Last week, the Federal Reserve Bank of Kansas held its annual meeting of global central bankers in Jackson Hole, Wyoming.

Central bankers, leading policymakers, and economic thinkers met to discuss the latest trends in the world economy and set the agenda for future research.

Inflation, not the theme

Although inflation has been the central concern for policymakers over the past two years, officials chose to title the conference, ‘Structural shifts in the global economy.’

This re-focusing may in part be due to the success that the Federal Reserve has had in bringing inflation down to more manageable levels.

The key questions discussed during the 3-day conference related to how lasting structural shifts may impact long-run trajectories in the world economy, usher in changes in financial markets and monetary policy, constrain long-term growth, transform global production networks and re-allocations in global supply chains, and impact global financial flows.

However, inflation remains a severe threat.

Jerome Powell’s opening speech

Although the theme of discussions was on structural shifts, Governor Powell doubled down on last year’s message, noting that the Federal Reserve was committed to bringing inflation to the 2% level.

Crucially, Powell noted,

Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level … the process still has a long way to go…

Even though the Governor acknowledged that food and energy may be susceptible to volatility, he zoned in on core inflation (non-food, non-energy) which has remained incredibly sticky, declining from a peak of above 5% to 4.1% in the most recent data release.

Goods inflation has come down sharply, owing to higher interest rates, while housing sector prices have recently started to see a pullback, despite the shortage of inventories.

However, among services (including healthcare, food, and transport), which make up half of the core PCE index, Powell admitted,

Twelve-month inflation in this sector has moved sideways since liftoff.

Although there have been some encouraging developments in this category in recent months, by being relatively immune to interest rate changes and supply chain disruptions, as well as benefitting from a still-tight labour market, services inflation continues to be elevated.

Powell insisted that recent data needs to be taken with a grain of salt, and price stability is still a way off.

He expects tighter monetary policy to eventually bring aggregate supply and demand back into balance allowing a return to 2% levels.

Lagarde on supply shocks

Christine Lagarde, President of the ECB, stressed that rising protectionism, re-alignment of trade linkages, and climate change impacts (and associated decarbonization efforts) could lead to intensification of supply shocks in the future.

The macroeconomic shifts that Lagarde focused on included profound labour market changes given the after-effects of the pandemic, rapid digitalisation in the workplace, the era of remote working and AI-led growth which will support some jobs and threaten others; the energy transition coupled with OPEC+ underperforming its targets and the uncertainty in the supply mix of the future; and the ‘deepening geopolitical divide’ due to reshoring, friend-shoring and fragmentation into competing blocs, and subsequent re-designing of supply chains.

ECB research finds that geopolitical fragmentation could lead to real imports declining by up to 30% globally.

Investments imbalance

In addition, she anticipates significantly higher investment within the decade including an average of €600 billion per year on the EU’s energy transition; NATO-related expenditure; and accelerated digitalization across multiple sectors with countries looking to boost their respective productivity factors (as shown in the graph below).

However, such significant investment in a slowing economy could impede economic clarity.

Referring to increased volatility in economic indicators, and consequently, the inability to draw sufficient lessons from historical datasets and uncertainty of projections, Lagarde quoted the philosopher Søren Kierkegaard,

…life can only be understood backwards; but it must be lived forwards.

She further expressed her concern that inflation could re-emerge especially in the commodities sector amid higher investment demand (especially in green energy), and deeper supply constraints, making it much more challenging for central banks to manage inflation expectations in the long run.

Broadbent on geopolitics and the role of demand

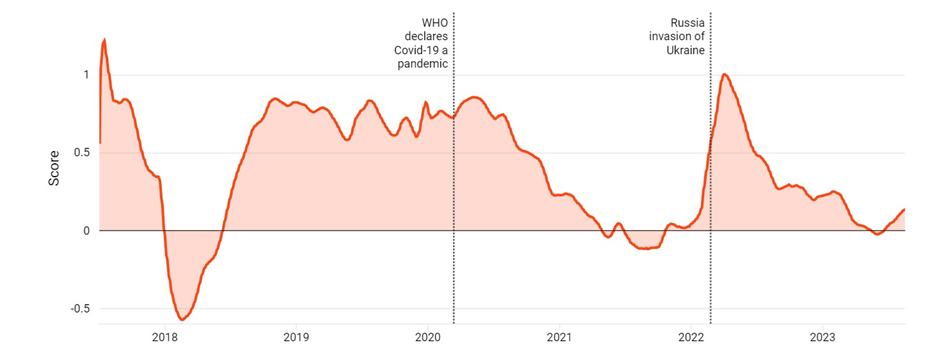

Ben Broadbent, Deputy Governor at the Bank of England concurred that supply shocks were a key concern, noting that geopolitical issues such as the Russia-Ukraine war led to higher food and energy prices.

It is unclear how persistent geopolitical impacts can be but monetary policy is likely to remain elevated for the foreseeable future.

An uptick in geopolitical frictions in 2023, may contribute to lasting inflation in open economies that tend to rely on international trade, further requiring higher for longer rates to achieve price stability.

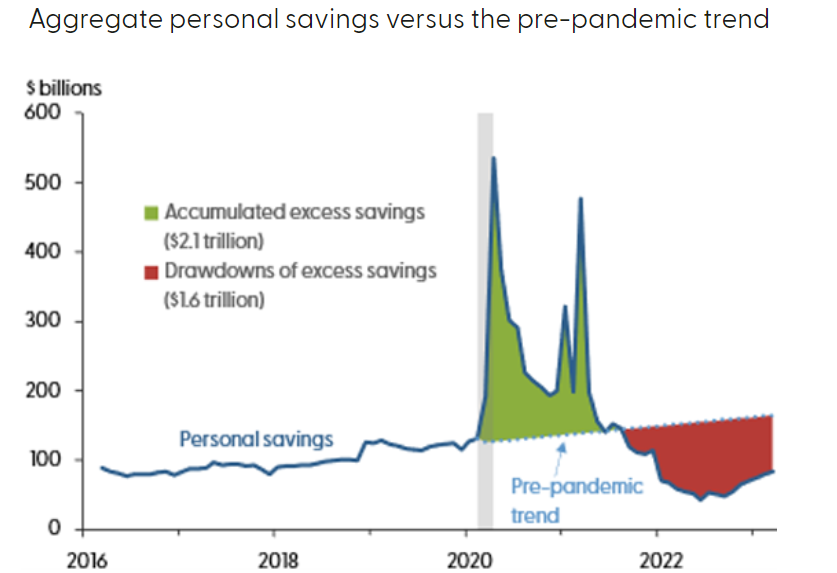

Adding to Lagarde’s views on supply shocks, Broadbent noted that the persistent imbalance in supply and demand of goods that materialized during the pandemic is not only down to broken supply chains but also a swell in demand as consumers received unprecedented payroll protection assistance.

SF Fed research

In relation to Broadbent’s comments regarding the importance of demand, the San Francisco Fed found that the US public was able to build up a cushion of $2.1 trillion in excess savings amid the pandemic.

However, significant additional consumption has now brought accumulated savings down to $500 bn.

Despite the heavy decline, the SF Fed expects this amount to support the consumption leg of the economy at least until Q4 2023.

These additional savings may be a key factor in explaining why the US economy has remained so resilient amid unprecedented tightening.

US outlook

Powell noted that restrictive monetary policy shall have to continue, while economic growth has remained too resilient to sustainably return to 2% levels.

Despite raising rates by 300 bps since the last edition of the Jackson Hole conference, quarterly GDP growth in the US has increased during the two previous reports.

He argued that,

…(we) require a period of below-trend economic growth…

On the other hand, the labour market has begun to cool and nominal wage demand has reduced, even though the job market remains relatively robust compared to pre-pandemic levels.

Given elevated rates, Powell expects there to be a ‘gradual normalization’ in the labour market.

Tightening of financial conditions, falling loan growth and stricter bank lending regulations shall support the intended monetary response along with a reduction in the size of the Fed’s security holdings.

The complication however comes from two sources – variable and unpredictable monetary lags, and the difficulty in identifying the neutral rate of interest.

As a result, Powell added that undershooting and overshooting both remained a threat to economic stability, stating,

Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy.

The post Powell, Lagarde and Broadbent discuss the inflation challenge at Jackson Hole appeared first on Invezz.