US Markets: All the major American stock indices started on a positive footing on Friday, 12 November, with the Dow Industrials recovering from the three-day plunge. The wider share index S&P 500, the tech heavy average Nasdaq Composite and Dow Jones Industrial Average are on track to break the five consecutive weeks of positive closings as inflationary worries renew after CPI based inflation rate in the United States rose to a 31-year high.

The corporate earnings season has adequately helped the American equities in the last one-and-half-month period as investors accumulated shares on better-than-expected outlook by the majority of the heavyweight corporations.

The sliding consumer sentiment in November has slightly increased the caution as consumers believe that monetary policies have failed to address the rising inflation. According to the preliminary estimates released by the University of Michigan, the consumer sentiments of Americans slid to 66.8 in November, registering the lowest reading since November of 2011 as inflation rate hovers at 31-year high. Earlier in October of 2021, the University of Michigan’s consumer sentiment stood 71.7.

Top Global Cues to set the market tone for the week ahead

The Dow Jones Industrial Average rose 34.61 points, or 0.09% to 35,955.84, Nasdaq Composite jumped 41.31 points, or 0.26% to 15,745.59, while the wider share average S&P 500 added 5.89 points, or 0.13% to 4,655.16.

US Market News: Shares of 3M, Johnson & Johnson, Nike, Boeing, Visa, Dow, Microsoft and Caterpillar contributed substantially in the upsurge of Dow Industrials. The uptick in stock of Johnson & Johnson supported the index after the New Jersey-headquartered healthcare major declared the splitting plans. The corporation is planning to split its consumer health division from its pharmaceutical arm.

On the other hand, shares of Walgreens Boots Alliance, Walt Disney, JPMorgan Chase, Merck & Co, American Express and Goldman Sachs shed 0.40-1.20%, partly offsetting the positive points provided by the leading shares.

Shares of Tesla continued the decline with the weekly losses escalating to 15% after considering the 4% recovery on Wednesday. The stake sale by Co-founder and CEO Elon Musk in the present week following the Twitter poll has partly unnerved the investors’ community, while options expiry due today has furthered the volatility as traders square off their respective positions.

UK Markets: London equities dived into red in the terminal trades on Friday, 12 November, with the benchmark FTSE 100 slipping into negative territory after briefly retaking the psychological level of 7,400 after a stretch of more than 20 months. The last time was in February of 2020, when the index made an intraday high over 7,400.

Shares of AstraZeneca counterbalanced all the gains and positive points contributed by other respective components as the stock of the pharmaceutical giant collapsed more than 7% after the Cambridge-based drug maker and vaccine supplier provided a muted outlook for the upcoming quarters.

The stock of the market capitalisation leader has suffered a loss of more than 7% after 19 months. Earlier on 12 March 2020, the shares of AstraZeneca crashed over 9% in a market-wide sell-off led by the widespread worries of Covid-19 pandemic. According to the data available with the London Stock Exchange, the stock tumbled as much as 7.22% to an intraday bottom of GBX 8,759, from the previous closing price of GBX 9,444 apiece.

Given the weakness in heavyweight shares, the headline FTSE 100 traded 35.93 points, or 0.49% lower at 7,348.25, after hitting an intraday high and low of 7,402.68 and 7,340.49, respectively. Meanwhile, the mid-cap stock indicator FTSE 250 was flat at 23,575.17.

FTSE 100 (1-year performance)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Vodafone Group and BP

Top 3 sectoral indices: Automotive, Personal Goods and Tobacco

Bottom 3 sectoral indices: Medicine and Biotech, Precious Metals, and Consumer Services

Crude oil prices: Brent crude down 0.64% at $82.34/barrel; US WTI crude down 0.72% at $81.00/barrel

Gold prices: An ounce of gold traded at $1,863.65, down 0.01%

Exchange rate: GBP vs USD - 1.3405, up 0.26% | GBP vs EUR - 1.1709, up 0.30%

Bond yields: US 10-Year Treasury yield - 1.561% | UK 10-Year Government Bond yield - 0.9170%

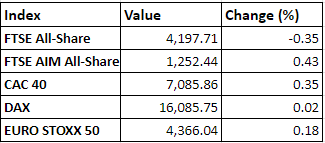

Markets @ 16:30 GMT