Sumamry

- UK-based electric vehicles manufacturer Arrival Ltd has chosen to debut in New York instead of the London Stock Exchange

- The company has announced a business combination with the New York-based special purpose acquisition company CIIG Merger Corp

- Following the development, the shares of Nasdaq-listed CIIG Merger Corp rallied more than 27 per cent on 18 November

In order to raise funds, capital markets have always been the favourite spot for most of the companies as it has various channels of capturing a sizable chunk of money through equity and debt offerings.

Higher visibility, liquidity, a varied pool of shareholders and a global portrayal of a firm through a stock exchange are some of the other benefits that come along with a stock market listing.

To harvest the benefits of capital markets, a UK-based electric vehicles manufacturer has chosen to debut in New York instead of offering the equity via London Stock Exchange. Arrival Ltd, the London-headquartered light weight electric vehicle maker, has planned to list on the Nasdaq Stock Exchange in New York.

Arrival’s Nasdaq debut

Arrival Ltd on Wednesday announced a business combination with the New York-based special purpose acquisition company CIIG Merger Corp under which the amalgamated entity will be floated on Nasdaq with a ticker “ARVL”.

Peter Cuneo, Gavin Cuneo along with Michael Minnick founded CIIG Merger Corp (NASDAQ:CIIC) in 2019 with an objective of acquiring businesses through the route of stock purchase, asset acquisition, merger, and reorganisation with enterprises.

Why Nasdaq over LSE

As Nasdaq boasts to have all the heavyweight tech giants on its platform. So it is relatively easier for a technology-driven firm to gain the benefits of listing in New York as compared to anywhere else in the world. The pool of investors chasing the Nasdaq-listed companies is outrightly higher versus the institutions interested to invest in companies floated on other bourses.

Upon the successful stock market debut of Arrival on Nasdaq, the firm can compete head-to-head with the likes of tech giants Facebook, Alphabet, Amazon, Apple, Microsoft, and a comparable vehicle-to-energy conglomerate Tesla Inc.

Arrival has been manufacturing electric vehicles incorporating the alternatives to the fossil fuels that are competitively priced lower as against the units of already-established EVs makers.

Arrival-CIIG deal

Following the deal between Arrival and CIIG Merger Corp, the combined enterprise is expected to be valued at $5.4 billion. Further, the integrated business unit is likely to garner an approximate sum to the tune of $660 million.

CIIG Merger has already raised a quantum parallel to $400 million anchored by BNP Paribas Asset Management Energy Transition Fund, Fidelity Management & Research Company LLC, and Wellington Management. BlackRock has managed the funds and accounts of the establishment. The net cash recognised from the transaction has been set aside for funding the requirements of the amalgamated company.

Notably, all the existing shareholders and investors of Arrival Ltd including Hyundai Motor Company, Kia Motors Company, Winter Capital and United Parcel Service (UPS) are going to hold their respective equity ownerships in the company and will become the majority shareholders of the merged structure at the completion of the transaction.

CIIG Merger Corp shares

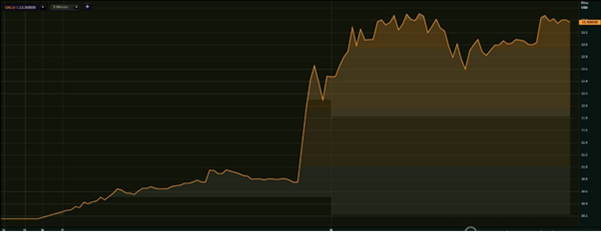

Following the development, the shares of Nasdaq-listed CIIG Merger Corp rallied more than 27 per cent on 18 November before settling slightly lower at the end of the trading window.

The stock of CIIG Merger Corp skyrocketed by as much as 24.28 per cent to $13.36 a piece on Wednesday from the previous closing price of $10.75 as on Tuesday. In the present week, CIIG Merger Corp share price has amassed a gain of over 31 per cent in just two trading sessions.

CIIG Merger Corp shares (1-week performance)

(Source: Thomson Reuters)

CEO’s take

Arrival’s focus on new methods of technology-driven production have played a primary role in diminishing the consumer cost of electric vehicles, said Arrival Founder and CEO Denis Sverdlov.

Arrival is excited to partner with CIIG Merger Corp as the organisation is set to begin the journey as a publicly traded company on Nasdaq, Sverdlov added.

CIIG Merger Corp Chairman and CEO Peter Cuneo said the “game-changing approach” of Arrival Ltd in the manufacturing of electric vehicles has been a key reason to prefer the EV maker as a potential choice for a partner.

Plans ahead

Arrival is set to start manufacturing its first batch of products in Q4 2021 as the enterprise has already received contracts totalling to a value of $1.2 billion including a commitment to purchase nearly 10,000 electric vans from its one of the investors and global logistics company UPS.

As per Arrival, low-cost micro factories, proprietary hardware along with robotics technology will be incorporated in designing and producing zero-emission electric vehicles.