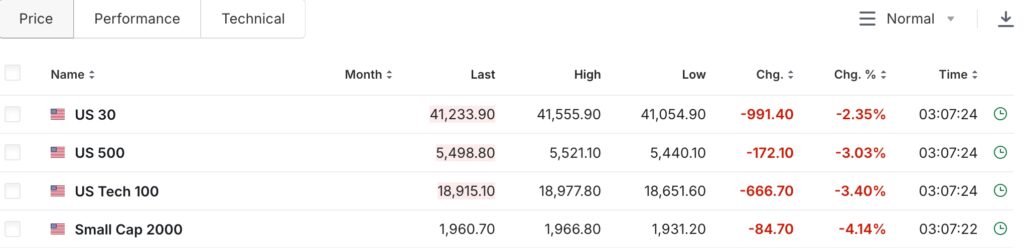

US stock index futures plummeted on Thursday as investors gave a thumbs down approval to Donald Trump’s tariffs.

Dow Jones Index futures plummeted by almost 1,000 points, while those tied to the S&P 500 and Nasdaq 100 fell by 170 points and 700 points, respectively. Popular ETFs like the DIA, QQQ, and SPY will open much lower.

DIA, QQQ, and SPY crash to accelerate

Popular ETFs tracking the Dow Jones, Nasdaq 100, and S&P 500 indices are set to crash once the market opens if the futures market is to go by.

The Dow Jones Index has crashed by over 8.2% from its highest level this year, while the Nasdaq 100 and S&P 500 have dropped by over 13% and 9%, respectively.

These indices have been in a downtrend this year, mostly because of the fears that the AI bubble is bursting. Now, they are selling off as concerns rise that the US is heading toward a catastrophic recession.

Odds of a recession have jumped in the past few days. This week, Goldman Sachs analysts boosted their recession odds to 35%, joining other powerhouses like PIMCO and Morgan Stanley that have warned about the US.

Gonna be a BLOODBATH on Wall St tomorrow. Investors will lose billions. Retirement accts will be further slammed. Inflation will keep rising. Co’s will lay off millions. Unemployment will spike. GDP will drop. Recession coming. He’s destroyed the best economy in decades…

We believe that the Trump tariffs he announced this year will be a black swan event because of their severity. He has announced a 25% tariff on all imported vehicles, steel, and aluminum. He also added a 25% tariff on goods from Canada and Mexico.

Trump has also boosted tariffs on imported goods from countries like China and those in the European Union.

Gold has emerged as a good place to hide

A common question among investors is whether there is a good place to hide as popular ETFs like DIA, SPY, and QQQ plummet. Gold has emerged as one of the best hiding places as these risks rise. It has soared to a record high of $3,150, and is up by over 20% today. Gold ETFs like GLD and IAU have accumulated substantial assets in the past few months.

Gold has jumped because of its strong history as a store of value. Besides, gold has maintained its value for centuries, demand from central banks is rising, and global supplies are falling.

Vanguard Utilities ETF (VPU)

The other hiding place to run as recession odds rise and QQQ, SPY, and DIA plunge is in the utilities. These are companies that provide essential and irreplaceable services like electricity, gas, and water.

Americans will continue to pay for these services whether there is a recession or a great depression. These companies are also mostly domestic, meaning that they will not be affected by tariffs. Instead, they will benefit from domestic policies like tax cuts and deregulation.

This explains why the VPU ETF has done well in the past few days. It has risen in the last six consecutive days, and is hovering at its highest point since February 24.

Vanguard Financials ETF (VFH)

The other hiding place to watch as the QQQ, DIA, and SPY ETFs crash is financials. The VFH ETF tracks the biggest financial services companies in the United States. The most notable companies in the fund are JPMorgan, Berkshire Hathaway, Mastercard, Visa, Bank of America, Wells Fargo, and S&P Global.

These companies will likely be less affected by tariffs because customers will continue to use their services. The only impact may come from the Federal Reserve, which may decide to slash interest rates if the US sinks to a recession.

Vanguard Real Estate ETF (VNQ)

Real estate companies are also expected to do well if the US sinks into a recession because it will force the Fed to cut interest rates. With many of them facing a wall of maturities, lower rates will be a welcome move for these companies.

Most importantly, many of these firms like Prologis, Welltower, Equinix, Simon Property Group, and Digital Realty, and Realty Income are domestic and will not be impacted by these tariffs and retaliatory ones.

The post Is there a place to hide as DIA, QQQ, and SPY ETFs plummet? appeared first on Invezz