European markets closed lower in Friday’s trading session with FTSE-100 index lost 142.19 points or 2.29 per cent lower and ended at 6,076.60. Some of the latest macro developments which are keeping investors’ on edge are stated below:

- On Saturday, the Hong Kong Government officials stated that they were unhappy and lashed out at Trump’s actions as it was critical and legal to put forth the national security laws in place.

- Rishi Sunak, British Finance Minister, offered further support to the companies being hammered due to covid-19 mayhem in the form of a gradual phase-in of contributions. To put a check on increasing unemployment rate, the Government has been paying 80 per cent of the wages of the workers who are temporarily laid off.

Today, we will share some insights into two general retailer stocks: Motorpoint Group PLC (LON:MOTR) and AO World PLC (LON: AO.). Both stocks were in the bright spot in Friday’s trading session as MOTR stock zoomed up by 7.26 per cent and AO. stock accelerated significantly by 6.06 per cent. Let’s deep-dive further into their business model, strategic updates, financial and operational performance so as to better gauge on the business outlook scenario.

Motorpoint Group Plc – Leading Vehicle Retailer with Sustainable Business Model

Motorpoint Group Plc (LON:MOTR) is one of the largest vehicle retailers in the UK working independently. The Company sells nearly-new automobiles, which have covered under 15,000 miles and around two years old. Motorpoint Group sell vehicles from the famous and biggest brands, and models from companies such as Mercedes-Benz, BMW, Audi, Hyundai, Nissan, Volkswagen, Vauxhall, and Ford are the best sellers. The Group operates from 13 retail destinations across Great Britain and are supporting customers telephone and digital enquiries by a central contact centre. The Company also operates in B2B (business to business) using a digital auction platform named as Auction4Cars.com, allowing a quick route and efficient sale of part-exchange automobiles which do not follow nearly-new retail conditions.

Key Elements of Strategy

Motorpoint Group Plc’s strategy revolves around maintaining leadership position, while focusing entirely on the core market and fascinating customer offers, which is centred around more choices with maximum value and premium quality service. The Company offers a portfolio of brands under one roof, which is free from limitations imposed by OEMs on franchised dealers and enabling improved consumer experience. Motorpoint Group’s business model is transparent, simple and clear, delivering the best value on the sales of the nearly-new vehicle and providing knowledgeable, friendly and professional buying experience and service. The Group is also improving its existing retail sites to achieve growth and will help then to capture a greater market share of the nearly-new automobile market in the United Kingdom. The Company is looking to deploy a measured rollout plan with an aim to open one new site (on average) a year in the medium-term period. The Group has been spending efficiently on marketing in both offline and online to develop and increase brand awareness. Motorpoint Group is actively seeking acquisitions for existing and new sites to boost the speed of site expansion.

Relaunching of Operations

On 21st May 2020, Motorpoint Group announced the launch of the contactless purchase process at 13 branches. The new process will allow customers to choose between contactless collection or free nationwide home delivery, after receiving clarification from the Department for Business Energy and Industrial Strategy and National Health England. All the members from the board have voluntary agreed to take at least 50 per cent reduction in fee and salary during the lockdown.

Financial Highlights – Solid Operating Cash Flow in H1 Financial Year 2020 (30th September 2019)

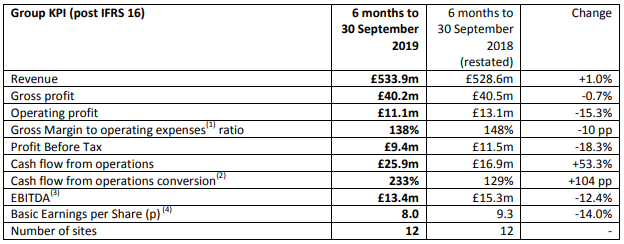

(Source: Interim Report, Company Website)

- In the first half of the financial year 2020, the group’s operating environment was challenging, with revenue grew marginally by 1 per cent to GBP 533.9 million against GBP 528.6 million in H1 FY2019.

- Gross profit for the period dropped marginally by 0.7 per cent to GBP 40.2 million in H1 FY2020 as against GBP 40.5 million reported in H1 FY2019. However, its operating profit plunged by 15.3 per cent to GBP 11.1 million for H1 FY2020. EBITDA for the first six-months plummeted by 12.4 per cent to GBP 13.4 million against the EBITDA of GBP 15.3 million reported in the first half of the corresponding period of the previous financial year.

- Pre-tax profit declined by 18.3 per cent to GBP 9.4 million against GBP 11.5 million reported in the year-over period, which dragged down the group’s basic earnings per share by 14 per cent to 8.0 pence for the period.

- The operating cash flow surged by 53.3 per cent to GBP 25.9 million in H1 FY2020 from GBP 16.9 million in H1 FY2019, with a conversion rate of 233 per cent for the period.

Share Price Performance Analysis

Daily Chart as of 29th May 2020, after the market closed (Source: Refinitiv, Thomson Reuters)

On 29th May 2020, shares of Motorpoint Group Plc closed at GBX 251.00, up by 7.26 per cent from the previous day closing. Stock's 52 weeks High is GBX 324.00 and Low is GBX 170.00. Total outstanding market capitalization stood at around GBP 226.38 million.

Resilient Performance Despite Uncertainty

The Group has shown a decline in financial performance in the first half of the financial year 2020. Despite the uncertain environment, the Company witnessed an improvement in the top-line performance and cash flow from operating activities increased significantly with a conversion rate of 233 per cent for the period versus 129 per cent in H1 FY2019. The net promoter score has improved for every site with a high level of customer revisit for the period. The Company has a strong leadership team which is competent to tackle the uncertain times due to covid-19 and due to impact of Brexit. The Group delivered growth in market share from every site and launched Home Delivery on a pilot basis, which delivered encouraging early results.

AO World Plc: FTSE-ALL Share Listed General Retailer Offering Sustainable Growth with Focus on New Investment Initiatives

AO World Plc (LON: AO.) is a seller of small and major consumer electronics and domestic appliances in Germany and the UK via its in-house logistics business and few selected third parties. The Group also provides additional services such as offering product protection plans, customer finance, installation of new products, collection of old products as well as recycling of waste appliances using the state-of-the-art facility. The Company has an employee base of more than 3,000 professionals.

(Source: Company Website)

Business Operations

AO Retail

The Company sold a variety of products from its sites a .com in Great Britain and a .de version for Germany. AO is continuously expanding its product range, tools and content to help customers in making the correct decision.

AO Logistics

The Group has bought its own logistics company and has its own warehouses to deliver products on time. The logistics are maintained through ao-delivery.com and expertlogistics.co.uk.

AO Recycling

At Telford, in the year 2017, build a state-of-the-art recycling facility and become the largest fridge recyclers in the United Kingdom.

AO Business

AO is selling a wide range of products to businesses from landlords to charities.

AO Outlet

The group’s outlet shops let its customers purchase end-of-line goods and professionally refurbished products to make big savings. These products are also available online from ao-outlet.co.uk site.

Financial Highlights – Solid Top-line Performance in H1 Financial Year 2020 (30th September 2019)

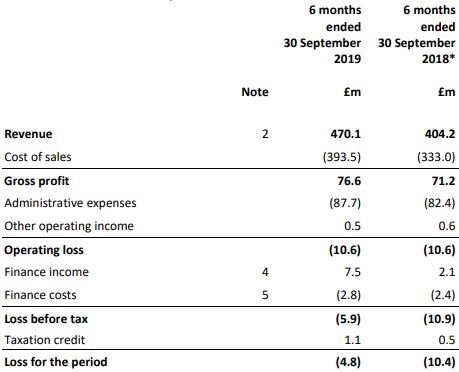

(Source: Interim Report, Company Website)

- In the first half of the financial year 2020, the company’s total revenue surged by 16.3 per cent to £470.1 millionas compared with £2 million in H1 FY2019.

- On a pre-IFRS 16 basis, the company’s adjusted EBITDA losses surged to £6.2 millionin H1 FY20 against the £5.4 million in H1 FY19.

- Statutory Group operating losses stood at £10.6 millionin H1 FY20 and remained the same against the same period of last year.

- Basic loss per share was 1.01 pence in H1 FY2020, which includes foreign exchange (Forex) gains. Reversing such Forex gains gives an adjusted loss of 1.98 pence per share.

Share Price Performance Analysis

Daily Chart as of 29th May 2020, after the market closed (Source: Refinitiv, Thomson Reuters)

On 29th May 2020, shares of AO. World Plc closed at GBX 136.60, up by 6.06 per cent from the previous day closing price. Stock's 52 weeks High is GBX 140.00 and Low is GBX 46.67. Total outstanding market capitalization stood at around GBP 652.86 million.

Driving Profitable Progress through Continues Investments

In the first half of the financial year 2020, there has been a huge amount of change and transition, due to which the company have been making investments and confident that they will pay back in the new financial year. AO. is focusing on driving profitable progress, but there would be some macro-economic uncertainty. The Company’s portfolio of complementary products and services continues to strengthen. The Group is expecting that these can be leveraged to underpin future progress and profitability in the United Kingdom. Additionally, the debt has increased over the year to fund the acquisition, while less progress has been made in terms of the ongoing cash requirements, negatively impacting the finances and limiting the long-term growth.