UK Market: The UK market was mixed on Friday as investors continued to exercise caution over the country's economic outlook. At around 1:00 pm GMT+1, the benchmark index FTSE 100 was trading 0.15% higher, while the FTSE 250 was down 0.51%. Meanwhile, the deputy governor of the Bank of England has said that it needs to keep raising interest rates to keep inflation in check, despite the consequences it might have for the economy.

Aveva Group Plc (LON:AVV): Shares of the industrial software maker jumped more than 1% following reports that a hedge fund is building its stake in the company. French industrial giant Schneider Electric last month agreed to buy out minority shareholders in the company in a £31 per share bid.

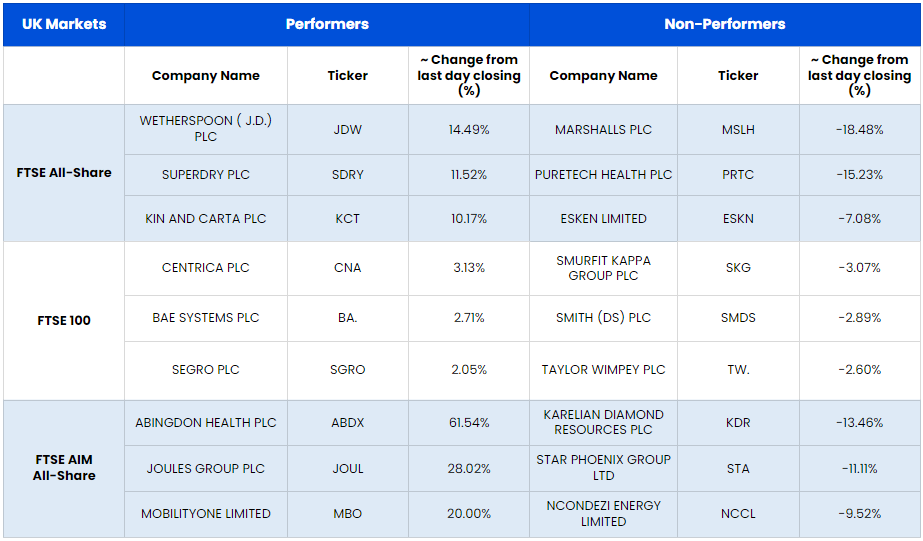

JD Wetherspoon PLC (LON:JDW): Shares of the pub operator soared over 14% despite the company posting a £30.4 million loss before tax in the first half of 2022.

PageGroup PLC (LON:PAGE): Shares of the recruitment consultant were down over 1% after a survey revealed that recruitment activity in September saw the weakest growth in about 19 months.

US Markets: The US market is likely to get a negative start, as indicated by the futures indices. S&P 500 future was down by 38.76 points or 1.02% at 3,744.52, while the Dow Jones 30 future was down by 1.15% or 346.93 points at 29,926.94. The technology-heavy index Nasdaq Composite future was also down by 0.68% or 75.33 points, at 11,073.31. (At the time of writing – 8:29 am ET).

US Market News:

Shares of chipmaker Advanced Micro Devices (AMD) slipped 5.3% in the premarket trading session after the company slashed its sales forecast due to a slump in the personal computer market.

Shares of apparel maker Levi Strauss (LEVI) slid 5.3% in the premarket session after it cut its revenue and profit outlook for the year. The company said higher costs, supply chain issues, and a stronger US dollar is likely to impact its business.

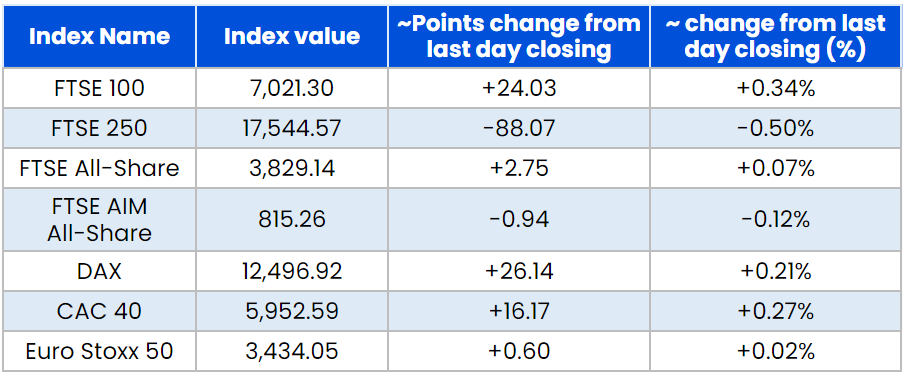

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 7 October)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BP Plc (BP.)

Top 3 sectors traded in green*: Utilities (1.15%), Healthcare (0.96%), Energy (0.78%)

Top 3 sectors traded in red*: Basic Materials (-1.48%), Consumer Cyclicals (-1.32%), Technology (-0.64%)

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $95.63/barrel and $89.39/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,717.45 per ounce, up 0.2% against the prior day's closing.

Currency Rates*: GBP to USD: 1.1211; EUR to USD: 0.9801.

Bond Yields*: US 10-Year Treasury yield: 3.833%; UK 10-Year Government Bond yield: 4.2585%.

*At the time of writing