5 Hidden Gems Revealedof Lockdown Period

- The unprecedented pandemic crisis has led investors to turn away from equity investing and save more money.

- The Brexit deadline is nearing, and the UK government is actively looking at local lockdowns to contain the spread of the deadly virus.

- There are many stocks which remained unnoticed, which have given handsome returns during the last six months of pandemic.

The coronavirus pandemic has led to a lot of wealth erosion for investors. Lockdowns, travel disruptions and other restrictions have slowed down the economic activities across the world. The unprecedented crisis has led people to save more rather than investing in asset classes. Usually, people are reluctant to invest money through equity investments when times are uncertain.

The number of coronavirus cases are rising globally, which might lead to new lockdowns and travel restrictions. The US stock markets have a significant impact on the global equity markets. And as the presidential elections are due in the US, the situation is uncertain and extremely volatile. For the UK, the situation At the same time, the UK is nearing its Brexit deadline and cautiously looking at lockdowns, restrictions to contain the spread of the deadly virus.

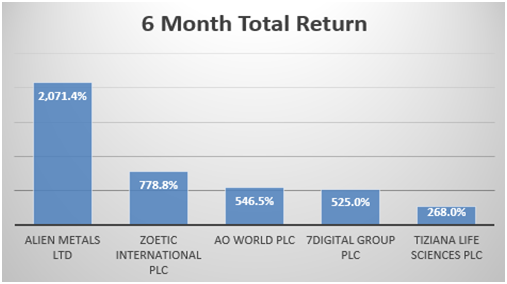

Despite the odds, the stock market remains a key hunting ground for investors. Despite the prevailing uncertainties and a gloomy outlook in the UK’s economy, there are a few gems which might have gone unnoticed but have given outstanding returns during the coronavirus crisis.

Also read: 3 Gold Stocks Doing Well on LSE

Let us analyse some of the LSE listed stocks which have proved to be hidden gems during the pandemic crisis.

(Source: Refinitiv, Thomson Reuters)

- 7digital Group Plc (LON:7DIG)

The global leader in B2B end-to-end digital music solutions, 7digital Group, witnessed an increase in its gross margin to 66 per cent during the first half of 2020 in comparison to the H1 2019. The company managed to optimise costs by reducing administrative expenses by 51 per cent to £3.1 million during the H1 2020 (H1 2019: £6.4 million). The digital music company reduced its operating loss by 73 per cent to £0.9 million during the H1 2020 (H1 2019: loss of £3.2 million).

In order to boost growth in immediate commercial opportunities, the company raised £6 million (gross) through placing shares and subscribed to a £1 million credit facility. The company is well poised to achieve operational profitability by the end of H2 2020. The company started the year on a positive note with new contracts and renewals. The company seeks to drive growth in the post-Covid environment by leveraging upon new models and markets such as social media, online fitness and artist monetisation.

On 28 October, 7DIG shares were trading at GBX 1.20 (GMT 08:47 AM +1), down by 2.04 per cent from the previous day closing price. The market capitalisation of 7digital Group stood at £33.35 million. In the last six-month period, 7DIG shares have delivered a price return of 525 per cent.

Also read: 10 FTSE Healthcare Stocks to Keep an Eye on For Good Returns

- Alien Metals Ltd (LON: UFO)

Exploration and development company Alien Metals Ltd had total assets of US$1.6 million (2019: US$1.2 million) and the cash position of the company stood at US$0.7 million (2019: US$0.4 million) for H1 2020 ending 30 June. Alien Metals has secured a 208 square kilometre new exploration ground in Greenland. The company has completed recent fieldwork at Hamersley Iron Ore projects with 95 samples taken and with more detailed mapping.

On 28 October, UFO shares were trading at GBX 1.55 (GMT 08:51 AM +1), down by 6.06 per cent from the previous day closing price. The market capitalisation of Alien Metals stood at £50.77 million. In the last six-month period, Alien Metals shares have delivered a price return of 2,070 per cent.

- AO World Plc (LON: AO.)

Leading European online electrical retailer AO World expects the group revenue to rise by 57 per cent and lie in the range of £715 million during the H1 2021, according to its recent trading update. The company has hugely benefitted from online penetration. AO World witnessed a solid performance in Germany as revenue grew by 83 per cent on a constant currency basis.

Despite the reopening of competitor bricks and mortar stores, the company witnessed momentum in sales extending from Q1 throughout Q2 that led to an increase of 54 per cent in the UK’s revenue during the H1 2021.

On 28 October, AO World shares were trading at GBX 334.50 (at GMT 08:55 AM +1), down by 2.62 per cent, from the previous day closing price. The market capitalisation of AO World stood at £1,643.79 million. In the last six-month period, AO World shares have delivered a price return of around 545 per cent.

- Zoetic International Plc (LON:ZOE)

Zoetic International Plc, previously known as Highlands Natural Resources Plc, is a Beckenham-based holding company, which has witnessed a transition from oil and gas to branded consumer CBD products during the fiscal year 2020. The company has been extending its reach in the international markets, such as the United States, by signing substantial distribution agreements with more than 6,000 retail stores. The company is currently focusing on its consumer CBD products business and has materially reduced its overheads.

Zoetic International shares were trading at GBX 42.50 (at GMT 08:58 AM +1) on 28 October, down by 4.49 per cent from the previous day’s closing price. The market capitalisation of Zoetic International stood at £86.58 million. In the last six months, Zoetic International shares have delivered a price return of around 770 per cent.

- Tiziana Life Sciences Plc (LON:TILS)

Pharmaceuticals & Biotechnology company Tiziana Life Sciences Plc is currently developing new technology for the treatment of COVID-19 infections. The company intends to initiate the clinical study for TZLS-501 (anti-Interleukin-6-Receptor) for Covid-19 treatment in Q1 2021.

The cash balance of the company as on 30 June increased to £7.2 million. The company during the Q1 2020 managed to raise £12.9 million in funds through public offerings. However, any failure during drug development or supply chain disruption during the Covid-19 crisis may hamper operations and reduce returns of the company.

Tiziana Life Sciences shares were trading at GBX 163.50 (at GMT 09:01 AM +1) on 28 October, down by 3.82 per cent from the previous day’s closing price. The market capitalisation of Tiziana Life Sciences stood at £314.63 million. In the last six months, Tiziana Life Sciences shares have delivered a price return of around 260 per cent.