US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 14.97 points or 0.40 per cent higher at 3,716.14, Dow Jones Industrial Average Index surged by 119.77 points or 0.40 per cent higher at 30,274.31, and the technology benchmark index Nasdaq Composite traded higher at 12,727.48, up by 69.29 points or 0.55 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The major indices of Wall Street traded in green amid positive stimulus hopes offset by grim jobless data. According to the Labor Department, 885,000 claims for jobless benefit were filed last week, higher than the forecast of 800,000. Among the gaining stocks, Accenture rose by approximately 6.1% after it had reported a growth in its full-year forecast. Shares of Roku grew by 7.0% as it had begun AT&T’s HBO streaming service. Lennar gained around 3.5% after the company had reported profit more than the expectations. Among the declining stocks, shares of ContextLogic fell by around 5.1% on its first day of trading. Tyson Foods shares dropped by around 4.4% after the food producer had stopped production at an Iowa pork plant.

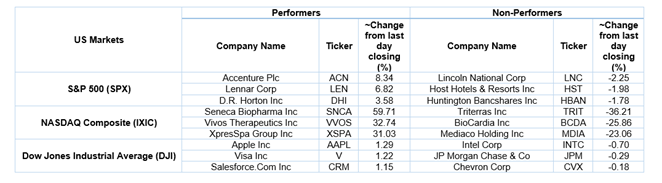

US Stocks Performance*

European News: The London and European markets traded in the green due to growing investor optimism towards Brexit deal and policy announcement from the Bank of England. The Bank of England kept its stimulus program the same and announced its bond-buying programme at £895 billion. It had kept the interest rate on hold at 0.1%. Among the gaining stocks, Shares of Reach grew by 6.2% as it had registered five million readers. WPP went up by around 4.9% after the company said that it would increase its dividend each year from 2020. Shares of Watches of Switzerland gained close to 2.5% after the company upgraded its full-year sales guidance. Among the decliners, Avon Rubber plunged by around 13.5% after the company updated that several US contracts were delayed due to Covid-19 pandemic. SSP Group was down by about 0.51% after the company said that it expects an 80% drop in first-quarter sales due to the second wave of Covid-19. Shares of Vodafone Group had dropped the most on FTSE-100 index.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 17 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Basic Materials (+1.45%), Real Estate (+0.66%) and Financials (+0.59%).

Top 3 Sectors traded in red*: Consumer Non-Cyclicals (-1.12%), Technology (-0.67%) and Energy (-0.59%).

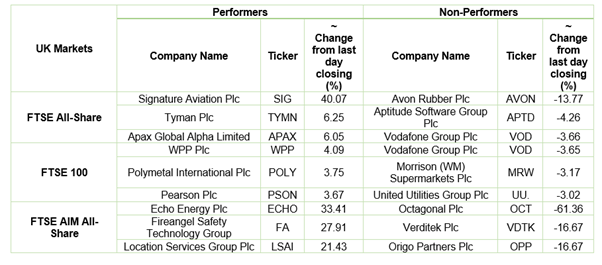

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $51.28/barrel and $48.18/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,889.85 per ounce, up by 1.65% against the prior day closing.

Currency Rates*: GBP to USD: 1.3617; EUR to GBP: 0.9013.

Bond Yields*: US 10-Year Treasury yield: 0.935%; UK 10-Year Government Bond yield: 0.279%.

*At the time of writing