UK Market: The UK market was trading in red as investors were nervous over volatility in the market following the rising borrowing costs for the government. At around 1:30 pm GMT+1, the FTSE 100 index was trading 0.1% lower while the FTSE 250 was trading more than half percentage point down. The government's long-term borrowing costs have hit record highs after the Bank of England's £65bn bailout to induce stability in the financial markets.

DS Smith PLC (LON:SMDS): The London-headquartered packaging business issued a trading update on Monday, which sent its shares over 12% up. The company expects its adjusted operating profit for the half year to October 31, 2022, to rise to £400 million, significantly higher than its previous guidance of £276 million.

Unite Group PLC (LSE:UTG): Shares of the student accommodation provider soared nearly 4% after it said it has sold 99% of its beds for the current academic year, surpassing its forecast of 97%.

Tesco Plc (LON:TSCO): Shares of the supermarket chain owner surged over 2% after reports that thousands of its store managers have been forced to take pay cuts in real terms while the company's lower-paid workers are offered bigger rises.

US Markets: The US market is likely to get a negative start, as indicated by the futures indices. S&P 500 future was down by 104.86 points or 2.80% at 3,639.66, while the Dow Jones 30 future was down by 2.11% or -630.15 points at 29,296.79. The technology-heavy index Nasdaq Composite future was also down by 3.80% or -420.91 points, at 10,652.41. (At the time of writing – 9:14 am ET).

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 10 October)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), Glencore Plc (GLEN)

Top 3 sectors traded in green*: Basic Materials (1.51%), Technology (0.92%), Real Estate (0.85%)

Top 3 sectors traded in red*: Utilities (-1.11%), Healthcare (-1.03%), Consumer Non-Cyclicals (-0.46%)

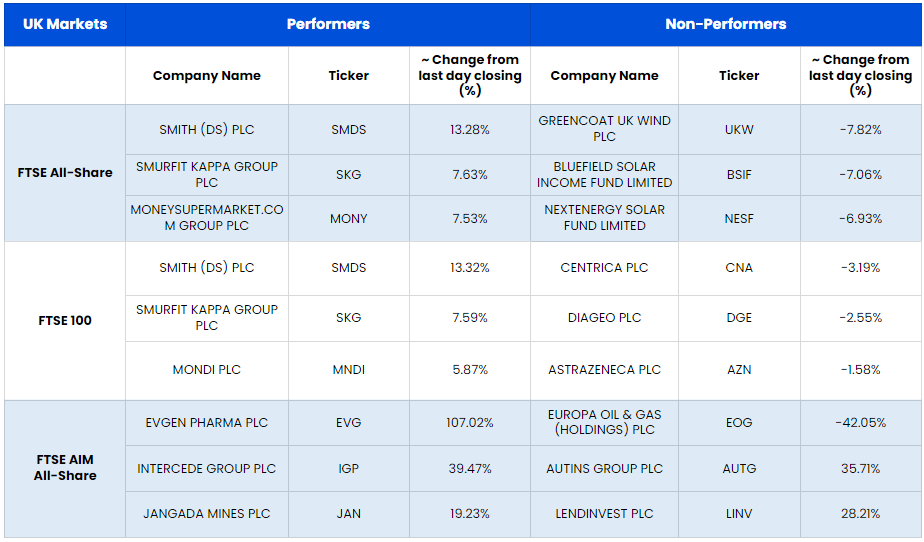

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $97.59/barrel and $92.39/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,681.30 per ounce, down 1.64% against the prior day's closing.

Currency Rates*: GBP to USD: 1.1048; EUR to USD: 0.9719.

Bond Yields*: US 10-Year Treasury yield: 3.888%; UK 10-Year Government Bond yield:4.426%.

*At the time of writing