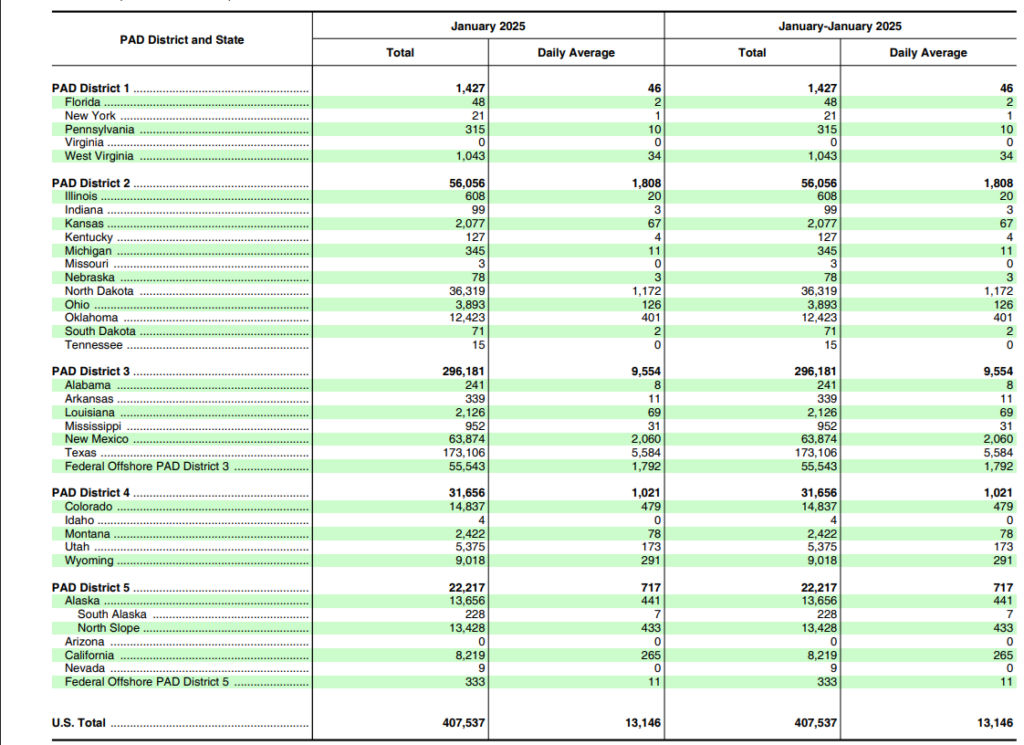

US crude oil production experienced a significant decline in January, falling by 305,000 barrels per day to reach 13.15 million barrels per day, according to the Energy Information Administration.

This represents the lowest production level observed since February 2024, according to the data.

This decrease in production could have various implications for the US energy market, including potential impacts on domestic oil prices, supply and demand dynamics, and import levels.

The EIA report may also shed light on the factors contributing to this decline, such as changes in drilling activity, well completions, or production curtailments.

Additionally, the data could provide insights into the future trajectory of US oil production and its role in the global energy landscape.

The latest data released by the EIA revealed a substantial decline in US oil production for the month of January 2025.

This decrease represents the most significant drop in monthly output since January 2024, signaling a potential shift in the US energy landscape.

Furthermore, the EIA has revised its initial estimate of record US oil production in December 2024.

The agency now estimates that December’s output was approximately 40,000 barrels per day lower than previously stated, setting the new record at 13.45 million barrels per day.

US oil output

In a notable downturn, Texas, the leading oil-producing state in the US, experienced a substantial decrease in oil output.

Production fell by 105,000 barrels per day to a total of 5.58 million barrels per day.

This marks the lowest production level for the state since March 2024 and represents the most significant monthly decline since January 2024.

This decrease in production contributes to a broader picture of fluctuating oil output levels and highlights potential challenges within the energy sector.

In January, New Mexico’s crude oil production fell to its lowest point since July 2024.

Data from the EIA showed a decrease of 53,000 barrels per day, resulting in a total output of 2.06 million barrels per day.

This represents the largest monthly decline in a year for the state, which is the second-largest oil producer in the US.

Gas production

The EIA also reported that gross natural gas production in the US. The lower 48 states decreased by 1.7% from December’s monthly record high of 118.3 bcfd to 116.3 billion cubic feet per day in January.

In January, Texas saw a 1.2% decrease in monthly gas production, falling to 36.0 bcfd.

This is slightly lower than their record monthly production of 36.4 bcfd in December 2024. Meanwhile, Pennsylvania experienced a 0.1% increase, reaching 21.4 bcfd, which remains below their peak of 21.9 bcfd in December 2021.

Oil prices surge

Oil prices surged to a five-week high on Monday after US President Donald Trump threatened to impose secondary tariffs of 25 to 50% on any country that buys oil or gas from Russia.

Brent crude prices on the Intercontinental Exchange rose nearly 3% to $74.83 per barrel and touched a five-week high of $75.04 per barrel earlier on Monday.

At the time of writing, the West Texas Intermediate crude oil was up 3.2% at $71.56 per barrel. It had also hit a five-week high of $71.84 a barrel.

“Prices were supported by comments from President Trump over the weekend. He forcefully expressed his anger over President Putin’s delaying tactics and obvious reluctance to agree to a ceasefire with Ukraine,” David Morrison, senior market analyst at Trade Nation said.

This would affect many countries, not just the obvious Asian Pacific ones, but across Europe as well. It would also be the first serious sanction affecting Russia’s ability to fund its war with Ukraine.

The post Oil prices surge to 5-week high on tariff threat as US crude production hits 11-month low in January appeared first on Invezz