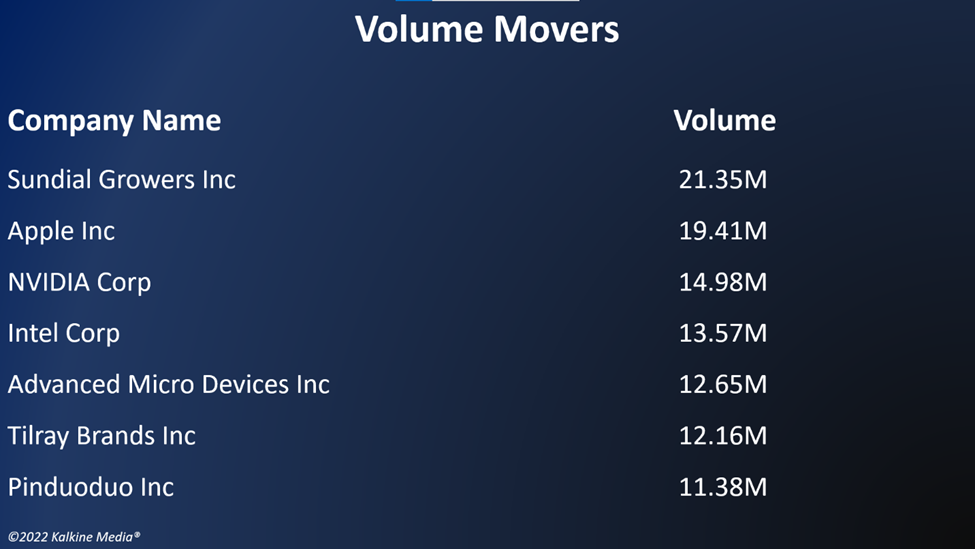

In the technology sector, Apple Inc. (AAPL) stocks rose for the eighth straight day, closing at 2.27% higher. Microsoft Corporation (MSFT) gained 1.54%, and NVIDIA Corporation (NVDA) surged 9.82%.

Semiconductor maker TSMC (TSM) rose 2.44%, ASML Holding N.V. (ASML) gained 3.78%, and Broadcom Inc. (AVGO) surged 4.51%. Shares of Advanced Micro Devices, Inc. (AMD) were up 5.80%.

In communication services segment, Alphabet Inc. (GOOG) stock was up 2.03%, Meta Platforms, Inc. (FB) increased by 2.86%, and The Walt Disney Company (DIS) was up 0.96%

In consumer cyclicals, Amazon.com, Inc. (AMZN) stock rose 0.15%, and Tesla, Inc. (TSLA) gained 1.48%.

In the energy sector, Exxon Mobil Corporation (XOM) traded at 0.30% up, Chevron Corporation (CVX) increased by 0.27%, and Shell plc (SHEL) gained 0.51%.

In financial stocks, Berkshire Hathaway Inc (BRK-B) gained (1.21%), while JPMorgan Chase & Co. (JPM) and Visa Inc. (V) gained 0.65% and 1.23%, respectively.

The global crypto market climbed 3.38% to US$1.99 trillion on Thursday afternoon. Bitcoin (BTC) gained about 3.65% to US$43,830.69 at around 4 pm ET.

Also Read: UNP to MANH: Top supply chain stocks to watch amid global concerns

Also Read: What is Anyswap (ANY) crypto and why is it rising?

Also Read: OKE, KMI among top 5 dividend stocks to explore amid market volatility

Futures & Commodities

Gold futures were up 1.06% to US$1,957.80 per ounce. Silver increased by 2.49% to US$25.815 per ounce, while copper rose 1.62% to US$4.7763.

Brent oil futures increased by 0.12% to US$118.10 per barrel and WTI crude fell 3.25% to US$111.19.

Also Read: Why is metaverse game Axie Infinity (AXS) rising?

Bond Market

The 30-year Treasury bond yields were up 0.48% to 2.532, while the 10-year bond yields rose 2.11% to 2.370.

US Dollar Index Futures increased by 0.19% to US$98.800.