British telecommunication network company Three has announced that it will be rolling out its 5G communications network in some of the major cities in the United Kingdom such as Glasgow, London and Birmingham. With the intended rollout, the company will become a member of the exclusive 5G mobile club, competing with some of its biggest competitors such as the BT Group, Vodafone Group and TalkTalk group.

Three, which is owned by the Hong Kong based group Hutchison, though had already launched a 5G home broadband service in the central London Metropolitan area a year ago, but Chief Executive Dave Dyson stated that he needed all components of the system, including its latest cutting edge technology "cloud core", completely working before moving onto mobile-based 5G telecommunications system.

The companyâs unique selling proposition (USP) with this offering is the features such as offering accessibility for the customers to the 5G technology, with no cap on speed limits and at no extra cost on all payment methods such as contract mechanism, SIM-only method as well as the pay-as-you-go payment module.

In a similar move last month, Vodafone Group announced a partnership with Switzerland based Sunrise Communications Group to develop the fifth-generation (5G) telecommunications space in the country. As the organisation work in a comparable space, the arrangement is to chip away at their synergy of collaborations, for example, this Fifth Generation tech to extend their impression to convey fixed/portable services to Enterprises across the European Union and in other countries globally as well, and give advantage to their end-clients with higher speed based information systems.

While announcing the launch of this new product, the Chief Executive of Three revealed that the company currently also holds more 5G spectrum than the rest of the industry combined and it was the only UK operator with the 100MHz of 5G spectrum required to meet the International Telecommunication Union (ITU) standard for a 5G network

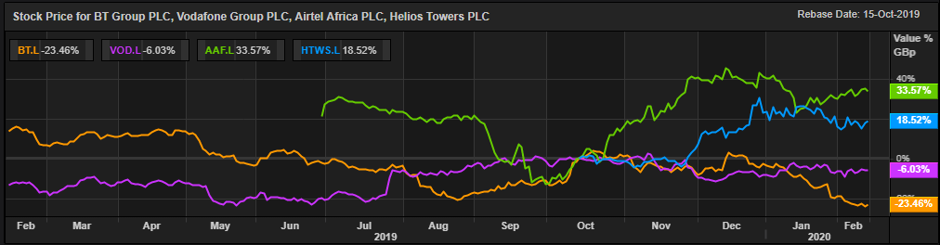

As the 5G technology progress in the United Kingdom, various telecom companies in the country have either launched or are in the process of launching this technology for their users. It is expected that most of the future will be dominated by this technology, and so will the stock of these companies. In light of this, it is important to look at the companies that can make strong moves on the stock markets. The following is a brief discussion of the price performance of the stocks of the four telecom giants in the UK.

BT Group Plc (LON: BT.A) Stock Price Performance

As on 14th February 2020, at 10:00 A.M (Greenwich Mean Time), by the time of writing this report, the BT Group Plc Stock was trading at a price of GBX 154.36 per stock on the London Stock Exchange market, an increase in the value of 0.89 per cent or GBX 1.36 per stock, as opposed to the price of the stock on the previous trading day, which had been reported to be at GBX 153.00 per stock. The market capitalisation (M-Cap) of the stock stood at a value of GBP 15.119 billion, with respect to the current market price of the stock of the company at the time of writing this report.

BT Group Plc stock had reportedly lost around 32.64 per cent in value, in the last twelve months, since February 14, 2019, when the stock was trading at a price of GBX 229.15 per stock at the time of the close of the market. It has also been reported that the companyâs stock has lost approximately 7.94 per cent, in the last six months, in comparison with the stock price of GBX 167.68 at the time of the close of the market as on August 14, 2019. BT Group Plcâs stock has been reported to have lost 16.83 per cent, in the last one month time from the stock price of GBX 185.60 per stock that the stock set as on January 14, 2019.

The beta of the BT Group Plcâs stock has been reported to be at 0.80, giving an idea that the movement in the stock price, is less fickle, as against the movement of the comparative benchmark index.

Vodafone Group Plc (LON:VOD) Stock Price Performance

As on 14th February 2020, at 10:05 A.M (Greenwich Mean Time), by the time of writing this report, the Vodafone Group Plc Stock was trading at a price of GBX 151.82 per stock on the London Stock Exchange market, an increase in the value of 0.04 per cent or GBX 0.06 per stock, as opposed to the price of the stock on the previous trading day, which had been reported to be at GBX 151.76 per stock. The market capitalisation (M-Cap) of the stock stood at a value of GBP 40.627 billion, with respect to the current market price of the stock of the company at the time of writing this report.

It has been reported that the Vodafone Group Plc stock had gained around 8.55 per cent in value, in the last twelve months, since February 14, 2019, when the stock was trading at a price of GBX 139.86 per stock at the time of the close of the market. It has also been reported that the companyâs stock has gained approximately 1.88 per cent, in the last six months, in comparison with the stock price of GBX 149.02 at the time of the close of the market as on August 14, 2019. Vodafone Group Plcâs stock has been reported to have lost 3.02 per cent, in the last one month time from the stock price of GBX 156.54 per stock that the stock set as on January 14, 2019.

The beta of the Vodafone Group Plcâs stock has been reported to be at 1.11, giving an idea that the movement in the stock price, is more volatile, as against the movement of the comparative benchmark index.

Airtel Africa Plc (LON:AAF) Stock Price Performance

As on 14th February 2020, at 10:10 A.M (Greenwich Mean Time), by the time of writing this report, the Airtel Africa Plc stock was trading at a price of GBX 74.55 per stock on the London Stock Exchange market, a decline in the value of 1.19 per cent or GBX 0.90 per stock, as opposed to the price of the stock on the previous trading day, which had been reported to be at GBX 75.45 per stock. The market capitalisation (M-Cap) of the stock stood at a value of GBP 2.835 billion, with respect to the current market price of the stock of the company at the time of writing this report.

It has been reported that the Airtel Africa Plc stock had gained around 9.79 per cent in value, since the stock was first admitted to the London Stock Exchange market, on June 28, 2019, when the stock was trading at a price of GBX 67.90 per stock at the time of the close of the market. It has also been reported that the companyâs stock has gained approximately 11.60 per cent, in the last six months, in comparison with the stock price of GBX 66.80 at the time of the close of the market as on August 14, 2019. Airtel Africa Plcâs stock has been reported to have lost 0.40 per cent, in the last one month time from the stock price of GBX 74.85 per stock that the stock set as on January 14, 2019.

Helios Towers Plc (LON:HTWS) Stock Price Performance

As on 14th February 2020, at 10:15 A.M (Greenwich Mean Time), by the time of writing this report, the Helios Towers Plc Stock was trading at a price of GBX 143.50 per stock on the London Stock Exchange market, an increase in the value of 0.35 per cent or GBX 0.50 per stock, as opposed to the price of the stock on the previous trading day, which had been reported to be at GBX 143.00 per stock. The market capitalisation (M-Cap) of the stock stood at a value of GBP 1.43 billion, with respect to the current market price of the stock of the company at the time of writing this report.

It has been reported that the Helios Towers Plc stock had gained around 18.11 per cent in value, in the last five months, since October 15, 2019, when the stock was first admitted to the London Stock Exchange marketâs FTSE 250 Index, trading at a price of GBX 121.50 per stock at the time of the close of the market.

Comparative share price chart of BT.A, VOD, AAF and HTWS

(Source: Thomson Reuters) Daily Chart as on 14-February-20, before the closing of the LSE Market