UK Market News: The UK stock markets are on a recovery path on Tuesday after losing some ground in the early part of the day, with energy firms dragging the index down. According to recent data from the Office for National Statistics (ONS), government borrowing, excluding public sector banks, stood at £18.6 billion last month, which was £5.6 billion less than in April 2021 and lower than the expectation of £18.9 billion. Further, according to the latest figures from Kantar UK Grocery sales fell by 4.4% during the 12 weeks to 15 May 2022 as compared to the same period last year. Grocery prices were up by 7% over the past four weeks as compared to the same period last year, the highest level since May 2009.

ITV Plc (LON: ITV): The share of the UK-based media company ITV Plc fell by 4.40%, with a day’s low of GBX 70.94. According to recent data from Kantar, around 1.5 million subscriptions for streaming services were cancelled in Q1 2022 by Britons due to rising inflationary pressure.

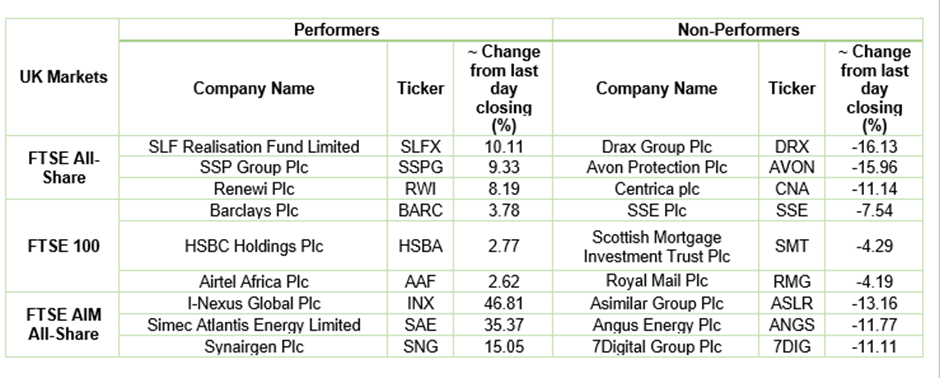

Drax Group Plc (LON: DRX): The share power generation business plunged by almost 16%, with a day’s low of GBX 657.00 after the Financial Times reported that the UK government is planning a possible windfall tax on over £10 billion of excess profits by power generators.

Barclays Plc (LON: BARC): The shares of British multinational universal bank jumped by almost 3.5%, with a day’s high of GBX 163.88. the bank announced the commencement of the share buyback programme to purchase ordinary shares of 25 pence each for up to a maximum consideration of £1,000 million to reduce the share capital.

US Markets: The US market is likely to have a negative start, as suggested by the futures indices. S&P 500 future was down by 51.97 points or 1.29% at 3,921.10, while the Dow Jones 30 futures were down by 0.66% or 209.27 points at 31,646.54. The technology-heavy index Nasdaq Composite future was down by 2.00% at 11,762.03 (At the time of writing – 9:40 AM ET).

US Market News:

The share of the multinational consumer electronics retailer Best Buy (BBY) rose by 5.2% in the premarket trading session after the company reported a drop of 4 cents a share shy of the forecast, with quarterly earnings of US$1.57 per share. However, its revenue was better than forecast, and it has downgraded its full-year outlook.

The share of the retailer of aftermarket automotive parts and accessories, AutoZone (AZO) gained 1.4% in the premarket trading session after its reported earnings of US$29.03 per share for Q3 2022, beating the forecast of US$26.05 a share. Its revenue also beat the estimates, and comparable-store sales posted an unexpected gain.

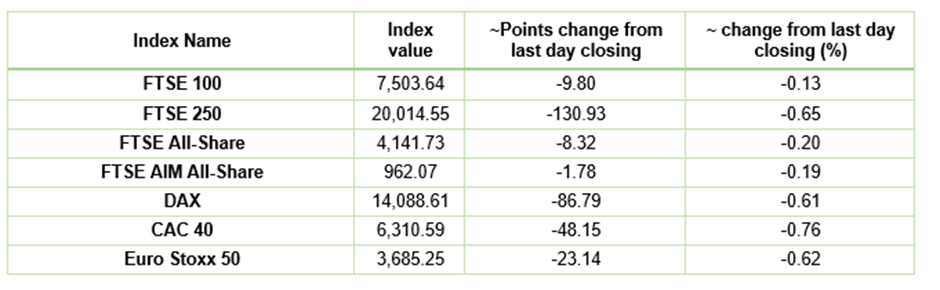

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 24 May 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Barclays Plc (BARC) and Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Technology (1.21%), Financials (1.14%) and Real Estate (0.77%).

Top 3 Sectors traded in red*: Utilities (-1.89%), Energy (-1.22%) and Consumer Cyclicals (-0.83%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $110.94/barrel and $110.56/barrel, respectively.

Gold Price*: Gold price was quoted at US$ 1,857.85 per ounce, up by 0.55% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2509; EUR to USD: 1.0725.

Bond Yields*: US 10-Year Treasury yield: 2.817%; UK 10-Year Government Bond yield: 1.9060%.

*At the time of writing