Summary

- Ping An Asset Management of China increased its stake in the bank to 8 per cent, which is seen as a vote of confidence by investors despite a recent spat between Chinese and British governments over Hong Kong.

- The bank had been embroiled in two major controversies recently - first HSBC making a statement to the US investigators which led to a senior Huawei official’s arrest and second the allegations of supporting money laundering activities.

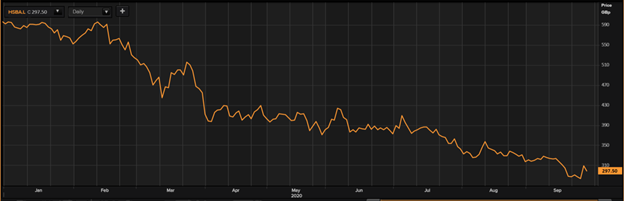

- The shares of the bank have lost almost half their value at the LSE during 2020 until now, the worst performance in 25 years.

One of the major Chinese investors in the company Ping An Asset Management has increased the stake in the company from their current holding of 7.95 per cent to 8 per cent. This is probably a good news that has come from the HSBC bank in a long time after it has been embroiled in a series of unpleasant headlines and not so encouraging financial performance since the beginning of the year 2020.

This comes even as the largest British bank has been facing increased hostility from the Chinese establishment over allegations that statements made by the HSBC bank to US investigators led to the arrest of a senior functionary of Huawei, which is a Chinese telecommunication equipment manufacturer. It is worth noting here that though HSBC is a British bank, a significant portion of its revenues come from Mainland China and Hong Kong where the company was incorporated before shifting its headquarters to London.

The year 2020 has been particularly a disappointing year for the company not only in terms of the above-mentioned controversies but also because of the below-par financial performance due to the outbreak of the coronavirus pandemic in most of its key markets. This year the bank also had to suspend its dividends, due to its current financial crunch, something which it had not done in 74 years.

The Chinese allegations

The Chinese allegations against HSBC led to the first hit on its shares at the Browses during 2020. China has been accusing HSBC of being an accomplice with the US, which led to the arrest of China's largest telecom equipment manufacturer Huawei's CFO Meng Wenzhou in Vancouver Airport in Canada. Huawei has been in a lot of controversies lately over allegation of its 5G equipment being used by Chinese intelligence agencies for espionage activities on other countries.

It is to be noted here that Huawei has been facing sanctions from the United States of America for various reasons including doing business with Iran whom the United States considers as a rough country supporting terrorism and harming American interests.

Huawei 5G telecom equipment is banned in several countries as they are alleged to have security flaws that make them susceptible to hacking.

FinCEN file leaks

The FinCEN file leaks controversy caused the second blow to the HSBC share prices on the LSE. Recently, an investigation by the International Consortium of Investigative Journalists (ICIJ) on leaked SAR (Suspicious Activity Reports) files submitted to FinCEN (U.S. Department of Treasury’s Financial Crimes Enforcement Network) targeted HSBC for the lapses which allowed financial dealings by fraudsters through its systems.

The report of ICIJ that was published on Sunday night 20 September 2020 could spell major trouble for the bank if an investigation is conducted by authorities in either in UK or USA regarding these allegations. The Secret SAR files stressed that the HSBC bank continued to aid the movement of illicit funds of suspicions people and criminal organisations, despite commitments made to the authorities. The documents have revealed that in a particular instance HSBC helped fraudsters move funds totaling up to $80 million from a Ponzi scam in Hong Kong to overseas locations in 2013 and 2014 while being fully aware of the suspicious nature of those transactions. The SAR files also state that the bank continued to transact with criminal groups, fraudsters, and corrupt regimes across the world despite being cautioned by US law enforcement agencies that they could face legal prosecution.

Financial performance

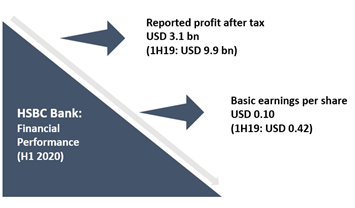

Let us take a closer look at the latest financial performance of the company in the year 2020. Owing to the outbreak of the coronavirus pandemic in China and other important markets for HSBC, the first half-year financial performance of the bank has been weaker compared to the corresponding period during the previous year 2019.

For the half-yearly period ending 30 June 2020, the bank reported a revenue of $26.75 billion (H1 2019: $29.37 billion). The reported profit after tax of the company for the period stood at $3.13 billion compared to $9.94 billion reported for the corresponding period during 2019. The diluted earnings per share of the company for the period stood at 10 US cents per share (HI 2019: 42 cents per share).

Stock performance

Now, let us analyse the performance of the bank’s stock on the London Stock Exchange since the beginning of year 2020. Having a global footprint, HSBC Holdings Plc (LON:HSBA),has been consistently ranked amongst the top ten largest banks in the world, and is the largest banking and financial company within Europe.

Source- Thomson Reuters

At the LSE, the shares of HSBC Holdings plc have been on the downslide since the start of 2020, except for a minor upheaval during the month of March, just after the lockdown was imposed in the country. On 2 January 2020, the shares of the company were trading at GBX 595.10 per share after which they hit a minor peak of GBX 515.00 on 24 March 2020. Thereafter the shares cooled down and hit a low of GBX 397.75 on 2 April 2020, after which they had been on a steady decline.

The shares of the company were trading at GBX 298.30 per share on 29 September 2020 (11.05 AM GMT+1), losing 3.31 per cent over the previous day’s close.