UK stock markets extended the morning gains on Tuesday, 3 November 2020, rallying a little more than 2 per cent in the afternoon trades tracking the positive mood of investors across the markets worldwide. A considerable surge in the US stock futures on Tuesday bolstered the investors’ sentiments, adding strength to the gains in FTSE 100, with Americans gearing up to exercise their constitutional right of voting.

The futures linked to S&P 500, the broader US index, went up by 1.2 per cent, while the Dow Jones 30 Futures gained 1.42 per cent to 27,177.5, indicating a positive opening on Wall Street today.

The benchmark FTSE 100 amassed as much as 2.14 per cent in the afternoon deals to hit an intraday high of 5,776.04. A market-wide gain was observed on the London Stock Exchange with all the key sectoral indices joining the party. The FTSE 250 index, FTSE 350, FTSE All-Share, FTSE AIM UK 50 Index, FTSE AIM 100 Index and FTSE AIM All-Share soared in a range of 1 to 2.1 per cent.

FTSE performance on 3 November 2020

Source: Thomson Reuters

We take a look at the top 12 FTSE blue-chip stocks that gained up to 6 per cent today

NatWest Group plc

Shares of NatWest Group (LON: NWG), the Edinburgh-headquartered banking and insurance major, added 6 per cent on Tuesday leading the pack of benchmark FTSE 100. NatWest share price climbed as much as 6 per cent to hit a one-month high of GBX 127.28 from the previous closing price of GBX 120.05.

Source: Thomson Reuters

Hargreaves Lansdown Plc

Shares of Hargreaves Lansdown (LON: HL), the Bristol-based financial services company, were among the top five gainers among the FTSE 100 constituents rising by more than 5 per cent in the afternoon trades. The stock of Hargreaves Lansdown surged 5.62 per cent, defying the falling trend of the last month, to a day’s high of GBX 1,428. Hargreaves Lansdown share price closed at GBX 1,352.00 on Monday, 2 November.

Source: Thomson Reuters

Prudential Plc

Shares of Prudential (LON: PRU), the London-headquartered insurer and financial services firm, also stood in the top five gainers among FTSE 100 stocks on Tuesday. The stock of Prudential scaled a gain of 5.82 per cent to an intraday peak of GBX 1,013.50 from the previous share price of GBX 957.80 a piece.

Source: Thomson Reuters

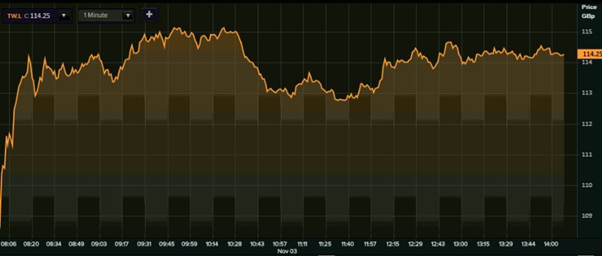

Taylor Wimpey Plc

Shares of Taylor Wimpey (LON:TW), the High Wycombe-based house building company, soared more than 6 per cent today extending Monday’s gains. Taylor Wimpey share price recorded a gain of 6.07 per cent to a day’s high of GBX 115.20 on Tuesday from the previous closing price of GBX 108.60. The stock of Taylor Wimpey has shed nearly 11.4 per cent in the last week of October following the week-long slump in FTSE 100.

Source: Thomson Reuters

Other major FTSE 100 shares that registered a gain of more than 4 per cent till the afternoon deals on Tuesday include RSA Insurance Group Plc (LON: RSA) (up 4.70 per cent); British Land Company Plc (up 4.90 per cent); Barclays Plc (LON: BARC) (up 5.18 per cent); Fresnillo Plc (LON: FRES) (up 4.63 per cent); Intermediate Capital Group Plc (up 4.43 per cent); Ferguson Plc (up 4.43 per cent); Standard Chartered Plc (LON: STAN) (up 4.29 per cent) and Ashtead Group Plc (LON: AHT) (up 4.05 per cent).