Summary

- Ted Baker revenue declined by 36.0 percent year on year in Q1 FY2021.

- Ted Baker targets the EBITDA margin in the range of 7 percent to 10 percent by FY2023.

- Superdry's revenue declined by around 19.1 percent year on year in FY2020.

- Superdry secured rental deferral of close to £20 million.

- Superdry experienced a surge in online sales.

Ted Baker PLC (LON:TED) & Superdry PLC (LON:SDRY) are two consumer stocks. Shares of TED and SDRY were down by about 2.62 percent and 5.66 percent, respectively from the last closing price (as on 24 August 2020, before the market close at 12:30 PM GMT+1).

Ted Baker PLC (LON:TED) - Menswear sales increased, whereas Womenswear sales declined year on year in FY2020

Ted Baker PLC is a UK based global lifestyle group. The Group brands and sells menswear, womenswear and accessories. Ted Baker owns and operates 560 stores, and it is included on the FTSE ALL-Share index.

Recent Events

- On 1 July 2020, Ted Baker appointed John Barton as Non-Executive Chairman of the board.

- On 30 June 2020, Ted Baker announced that it completed sale and leaseback of the Ugly Brown Building to British Airways Pension Trustees Limited for £78.75 million. The Group received net cash of close to £72.0 million post-tax.

Trading Update Q1 FY2021 (ended 2 May 2020)

In Q1 FY21, the total Group revenue was £90.4 million, which declined by 36.0 percent year on year from £141.3 million a year ago. Total Retail sales were £58.8 million, which declined by 33.9 percent year on year. Online sales improved during the reported period. During the reported period, stores were shut after the full lockdown was imposed. The orders from the Wholesale Partners were cancelled or delayed due to the pandemic.

FY2020 results (ended 25 January 2020) as reported 1 June 2020

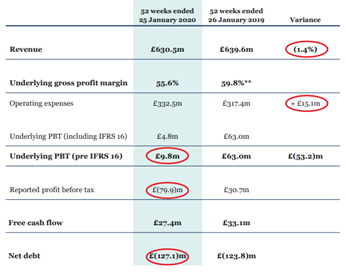

(Source: Group website)

In FY20, the Group reported revenue of £630.5 million, which decreased by 1.4 percent year on year from £639.6 million in FY19. The underlying gross profit margin declined to 55.6 percent in FY20 from 58.8 percent a year ago. EBITDA was £18.7 million in FY20, which declined from £68.8 million in FY19. The Group reported a loss before tax of £79.9 million in FY20 against profit before tax of £30.7 million in FY19. Ted Baker generated free cash flow and net cash outflow of £27.4 million and £0.5 million, respectively in FY20. As on 25 January 2020, it had net debt of £127.1 million. The Group suspended the final dividend for FY20; however, it paid an interim dividend of 7.8 pence per share for FY20.

Performance by business activity and region in FY2020

By business activity, stores sales were £321.2 million, which declined by 5.3 percent year on year from £339.3 million. Online and Retail sales were £118.7 million and £439.9 million, respectively. Wholesale revenue increased by 9.6 percent year on year to £171.5 million in FY20 from £156.5 million in FY19. License income was £19.0 million that declined by 14.1 percent year on year in FY20. Based on product type, Meanwear sales increased by 2.5 percent year on year to £241.1 million, whereas Womenswear sales decreased by 3.1 percent year on year to £370.4 million. Based on the regional revenue, North America sales increased by 6.7 percent year on year to £194.6 million. The UK & Europe generated revenue of £422.6 million, which decreased by 3.3 percent year on year and Rest of World revenue was £13.3 million, which declined by 34.5 percent year on year.

Share Price Performance Analysis

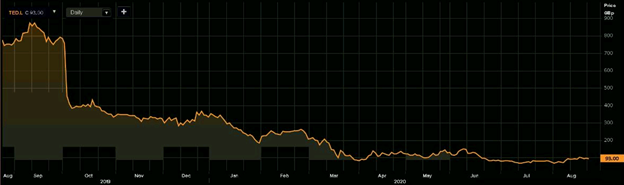

1-Year Chart as on August-24-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Ted Baker PLC's shares were trading at GBX 93.00 and were down by close to 2.62 percent against the previous closing price (as on 24 August 2020, before the market close at 12:30 PM GMT+1). TED's 52-week High and Low were GBX 910.35 and GBX 59.57, respectively. Ted Baker had a market capitalization of around £176.28 million.

Business Outlook

In FY21, the Group expects an improvement in margin, and it would limit the annual capital expenditure to around £15 million. It would focus on working capital efficiency by reducing the inventory cycle from three years to two years. The improvement of the retail store profitability would also be a key area of concern. The Group has planned for headcount reduction and payroll cut for improving margins. The Group highlights that it targets medium-term revenue growth of around 5 percent until FY23. It would target EBITDA margin in the range of 7 percent to 10 percent and after tax-free cash flow generation of about £30.0 million in FY23. It expects to bring down the net debt to EBITDA ratio to around 1x by FY23.

Superdry PLC (LON:SDRY) - Looking to raise funds to increase liquidity headroom

Superdry PLC is a UK based clothing and accessories group. Superdry owns 241 stores and has an average retail space of 1.2 million square feet. It also has 473 franchised stores and 26 license stores. Superdry is included on the FTSE All-Share index.

Trading Statement as reported on 7 May 2020

In FY20, the Group reported the sale of £705.5 million, which declined by 19.1 percent year on year from £871.7 million a year ago. Store sales added £288.3 million that declined by 22.9 percent year on year in FY20. Ecommerce and Wholesale sales were £149.6 million and £267.6 million, respectively in FY20. During the lockdown from 22 March 2020, all 241 stores remained closed in the UK, Europe and the US. Retail sales were subdued due to the closure of stores, whereas Wholesale revenue was impacted following the delay in shipments. The Group experienced a surge in online sales as the revenue almost doubled in the last four weeks of the reported period to close to £3.7 million per week against the average sales before complete lockdown. The online sales in the last four weeks almost compensated for one-third of the sales lost at stores. As on 5 May 2020, Superdry had net cash of £39.8 million.

Actions during the pandemic

The Group furloughed 88 percent of the staff, and the senior management took a pay cut and bonus cut. It had restructured the inventory, negotiated the payment terms and increased discounts on the stock. The Group secured rental deferral of close to £20 million, and it is negotiating long term rents. It has also deferred VAT, PAYE and duties on custom payments.

Share Price Performance Analysis

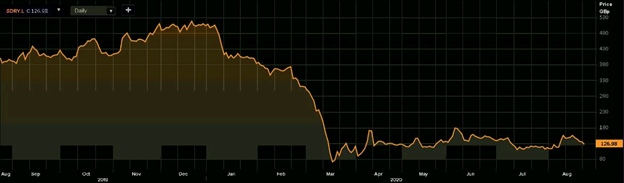

1-Year Chart as on August-24-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Superdry PLC's shares were trading at GBX 126.98 and were down by close to 5.66 percent against the previous closing price (as on 24 August 2020, before the market close at 12:30 PM GMT+1). SDRY's 52-week High and Low were GBX 529.00 and GBX 60.10, respectively. Superdry had a market capitalization of around £110.40 million.

Business Outlook

The Group highlighted that the pandemic caused disruption in the supply chain and the business operations; however, the sales through the online channels were encouraging. Superdry highlighted that the performance of women wear was resilient. The stores have started to reopen with new collection for the winter season. It is also looking to raise funds to increase liquidity headroom.